Q1 FY22 GDP: The statistical surge

KEY TAKEAWAYS

- India’s annualized Q1 GDP growth came broadly in line with market expectations, at 20.1%. Amidst a record collection in indirect taxes, GVA (i.e., GDP – Net indirect taxes) growth was a tad lower at 18.8%.

- GVA/GDP growth prints an unusually high pace of expansion, bolstered by an exceptionally favorable base from nationwide lockdown in Q1FY21.

- However, the second wave of the pandemic posed as a stumbling block, in the absence of which, annualized growth could have looked even better.

- Reflecting this on a sequential basis, GDP growth contracted by 16.9% compared to an expansion of 7.5% in Q4 FY21; although sizeably lower than 29.7% dip recorded in Q1 FY21.

- At the sectoral level, economic activity was uneven in nature, albeit with some upside surprises in agriculture and trade, hotels, transport & communications.

- Looking ahead into FY22 from growth perspective, progress on vaccination remains the most critical monitorable. Amidst global support to domestic exports and catch-up in sowing activity for the kharif season, we continue to hold on to our FY22 growth forecast of 10.0%.

- We do acknowledge downside risks emanating from the possibility of another wave of Covid infections, along with deficient monsoon and elevated inflation.

India’s annualized Q1 GDP growth came somewhat lower than market expectations, at 20.1%. Amidst a record collection in indirect taxes, GVA (i.e., GDP – Net indirect taxes) growth was a tad lower at 18.8%. Both, GVA and GDP growth record a high pace of expansion, which was bolstered by an exceptionally favorable base from last year’s nationwide lockdown. However, the second wave of the pandemic posed as a stumbling block for economic recovery, in the absence of which, annualized growth could have looked even better. Reflecting this on a sequential basis, GDP growth contracted by 16.9% compared to an expansion of 7.5% in Q4 FY21; albeit much lower than 29.7% dip recorded in Q1 FY21.

Key takeaways

At a granular level, economic activity was uneven in nature, albeit with some surprises.

- Agriculture clocked an above long-term trend growth of 4.5% despite the rural economy weathering a disproportionately higher impact of the second wave of Covid. The record Rabi harvest followed by Government’s intense procurement activities appear to have aided the sector.

- Industry, including construction expanded by 46.1% in Q1 FY22 compared to a deep contraction of 35.8% in Q1 FY21. Less stringent lockdown restrictions permitting continued operations in both manufacturing and construction sub-sectors have helped. At the margin, better adaptability of the sectors to Covid protocols and a recovery in exports further supported growth momentum.

- Services sector recorded an expansion, albeit much lower in comparison to manufacturing, at 11.4% in Q1 FY22 compared to -21.5% in Q1 FY21. The surprise quotient was the stronger than anticipated growth in Trade, Hotels, Transport & Communication sub-sector, at 34.3%, reflecting a likely resilience in transport and logistics sectors in Q1, and also nascent recovery in tourism sector that began to take shape since Jun-21. In a reflection of strengthening consumer confidence, Google mobility have recouped all losses induced by the second wave and are now back to Feb-21 levels (as of third week of Aug-21).

- Other sub-sectors within services, i.e., Financial, Real Estate and Professional Services and Public Administration, Defence and Other Services both posted subdued growth at 3.7% and 5.8% respectively on a YoY basis although the former recorded a recovery of 18.8% on a QoQ basis.

- On a sequential basis, GVA contracted by 13.3% with a broadbased contraction across all sub-sectors except for utility services (3.1%QoQ) and a part of the services as highlighted above.

- On the expenditure side, private consumption grew by 19.3%, albeit contracting by 17.4% QoQ compared to an expansion of 2.3% QoQ in Q4 FY22. The second wave of infections had taken a heavy toll on consumption, as seen in high frequency indicators of auto sales, tractor sales, fuel consumption – all sequentially slipping in months of Apr-May’21.

- Investments, i.e., Gross Fixed Capital Formation rose by 55.3% in Q1 FY22 compared to a contraction of 46.6% in Q1 FY21; it is likely to have found support from higher public capex spending growth at 26.3% in Q1 FY22.

