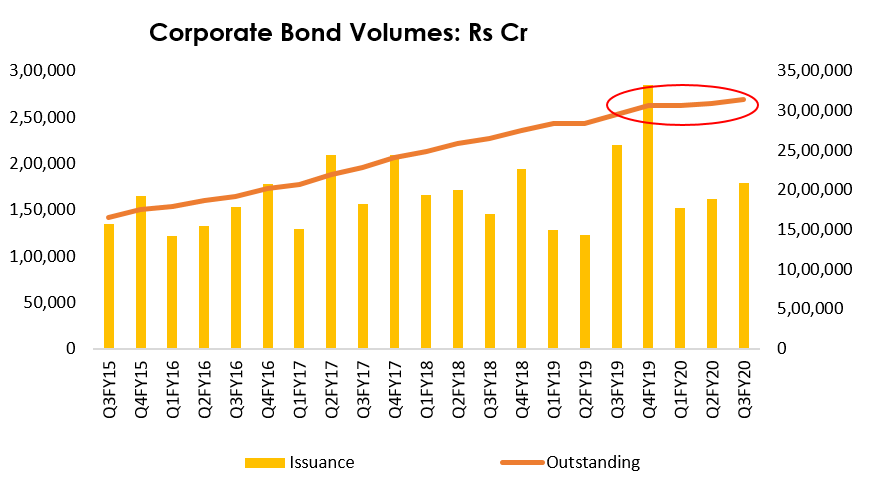

Bond markets are an important pillar in the financial eco-system of a strong and growing economy. While there has been a lot of scepticism around the deepening of India’s bond markets, data highlights that it has expanded steadily over the last ten years. The outstanding corporate bonds which was only around Rs. 8 Lakh Cr as on June 2010, have grown by four times to over Rs. 32 Lakh Cr as on June 2020 (SEBI). Over the last 5 year period (Dec 2014-Dec 2019), the stock of corporate bonds have almost doubled (Graph 1). Importantly, India has seen several innovations in debt instruments over the years including partial guaranteed structures and very long tenor (like 50 yr) bonds. The market expansion perhaps could have been even higher had it not been for the sharp drop in investor confidence on private sector credits since the middle of 2018.

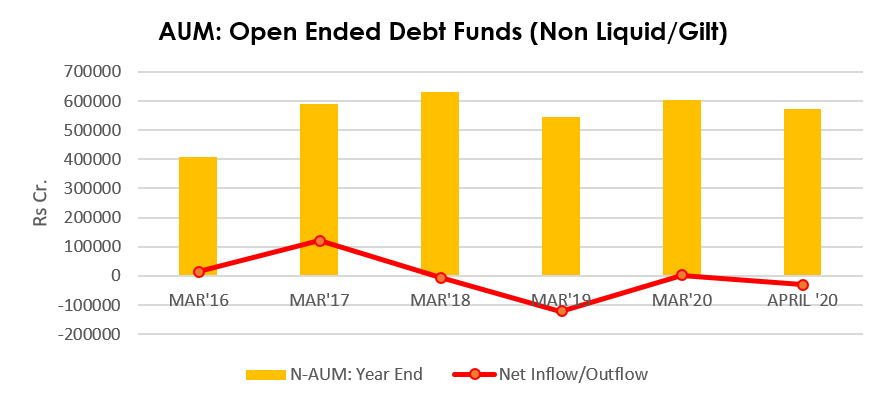

The bond markets were already witnessing headwinds from a large and persistent stock of NPAs in the banking system in the backdrop of an economic slowdown when a credit storm hit in 2018 through a default in an ‘AAA’ infrastructure conglomerate followed by a series of bond defaults in both the corporate and the financial sector. Clearly, this rattled the investors in debt mutual funds where a net outflow of Rs. 1.2 Lakh Cr was witnessed for non-liquid or gilt debt schemes in FY19. While the markets were attempting to stabilise, panic struck again due to the Covid crisis and another Rs. 1.1 Lakh Cr was withdrawn from the debt funds in March 2020 (Graph 3). Continuing withdrawals from debt mutual funds surely have led to high volatility in corporate bond yields and already precipitated the closure of a few debt schemes in a fund house.

