On July 1, 2019, it was reported that state government of Andhra Pradesh ordered review of power purchase agreements (PPAs) signed by state Discoms for the purchase of wind and solar power. According to the order, the state government has established a High-Level Negotiation Committee (HLNC) panel to review and renegotiate the PPAs. The government’s point of contention has been the issue of high priced PPAs entered in the last few years due to which the state Discoms have been facing huge power purchase dues. A condition that has led to financial distress.

Ensuing the directive, several renewable power producers challenged the Andhra Pradesh government’s move to renegotiate PPAs tariffs by filing a petition in the Andhra Pradesh high court. This could see a downward revision in agreed tariffs.

Viewpoint

The high court’s stay on the Andhra Pradesh government’s order is expected to be positive for the developers, who were anxious because of the possible renegotiations and the apparent disregard of signed contracts. Moreover, it would have set a precedent for other states, which on similar lines would had looked to garner benefit citing the said order. It is noted that in an event of Andhra Government being successful in its endeavour - similar agreements entered by other states would have been threatened as well. This is counterproductive to the keenness of the central government when it comes to green energy and the fact that it is cutting down on its coal-based capacity additions. India has an ambitious target of attaining 175 GW renewable energy capacity by 2022.

Several steps have been taken by the government in this regard to support the renewable sector, which includes providing fiscal and promotional incentives such as capital subsidy, accelerated depreciation, waiver of Inter State Transmission System (ISTS) charges and losses. The viability gap funding (VGF), the Green Energy Corridor projects along with integrated grids and Foreign Direct Investment (FDI) up to 100 percent under the automatic route are also part of the Government’s incentive plan. Further, to ensure cost competitiveness renewable energy projects are awarded through transparent bidding process (e- reverse auction), which has given reassurance to stakeholders.

Thus, if the sanctity of contracts is not respected, both the domestic and foreign investors would likely shy away from making future investment commitments in the country’s renewable sector, which has over the years coping with dampening of capacity additions despite consistent FDI inflows.

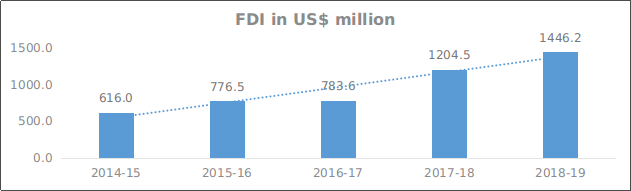

Trend in FDI investment in Renewable Energy sector

Government press releases, Acuité Research

As reflected in the above chart, FDI in the country’s renewable energy sector has seen a sustained rise over the past few years with 2017-18 witnessing a sharp jump of 54 percent y-o-y to $1.2 billion from $0.8 billion in 2016-17. In fact, during 2018-19 as well, investment into the sector through the FDI route continued its upward momentum to $1.4 billion, albeit at a lower rate. Cumulatively foreign investors have infused $7.8 billion from FY2001 till FY2019 in the sector.

Thus, it broadly reflects the confidence of investors in the country’s booming renewable energy sector, thanks to the thrust provided by the government’s various policies to support the same. It is noted that players such as Renew Power, Diligent Power, Welspun Renewables Energy Pvt ltd, Areva Solar Power and Ostro Energy 1 are some of the major beneficiaries of the said overseas financing. On the global front as well, India has made tremendous gains in terms of installed capacity - having the fourth highest installed wind power capacity and reckoned to be the fifth largest solar market by the end of 2018.

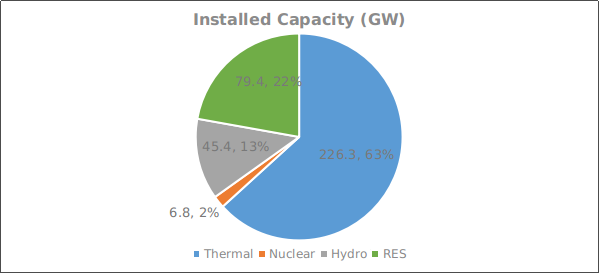

Snapshot of India’s overall installed capacity as on June 30, 2019

CEA, Acuité Research

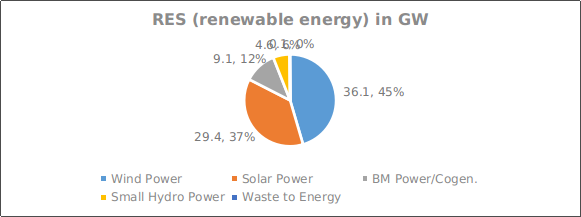

The RES (renewable energy) installed capacity can be further broken down from different sources as stated below;

CEA, Acuité Research

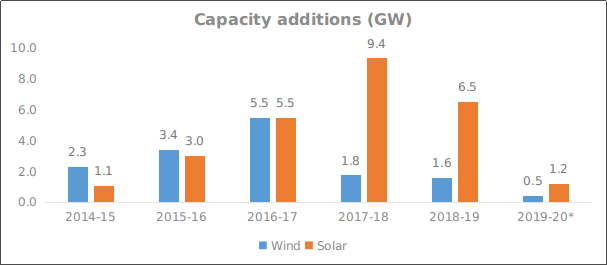

Fall in Capacity Additions despite Consistent FDI Inflows

Around 45 percent (~36 GW) of India’s renewable capacity is based on wind energy followed by solar energy which constitutes about 37 percent (~29 GW) of the capacity; other sources making up 1 Source: IBEF (India Brand Equity Foundation) the remaining pie. This displays the extent to which the wind and solar sectors are important to India’s renewable energy basket. In fact, over the last few years there has been a significant increase in percentage contribution of renewable energy to India’s total installed capacity. However, lately there has been a slowdown in capacity additions which can be seen in the chart below.

CEA, Acuité Research

To put things into perspective the solar sector saw a dip in capacity additions during 2018-19 due to issues pertaining to GST, safeguard duty imposition on imports of solar modules and frequent tender cancellations had crippled the sector. On the other hand, wind sector which has been adjusting to shifting to tariff based competitive bidding (TBCB) from the earlier feed-in tariffs (FiTs) - has been unable to take flight since 2016-17, when it added 5.5 GW in capacity. Moreover, issues such as land acquisition, tariff caps and tepid power demand growth has further impacted the sectors.

There have also been some recent instances wherein states in a bid to lower their tariff burden have tried to negotiate even after the auction process has been completed. This not only weakens the entire bidding process but also leads to lower private sector confidence causing tenders getting undersubscribed or cancelled.

Therefore, the recent stay provided by the High Court of Andhra Pradesh on state government’s order of tariff renegotiation, will likely provide some assurance to investors in the short term. Going ahead however, investor confidence would be of paramount importance for the sector to grow as envisaged by the government and contracts such as the PPA, which are sacrosanct - need to be shielded form states dictating terms. For the sake of sustainability, it must be noted that despite electricity supply being a state centric issue, contracts are completely based on the mutual consent of bidding parties. India must be watchful of this growing tendency of states which will jeopardise this very promising growth story.