The big picture

Q1FY22 double-digit GDP growth must be viewed as a statistical surge, masking the sequential deceleration in momentum seen in the quarter owing to the staggered state-level restrictions imposed. Having said so, the last week of May-21 saw economic activity bottom-out, with the momentum continuing to tick in the months of Jun-Aug 2021. This is validated by high frequency indicators such as E-way bill collections, Google mobility, Auto sales, Electricity generation, Rail Passenger movements among others, shifting into swift recovery mode with most of them now nearing or have already surpassed pre-second wave respective peaks.

Looking ahead into subsequent quarters, while headline GDP/GVA growth is likely to increasingly ‘normalize’, one must keep an eye on sequential momentum which is expected to fare better Q2 onwards, owing to -

- Strong V-shaped global growth recovery that is likely to be supportive of India’s exports momentum.

- A stronger comeback in rural demand vis-à-vis urban, amidst above normal area sown for Kharif crops as of end Aug-21 and policy support.

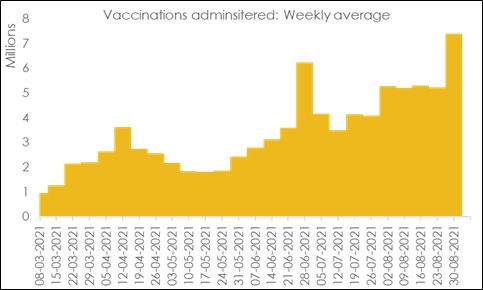

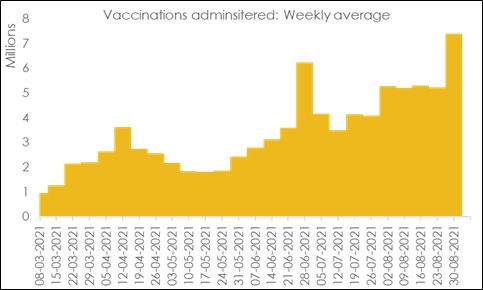

- Vaccination drive having gained momentum in the last one week. Not only did India achieve the highest ever daily vaccination pace of more than 10 mn doses on 2 days in the last week of Aug’21, it also set a record average daily pace of vaccination for the week ending Aug 29, 2021. If vaccinations keep up this pace over the next 3 months, India can achieve inoculation of close to 60% of the population by the end of the year.

- As vaccinations approach critical mass, it could boost consumer sentiment and demand, with the festive season providing an added fillip. It is likely to also propel a lagged pickup in pent-up demand for services.

Nevertheless, potential risks to growth do remain on the table from the possibility of a third wave of infections, though the loss of economic momentum is expected to be much less in comparison to the second wave. In addition, a deficient monsoon possibly weighing on Rabi prospects and inflation remaining above RBI’s target could be additional headwinds. As such, we continue to retain our FY22 growth forecast at 10% with downside risks. Looking beyond FY22, the recent Government announcement of deciding to roll back the retrospective taxation law and gradual progress on Production Linked Incentive Scheme, may mean that loss of potential industrial output can be made up for in the medium term.

Tables 1 and 2: India’s GVA and GDP: Break-up

| Growth in GVA (%YoY) |

Q1FY21 |

Q1FY22 |

| GVA |

-22.4 |

18.8 |

| Agri and allied |

3.5 |

4.5 |

| Industry |

-35.8 |

46.1 |

| Mining and Quarrying |

-17.2 |

18.6 |

| Manufacturing |

-36.0 |

49.6 |

| Electricity, Gas, Water Supply etc. |

-9.9 |

14.3 |

| Construction |

-49.5 |

68.3 |

| Services |

-21.5 |

11.4 |

|

Trade, Hotels, Transport, Communication |

-48.1 |

34.3 |

| Financial, Real Estate & Professional Services |

-5.0 |

3.7 |

| Public Administration, Defence |

-10.2 |

5.8 |

| Growth in GDP (%YoY) |

|

Q1 FY21 |

Q1 FY22 |

| Private Consumption |

-26.2 |

19.3 |

| Government Consumption |

12.7 |

-4.8 |

| Gross Fixed Capital Formation |

-46.6 |

55.3 |

| Exports |

-21.8 |

39.1 |

| Imports |

-40.9 |

60.2 |

| GDP |

-24.4 |

20.1 |

Chart 1: Average weekly vaccinations at a record high, week ending 29th Aug-21