SUV market share climbs to 38% in FY21 from 25% in FY17

KEY TAKEAWAYS

Since the liberalisation of the economy in the 1990s, the Indian automobile industry has not only been one of the fastest growing industries in the country but also one of the largest in the whole world both in terms of sales and production. The alliance between Maruti and Suzuki was the first joint venture in the Indian automobile segment between an Indian and a foreign company. Later in 2000s, the implementation of economic reforms led to the entry of major foreign auto players in the industry such as Hyundai, Honda, and Toyota among others and by 2010 almost all the major auto company expanded their presence in India by establishing manufacturing facilities across different parts of the country. The Indian automobile industry is currently divided into four major segments namely Two Wheelers (2Ws), Passenger Vehicles (PVs), Commercial Vehicles (CVs) and Three Wheelers (3Ws). The 2W segment is the largest segment in terms of volumes with 81% market share followed by PV, CV and 3W with 15%, 3% and 1% respectively.

Undoubtedly, the PV segment in the Indian auto industry has been one of the biggest beneficiaries of economic growth, increasing urbanisation and the rise in per capita income of the country over the last two decades. With better affordability, availability of retail finance and the change in demographics in favour of the younger generation, the PV market has seen a huge scale up. The market is further divided into three sub segments namely Passenger Cars (PCs), Sports Utility Vehicles (SUVs) and Vans. Clearly, the SUV category has evolved as the fastest growing segment in the whole PV industry in the last five years.

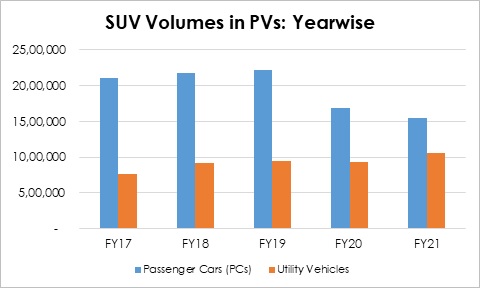

Nevertheless, not all was hunky dory for the PV market in the pre-pandemic period. Before the onset of the Covid pandemic and starting from H2FY19, the Indian automobile industry witnessed one of the worst slowdowns in over a decade and the sales across all the segments of the industry including PV segment reflecting a distinct slowdown in the economy followed by various regulatory changes from the government in a short span of time particularly the introduction of BS VI standards. The domestic sales of the overall PV segment witnessed a CAGR volume growth of only around 5% over the 3 yr period (FY17-19) period. Expectedly, the emergence of Covid pandemic led by nationwide lockdown, massive economic disruption and the restriction in movements of goods and people across the country led to a decline in domestic PV sales by 18.8% and 1.2%YoY in FY20 and FY21 respectively.

However, the volume trajectory in the SUV segment has moved in a different manner with a CAGR of around 11.0% over the same period, FY17-FY19. It registered only a marginal decline of 0.9%YoY in FY20 and a growth of 13.8%YoY in FY21. Further, an upsurge in the demand for compact SUVs is clearly visible in the current year which has led to a growth of 93%YoY in UV sales during H1FY22 compared as H1FY21. The momentum in UV volumes have been a key factor behind the growth of 58% YoY in H1FY22 despite the impact of the second Covid wave in Q1FY22 and shortages in semiconductors.

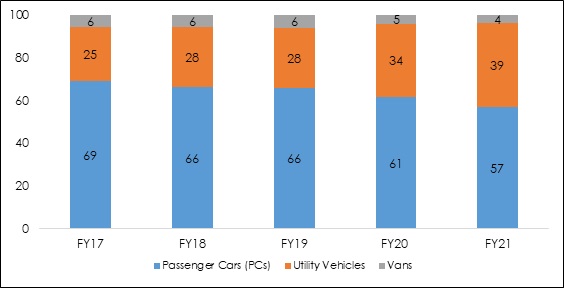

The growth witnessed in the domestic sales of SUVs in H1FY22 provided a much needed relief to the PV industry during the Covid pandemic. While passenger cars had been continuously dominating the PV industry over the last two decades, a gradual transformation in favour of SUVs have been visible over the last five years. The market share of SUV in the PV space has significantly increased from 25% in FY17 to 39% in FY21 whereas the market share of PC has dropped from 69% in FY17 to 57% in FY21.

