Apr-21 Trade Balance: Normalized deficit may narrow in the short term

KEY TAKEAWAYS

- India’s merchandise trade deficit widened to a 4-month high of USD 15.1 bn in Apr-21 from USD 13.9 bn in Mar-21.

- Both exports and imports registered their first triple digit annualized growth at 195.7% and 167.1% respectively, buoyed by an exceptionally favorable base effect given the economic shock from the national lockdown in April 2020.

- On sequential basis, exports and imports contracted by 11.1% and 5.5% MoM in Apr-21, an outcome that is expectedly in line with the calendar effect.

- Normalization of trade deficit seen in the last few months may, however again face disruptions from the ferocious second wave of Covid that has engulfed India.

- We expect trade deficit to narrow in the short-term as exports remain largely unaffected while imports come under pressure from subdued domestic demand.

India’s merchandise deficit widened to a 4-month high of USD 15.1 bn in Apr-21 from USD 13.9 bn in Mar-21. Both exports and imports registered their first triple digit annualized growth at 195.7% and 167.1% respectively, buoyed by an exceptionally favorable base effect (with the month of Apr-20 bearing the full impact of the stringent nationwide lockdown that had curtailed external trade activities significantly). On sequential basis, exports and imports contracted by 11.1% and 5.5% MoM in Apr-21, an outcome that is broadly in line with the calendar effect (sequential retracement is usually observed at the beginning of the financial year following the March ramp-up).

Looking at the drivers of trade deficit in Apr-21, we find that:

Exports: Broad based sequential moderation

In value terms, exports stood at USD 30.6 bn in Apr-21 vis-à-vis USD 34.4 bn in Mar-21. At a granular level:

- Except Petroleum Products that rose sequentially, all other key sub-categories declined on MoM basis. We will refrain from making any inference on YoY basis at a sub-category level as the statistical base effect is seen to be causing outliers at every level (with exceptional growth figures). Nevertheless, we do note that Chemical Products clocked the lowest annualized growth of 43.2% in Apr-21, possibly reflecting the impact of temporary restrictions imposed by the government on exports of Covid related pharmaceutical products.

- Core exports (headline ex petroleum and gems & jewellery) stood at USD 23.6 bn in Apr-21, down from USD 27.4 bn in Mar-21. Nevertheless, it is encouraging to see that compared to 2-years ago (Apr-19), core exports registered a healthy growth of 21.2%. In our opinion, this has been driven by a demand recovery in the major export markets for India. Among others, there has been a stronger demand for automobiles and particularly two wheelers exports in many developing nations due to personal mobility needs enhanced by the pandemic.

Imports: Sequential moderation dominated by gold

Merchandise imports slipped to USD 45.7 bn in Apr-21 from USD 48.4 bn in Mar-21. At a granular level:

- Bulk of the sequential moderation was driven by imports of Gems & Jewellery that fell by USD 2.3 bn to a level of USD 8.7 bn in Apr-21. The combination of previous restocking (to take advantage of lower prices in Mar-21) and re-imposition of lockdowns in several states amidst sharp resurgence in Covid infections seems to have weighed on sequential momentum for gold imports. Despite the sequential deceleration, we do note that gems and jewellery imports continue to remain much above their long term (8-year) trend of USD 4.9 bn on monthly basis.

- Meanwhile, sequential increase was observed in case of imports of Petroleum Products, Ores and Minerals, Agri Products, and Chemical Products. The price dynamics seems to have played a vital role in case of petroleum, metals, and vegetable oils imports. For Chemicals as ingredients for pharma sector, the imports ought to have picked up in the backdrop of the second wave of Covid in India.

- Overall, core imports (headline ex petroleum and gems & jewellery) moderated to USD 26.1 bn in Apr-21 from USD 27.1 bn in Mar-21. While core imports appear to be doing well vis-a-vis the last 3-month average run rate of USD 25.7 bn; compared to 2-years ago (Apr-19), core imports registered a sober growth of 8.2%, reflecting subdued domestic demand triggered primarily by the pandemic.

Conclusion

We had pointed out earlier that India’s merchandise trade deficit has already normalized vis-à-vis pre Covid levels. While we stick to that belief, the second wave of Covid that continues to ravage India over the last 2 months, will cause short term disruptions. There is likely to be a disproportionate adverse impact on imports vis-à-vis exports as:

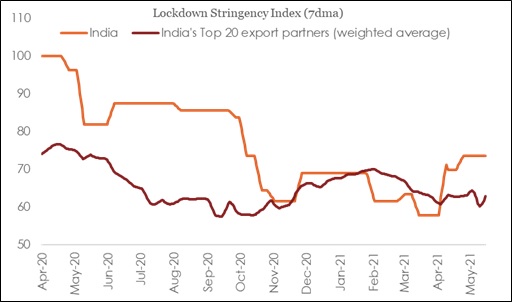

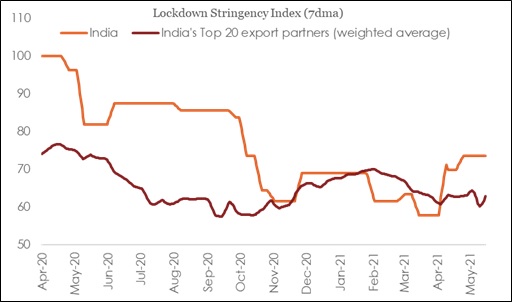

- The ferocity of the recent surge in Covid infections has not only resulted in lockdown restrictions affecting economic activity (albeit to a lesser degree compared to the stringent nationwide lockdown during Apr-May 2020), but it is also likely to depress consumer sentiment, at least in the near term.

- In contrast, most of India’s major export destinations have already gone past their second wave of Covid. As such, most countries have seen relaxation in their respective lockdown stringency, thereby supporting the outlook for India’s exports.

This should once again narrow the trade deficit, at least in the short term. We would monitor the ongoing situation for another month to assess the overall impact on the FY22 trade deficit.

Table 1: Merchandise Trade Balance

| India's merchandise trade highlights (USD bn) |

|

Apr-20 |

Mar-21 |

Apr-21 |

| Exports |

10.4 |

34.4 |

30.6 |

| Petroleum Exports |

1.2 |

3.4 |

3.6 |

| Gems & Jewellery Exports |

0.0 |

3.6 |

3.4 |

| Core Exports |

9.1 |

27.4 |

23.6 |

| Imports |

17.1 |

48.4 |

45.7 |

| Petroleum Imports |

4.7 |

10.3 |

10.9 |

| Gems & Jewellery Imports |

0.1 |

11.0 |

8.7 |

| Core Imports |

12.3 |

27.1 |

26.1 |

| Trade Balance |

-6.8 |

-13.9 |

-15.1 |

| Petroleum Balance |

-3.4 |

-6.9 |

-7.3 |

| Gems & Jewellery Balance |

-0.1 |

-7.4 |

-5.3 |

| Core Balance |

-3.3 |

0.4 |

-2.5 |

Chart 1: Compared to its key export markets, India’s lockdown stringency has increased in last two months