Sharp recovery in corporate credit quality

Gradual unlocking along with the measures by RBI and Govt drive rating upgrades

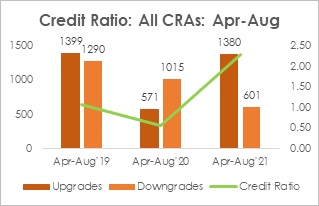

Acuité has undertaken an analysis of the overall rating migration data for the April-Aug period over the last 3 years. What emerges is a sharp recovery in the [1]Credit Ratio (CR) of the CRA industry from 0.56x in the previous year to 2.30x in the current year which is significantly higher than the levels seen in the pre-pandemic year i.e. FY20.

| All CRAs |

Apr-Aug19 |

Apr-Aug'20 |

Apr-Aug'21 |

| Upgrades |

1399 |

571 |

1380 |

| Downgrades |

1290 |

1015 |

601 |

| Credit Ratio |

1.08 |

0.56 |

2.30 |

Source: Prime-Acuité Rating Migration

Database

The number of upgrades have increased by 2.4 times in the Apr-Aug’21 period vis-à-vis Apr-Aug’20 and the downgrades have almost reduced by 40%. Further, the number of upgrades during this five month period is almost similar to that in the pre-Covid year while the number of downgrades has almost halved from those levels.

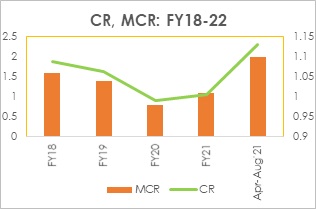

|

FY18 |

FY19 |

FY20 |

FY21 |

Apr-Aug’21 |

| CR |

1.87 |

1.64 |

0.91 |

1.07 |

2.30 |

| MCR |

1.06 |

1.04 |

0.98 |

1.01 |

1.10 |

Source: Prime-Acuité Rating Migration

Database

We have also looked at a longer time horizon since FY18 and analysed the movement of both Credit Ratio (CR) and

[2]Modified Credit Ratio (MCR). While the volatility in the MCR is far less than the CR given the stability provided by addition of the reaffirmation cases, the trajectory in both the ratios first reflect the slowdown in the economy since FY19 which got severely aggravated by the Covid pandemic starting from the last quarter of FY20 and thereafter, the subsequent recovery that has been set in motion in the current year. Most of the downgrades that happened in the first half of FY21 had taken into account an actual or expected deterioration in the liquidity position and a severe impact on the business profile of the rated entity.

[1] CR is the ratio of upgrades to

downgrades in a given period, non-cooperative issuers excluded

[2] MCR is the ratio of

upgrades and reaffirmations to downgrades and reaffirmations

The sharp upsurge in the Credit Ratio in the first 5 months (Apr-Aug) of the current fiscal can be explained by the following:

- A resilient corporate performance in FY21 in a significant part of the manufacturing sector including lower debt levels vis-à-vis the apprehensions in the early part of the pandemic

- With a steady progress in vaccination and gradually declining risks of a third wave of the pandemic, private consumption demand is expected to revive from H2FY22 and the ratings have started to factor in such a scenario

- Significant number of monetary policy measures taken by RBI since the outbreak of Covid-19 which has helped the corporate and the financial sector to meet their funding requirements and stabilise their liquidity position

- Various relief measures announced by the Government of India importantly, the Emergency Credit Line Guarantee Scheme (ECLGS) with an initial amount of Rs 3 Lakh Cr which enabled banks to disburse additional funds to enterprises facing a working capital crunch

- Buoyancy in the export sector since H2FY21 which have largely offset the weak demand in the domestic sector

- Favourable monsoon conditions and healthy agricultural output since last year which has kept rural demand at steady levels though despite a moderate impact of the second wave of Covid

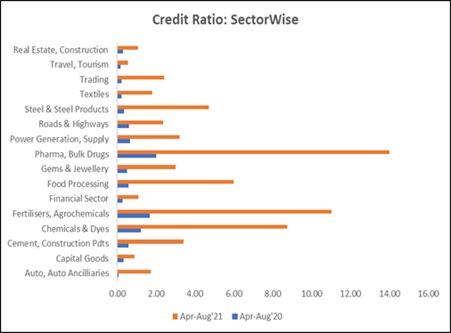

The credit ratio across the various sectors highlights the following aspects:

- There is a distinct recovery in the core infrastructure sectors with the focus on higher infrastructure investments leading to higher demand scenario in steel, cement and power

- With the removal of lockdown restrictions, the road sector has also started to see a recovery both in terms of project completion and toll collection

- There is also a significant revival in sectors such as auto, gems and jewellery and textiles with expectation of a pent up demand

- Few sectors such as chemicals, pharma and fertilisers were not only resilient to the economic disruption caused by the Covid pandemic but their business and financial position have strengthened over the last one year

- The improving credit ratio in the financial sector reflects a significant moderation in concerns on asset quality deterioration and liquidity impairment, given the monetary and the fiscal support measures; however, the credit ratio at 1.08x in Apr-Aug’21 indicates the continuing uncertainty particularly on retail asset quality

- The travel and the hospitality sector, understandably has been severely impacted during the pandemic and the persistent weak credit ratio indicates that recovery herein will take at least a few quarters; similar is the case for the real estate sector

- There appears to be an uptick in the capital goods sector although the number of downgrades is still slightly higher than that of upgrades

Annexure

| Sector |

Apr-Aug'20 |

Apr-Aug'21 |

| Auto, Auto Ancilliaries |

0.08 |

1.73 |

| Capital Goods |

0.33 |

0.89 |

| Cement, Construction Pdts |

0.57 |

3.40 |

| Chemicals & Dyes |

1.22 |

8.75 |

| Fertilisers, Agrochemicals |

1.67 |

11.00 |

| Financial Sector |

0.29 |

1.08 |

| Food Processing |

0.57 |

6.00 |

| Gems & Jewellery |

0.50 |

3.00 |

|

Pharma, Bulk Drugs |

2.00 |

14.00 |

| Power Generation, Supply |

0.65 |

3.21 |

| Roads & Highways |

0.60 |

2.36 |

| Steel & Steel Products |

0.36 |

4.71 |

| Textiles |

0.23 |

1.81 |

| Trading |

0.23 |

2.41 |

| Travel, Tourism |

0.16 |

0.56 |

| Real Estate, Construction |

0.30 |

1.06 |

Source: Prime-Acuité Rating Migration Database