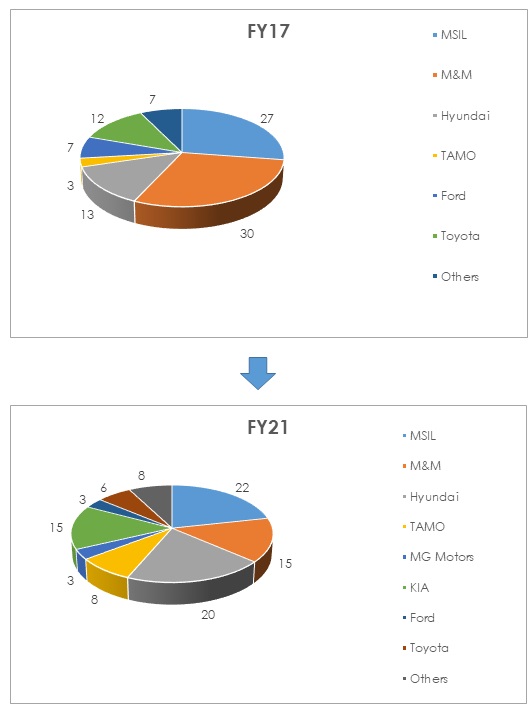

We believe that there are several factors which are driving the popularity of the SUV. One of the key reasons for the emergence of the SUVs is the growth in incomes in the upper middle class category particularly among the younger generation and in the major urban areas. With the change in lifestyles and better quality of highways, urban consumers prefer a sturdy and spacious vehicle with new amenities. Given the risk of flooding in the urban roads, the consumers also prefer a vehicle with high ground clearance. To cater to such consumer needs while making the product affordable, some of the major as also some new OEMs started to launch compact SUVs over the last few years. These were priced competitively compared to the sedans and also had on offer, accessories derived from the latest technology. Clearly, this has expanded the SUV market in a big way. In FY17, there were five major players who had around 90% of the total SUV space whereas in FY21, there are around 8 players whose market share aggregated to 92%. The emergence of new players and introduction of various new models such as Vitara Brezza, Hyundai Creta & Venue, Kia Seltos & Sonet, Tata Nexon, Nissan Magnite and Renault Kiger among others has clearly brought in a transformation in the PV industry.

The compact SUV (which we have defined as sizes upto 4400 mm costing less than Rs 20 lakhs) has clearly been one of the major game changer in the overall SUV segment. The compact SUV segment gained popularity from the year FY20 with new model launches from all major key players in the industry and its affordable prices compare with sedans along with advance technological gadgets such as high infotainment system, steering mounted key controls, sunroof etc. in the vehicle. The compact SUV segment grew around 15% CAGR over the FY19-21 period compared to the 6% growth of the overall SUV segment during the same period.

Going forward, Acuité believes that the SUV segment will continue to show a solid growth trajectory over the medium term especially with the ever growing popularity for the compact SUVs along with the support of new launches such as Mahindra XUV700, Volkswagen Taigun, Skoda Kushaq and the recently launched Tata Punch. However, a slowdown is expected in factory despatches the near term due to the continuing shortage of semi-conductors that has already led to an increasing waiting period for selected models.

Annexure

Table 1: Key items within merchandise trade balance

.jpg)

Source: CMIE, Acuité Research

Chart 1 1: SUV sales continue to grow at a faster rate vs Passenger Cars

Source: CMIE, Acuité Research

Table 2: Compact SUVs has been a game changer for UVs

.jpg)

Source: CMIE, Acuité Research

Chart 2: Segment wise market share of PVs over the years

Source: CMIE, Acuité Research

Chart 3-4: Variation in player wise market share in the SUV space (FY17-21)

Source: CMIE, Acuité Research