Q2 FY22 GDP: A strong sequential rebound

KEY TAKEAWAYS

- India’s annualized GDP growth came in line with our expectation (Acuité’s forecast: 8.5% YoY) at 8.4% in Q2 FY22, expectedly lower from a record high level of 20.1% recorded in Q1 FY22.

- While the sharp deceleration in annualized GDP growth was expected on account of the taper down of favorable statistical base, the Q2 print turned out to be higher than RBI’s forecast of 7.9% as well as market consensus of around 8.1%.

- More importantly, the sequential momentum recorded at 10.4% QoQ for GDP growth in Q2 FY22 is encouraging and represents a partial rebound of growth momentum from the sequential contraction of 16.9% seen in Q1 on account of the second wave of Covid.

- We expect sequential growth momentum to remain strong in the coming quarters given the unlocking of the economy and a pickup in the contact intensive services which have led to an outperformance of the services sector vis-à-vis industry.

- However, global risks in the form of ongoing energy crisis and a potential Covid resurgence (due to the discovery of a new virus variant) needs to be closely assessed for spillover impact.

- We continue to stick to our FY22 GDP growth estimate of 10.0% with a moderate quantum of downside risk.

India’s annualized GDP growth came at 8.4% in Q2 FY22, lower from a record high level of 20.1% in Q1 FY22. The deceleration in GDP growth is understandable as compared to the previous quarter on account of the taper down of the extremely favorable statistical base.

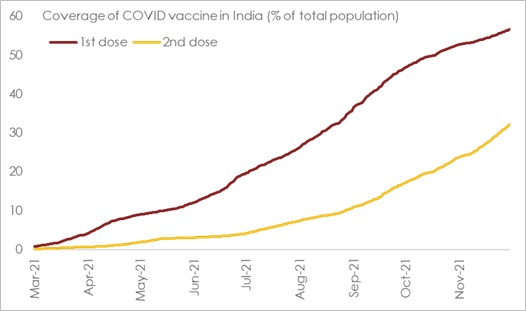

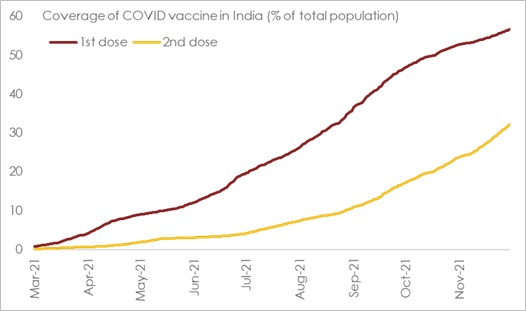

More importantly, the sequential momentum recorded at 10.4% QoQ for GDP growth in Q2 FY22 is exceptionally strong and represents a partial rebound of growth momentum from the sequential contraction of 16.9% seen in Q1 on account of the second wave of Covid. Gradual lifting of lockdown restriction by state governments and a scale-up in vaccination coverage were two important triggers for a move towards normalization of economic activity particularly by the end of Q2 FY22.

From the supply side, GVA also recorded a similar outturn with the annualized print clocking a growth of 8.5% YoY in Q2 FY22 from 18.8% in Q1 FY22. It also managed to expand strongly on sequential basis by 7.9% QoQ in Q2 compared to a contraction of 13.3% seen in Q1. The sequential revival in economic activity was clearly reflected in our proprietary AMEP (Acuité Macroeconomic Performance) index expanding by 7.2% QoQ in Q2 FY22 from a contraction of 9.3% in Q1 FY22. Growth momentum in the month of Oct-21, as also highlighted in our AMEP index, saw considerable upside with most high frequency indicators recovering above their pre-pandemic levels (for further details refer: https://www.acuite.in/pdf/PR_Index_Oct-21.pdf). In first half of Nov-21, we however notice some slowdown in incremental economic activity, which we attribute to seasonality on account of Diwali holidays. Nevertheless, the continued tapering of Covid infections, further progress on vaccination along with the festive season augmenting pent-up demand are likely to push India’s sequential growth recovery well into Q3 FY22.

Key takeaways

From the demand side:

- Consumer expenditure picked up pace registering a growth of 9.2% YoY as gradual unwinding of lockdown restrictions and increase in the pace of vaccinations augmented pent-up demand. Government consumption also expanded by 8.7% YoY in Q2 FY22 vis-à-vis a contraction of 4.8% in Q1 FY22. The removal of spending restriction by the central government in Aug-21 along with healthy pace of disbursal by states ensured that overall government consumption spending provided support to GDP.