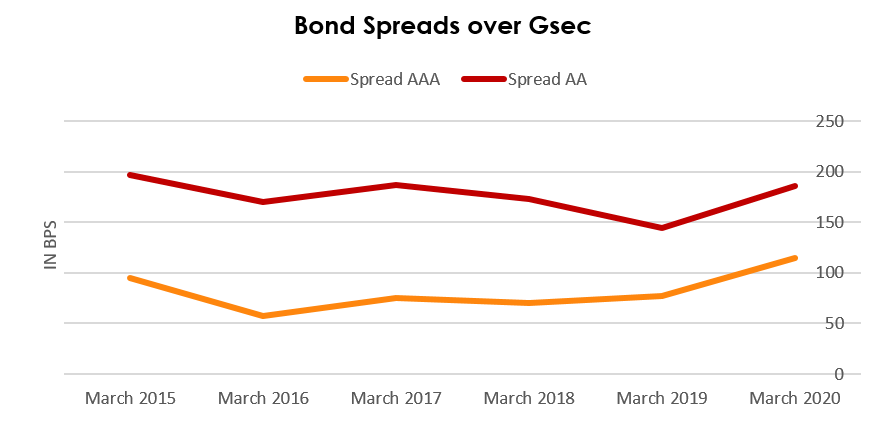

It is not unusual for corporate bond spreads to widen when gsec yields drop as they did by 115 bps in the last one year. But they have widened over the normal band with both AAA and AA bond spreads rising by over 50 bps between March 2019 and March 2020 (Graph 4). Clearly, this reflects higher credit and liquidity concerns among bond investors and their intent to build in higher risk premiums in response to a string of corporate defaults starting with IL&FS in September 2018. With additional headwinds in the macroeconomic landscape aggravated further by the Covid crisis, such higher bond spreads are here to stay in the near to medium term.

One of the debt instruments that has borne the brunt of the investor panic is the Basel III bank perpetual bonds. Even the perpetual bonds of strong banks rated in the high AA category have seen unusually high yields in the secondary market. Both credit and liquidity factors have contributed to this phenomenon. Clearly, the complete write-off of the Basel III perpetual bonds of Yes Bank has given a severe shock to the investors, leading to a significant change in the risk perception on these bonds. Further, the investor base in these bonds is quite limited with pension funds and insurers not permitted to invest in such instruments. With redemption pressures building up, some mutual funds had to sell their holdings at a sharp discount in the secondary market in March-April 2020.

The regulatory framework for the bond market needs to address two fundamental aspects – adequate liquidity and better diversity in the investor base. There is clearly a need to develop a segment of market makers and underwriters for corporate bonds rated AA and below who will provide liquidity by offering buy/sell quotes and this can be facilitated by access to low cost line of credit on the lines of TLTRO. The domestic banks who typically tend to focus on loan assets, need to be suitably incentivised to play a more active role in both the primary and the secondary corporate bond markets. The investment regulations across various stakeholders such as provident and pension funds as well as the insurance sector have to be streamlined to create a wider base of investors particularly for longer term structured debt instruments. The requirement of very high ratings for corporate bond investments by some of these market players has also been a factor in creating distortions in the debt markets and allocating specific limits for non AAA rating categories may help. The regulatory guidelines should also encourage investments by FPIs to create depth in the rupee debt segment.

Indian bond markets have seen the issuance of structured products with various forms of credit enhancement. However, expansion of that market has been indeed a challenge since long term investors such as the insurance and provident funds have restrictions in investing in such structured cash flow based debt. Pension funds can’t invest in debt issued by trusts, therefore the long term bonds issued by the InvITs and REITs don’t get the right profile of investors. This also restricts any secondary market trade in structured papers. Hence, a modification in the investment guidelines of pension and provident funds as well as of insurers is necessary to build depth in the markets.

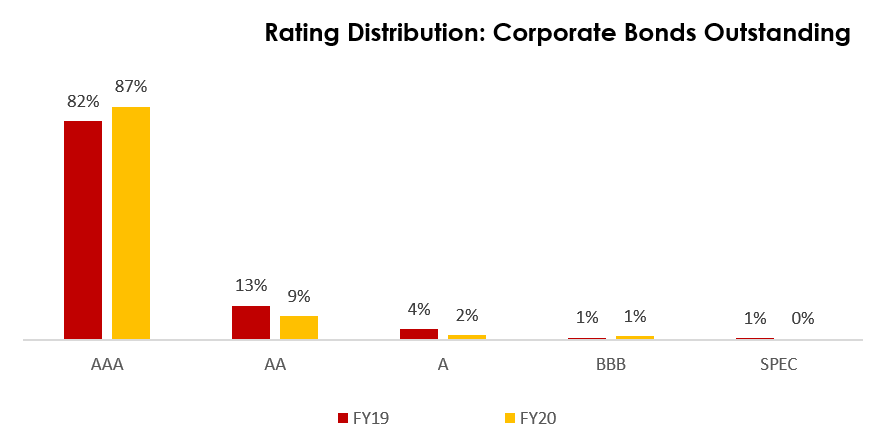

One of the structural imbalances in the Indian bond market is the preponderance of AAA papers. With the increased investor risk aversion since the defaults in 2018-19, the share of AAA in the outstanding corporate bonds has increased further to 87% in March 2020 as compared to 82% in March 2019 (Graph 5). With a significant part of the AAA issuances arising from sub-sovereign PSUs, the access of even AA private sector credits is severely restricted in the markets today. Banks or financial institutions can act as market makers or underwriters for well rated bonds to improve the liquidity of such papers. We are still quite some time away from a market that can see regular issuance of ‘A’ and lower rated investment graded papers.