- Investments, i.e., Gross Fixed Capital Formation rose by 11.0% YoY in Q2 FY22 compared to a contraction of 8.6% in Q2 FY21 reflecting an improvement in production of infrastructure & construction goods, capital goods and robust capital expenditure (central government capital expenditure grew by 51.9% YoY in Q2 FY22).

- The drag from net exports increased in Q2 FY22, a likely reflection of elevated merchandise trade deficit during the quarter.

- Comparing the dataset with two year ago levels to look through the statistical distortions created by the lockdowns, we note that GDP registered a modest expansion of 0.3% in Q2 FY22 compared to Q2 FY20. This is led by revival in exports and investments (that is likely to have found support from accelerated pace of public capital expenditure)

On the supply side:

- Agriculture and allied sector maintained a healthy growth of 4.5% YoY compared to its long-term average of 3.6%, backed by adequate monsoon and higher pace of government’s rural spending since the beginning of the pandemic.

- Value add in services exceeded the industry value add in Q2 FY22, for the first time since the beginning of the pandemic. Within services, trade, hotels, and transportation recorded a robust growth on annualized and sequential basis by 8.2% YoY and 24.9% QoQ respectively led bygradual opening up of contact intensive services amidst receding wave of Covid and improvement in vaccination coverage. This was very well corroborated in certain high frequency indicators such as google mobility index which is now tracking at pre-Covid levels along with uptick recorded in passenger freight (air and rail).

The big picture

The Q2 GDP print underscores the following anticipated developments:

- Pickup in sequential momentum even as annualized growth rates in most categories, expectedly saw a marked deceleration.

- Growth in services finally catching up with industry for the first time since the beginning of the pandemic.

Both these trends are likely to persist in Q3 FY22 as well with vaccination coverage providing a critical pivot (as on Nov 30, 2021, India has covered around 57% and 32% of its population with single and double dose of Covid vaccine respectively, up from 47% and 17% respectively towards the end of Q2) and a continuous tapering of lockdown restrictions has benefitted contact intensive services. Festive related seasonality along with pent-up demand will further buoy overall growth momentum, especially for services.

Going forward, we expect the sequential real activity to likely remain strong (although there would be further moderation in annualized growth prints). As such For FY22, we continue to retain our GDP growth forecast at 10.0% albeit with some downside risks that could possibly emanate from

- Supply chain disruptions and raw material shortages such as semiconductors that has impacted automobile output.

- Higher commodity prices that have led to a surge in input costs in several manufacturing sectors and could weigh on producer margins in the manufacturing sector in Q3FY22 and may also impact demand if a higher pass through of the increased costs happen.

- Persistence of higher global inflation which may translate into a faster normalization of monetary policies in some of the developed economies, translating to a volatility in capital flows

- Lastly, resurgence in Covid cases in Europe and the discovery of a new variant of concern in Africa have cast some fresh clouds on global growth. While we believe that the economic implications of another potential pandemic wave should remain limited amidst strong progress in the pace of vaccination, it is likely to create fresh uncertainties for the contact intensive and the travel sectors.

Tables 1 and 2: India’s GVA and GDP: Break-up

| Growth in value add (%YoY) |

Q2 FY21 |

Q1 FY22 |

Q2 FY22 |

| GVA |

-7.3 |

18.8 |

8.5 |

| Agri and allied |

3.0 |

4.5 |

4.5 |

| Industry |

-3.0 |

46.1 |

6.9 |

| Mining and Quarrying |

-6.5 |

18.6 |

15.4 |

| Manufacturing |

-1.5 |

49.6 |

5.5 |

| Electricity, Gas, Water Supply etc. |

2.3 |

14.3 |

8.9 |

| Construction |

-7.2 |

68.3 |

7.5 |

| Services |

-11.4 |

11.4 |

10.2 |

|

Trade, Hotels, Transport, Communication |

-16.1 |

34.3 |

8.2 |

| Financial, Real Estate & Professional Services |

-9.1 |

3.7 |

7.8 |

| Public Administration, Defence |

-9.2 |

5.8 |

17.4 |

| Growth (%YoY) |

Q2 FY21 |

Q1 FY22 |

Q2 FY22 |

| GDP |

-7.4 |

20.1 |

8.4 |

| Private Consumption |

-11.2 |

19.3 |

8.6 |

| Government Consumption |

-23.5 |

-4.8 |

8.7 |

| Gross Fixed Capital Formation |

-8.6 |

55.3 |

11.0 |

| Exports |

-2.0 |

39.1 |

19.6 |

| Imports |

-17.9 |

60.2 |

40.6 |

Chart 1: Increasing vaccination coverage in India