The development of the credit default swap (CDS) market can help to deepen the bond market in India. But that will require a review of the existing regulatory guidelines which doesn’t permit the distribution of risks across a wide spectrum of stakeholders. Currently, the investors including corporates are not permitted to write protection which constrains the liquidity in the swap market.

There is a multiplicity of regulations from different regulators that govern the domestic bond markets. Close co-ordination between the regulators and consistency between the different regulations will help to strengthen the markets.

Mutual funds have been an important investor in the Indian bond markets over the last ten years. Unfortunately, there has been excessive panic among debt fund unitholders post the moratorium in a few schemes of a large mutual fund in April 2020 which actually led to higher pain and crystallisation of losses. Most of the mutual funds have lost over 50% of their debt AUM over a short period of time, creating sharp volatility in the corporate bond markets.

While credit risks are driving investor sentiments in the current scenario, non-allocation of funds to fixed income is not a prudent strategy. Investors ideally should have a balanced allocation across these three fundamental asset classes – equity (wealth creator), fixed income (wealth stabiliser) and gold (wealth protector) depending on their liquidity needs and the risk appetite. Income or credit funds have largely delivered consistent returns over the medium term but if investors don’t have an appetite for credit risks, they can opt for liquid or gilt funds where the liquidity of the underlying portfolio is also high.

It goes without saying that the mutual funds need to work harder to segregate their portfolios appropriately depending on the objective and the credit quality requirement of the respective schemes. They also need to encourage unitholders to opt for close ended schemes in credit funds so as to ensure that any sudden market panic and liquidity freeze don’t impair the latter’s sustainability. Investors in mutual funds also need to be completely aware of the inherent risks in each of the products i.e. they should realise that it is not only credit risks but interest rate risks that can impact short term returns in debt mutual funds but such risks get largely offset over the medium term. For a revival in the bond market, it is important that investors come back to debt mutual funds with better awareness of the risks and returns along with better product clarity and transparency from the fund houses going forward.

Given that there would be a significant increase in both central and state level government borrowings in the current year in line with global trends, we expect RBI to deploy all its monetary tools including direct or indirect purchase of government securities to ensure that there is no crowding out of private sector borrowings. This is also important to prevent any further increase in bond spreads since mutual funds which have been a significant investor in corporate bonds, is expected to be largely out of action post the large spate of redemption in debt funds. Further, a revival in investor sentiments during this crisis period may also require very strong support preferably through direct purchases of corporate bonds by RBI vis-à-vis providing a line of credit or guarantees to banks or financial institutions.

Along with the bank NPA

challenge and the domestic economic slowdown, the bond markets received a

serious setback due to some corporate governance failures in large institutions

followed by the Covid-19 crisis which is ‘once in a hundred year’ phenomenon in

terms of its impact on the global economy and the financial markets; therefore,

it will take some time to recover from these shocks. However, it is encouraging

to see that the government and RBI have worked together to introduce some

measures like the TLTRO programmes to infuse liquidity and confidence in the

markets. This has given a boost to the primary issuance volumes that have

almost doubled in April-May 2020 compared to that in the last two years.

Interestingly, the secondary market volumes have also picked up with many investors

in the market seeking good credit at attractive yields. In our opinion, this is

an opportunity for the government and the regulators to explore some of the

market reforms suggested above and take the domestic bond market to a higher

orbit which will be necessary to fund the next phase of growth for the Indian

economy.

Graph 1: Steady growth interrupted by credit events

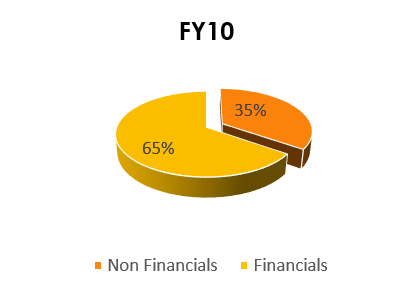

Graph 2: Financials drive volumes

Graph 3: Mutual Fund Redemptionsraph 2: Financials drive volumes

Graph 4: Rising Bond Spreadsraph 1: Steady growth interrupted by credit events

Graph 5: AAAs dominate the market