|

Executive Summary

Acuité believes that Indian industry has the wherewithal to successfully safeguard its interests and reduce India’s dependency on Chinese imports albeit in phases. With a strategic intent and highly calibrated approach from both the government and the industry, Indian economy can see a new narrative that can not only reduce its trade deficit but also kickstart a long awaited cycle of fresh private sector investments. Perhaps this can be the start of the implementation of the ‘Atmanirbhar Bharat’ campaign envisaged by the Government of India. |

Acuité believes that India can potentially reduce its trade deficit with China by $8.4 billion in FY21, which is equivalent to 17.3% of the deficit with China and 0.3% of India’s GDP. This can be achieved by the rationalization of just a quarter of India’s imports from that country in select sectors where the domestic economy has fairly well developed manufacturing capabilities.

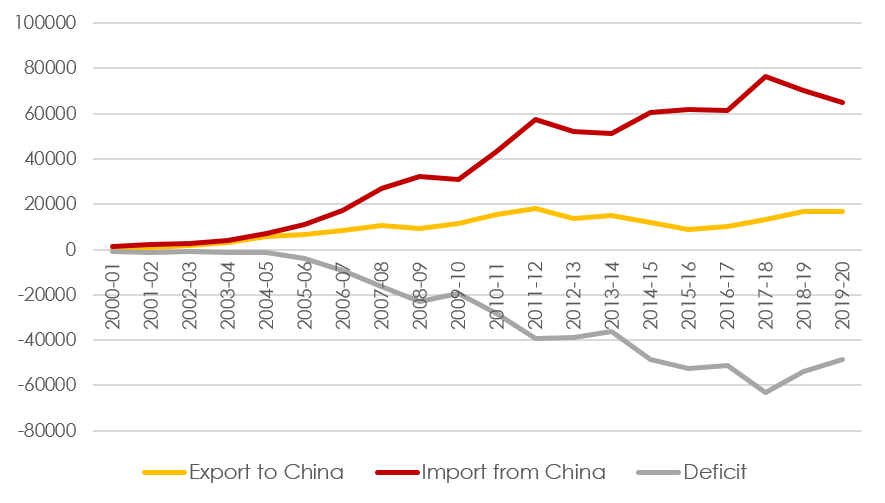

India and China shared a bilateral trade worth $81.7 billion in the previous year i.e. FY20. With an import of $65.1 billion and export of $16.6 billion, India recorded a trade deficit of $48.5 billion with China. While the imports from China have moderately declined by 15% since FY18 due to imposition of anti-dumping duties on some products, the dependence of the domestic economy on Chinese imports remain high with direct contribution to over 30% of India’s aggregate trade deficit. It is also noteworthy that in the non-petroleum category (POL), India’s exports to China account for just 5.3% of its total exports but the imports are more significant at 18.7% of the total import bill.

Interestingly, India started out as a net exporter to China until the financial year 1992-93. Under the IMF mandate to liberalize the economy and WTO regulations, several sectors opened up for free trade in the early 1990s and the vulnerable Indian industry in most sectors could not compete with the Chinese onslaught. As the years progressed, India-China trade became even more favourable to China, which in turn emerged as largest manufacturer of the world and obtained the advantages of high economies of scale. Consequently, over the past 28 years under consideration, while India’s exports to China grew by 30%, its imports expanded by 47%, ultimately leading to the current situation characterized by lower capacity utilization of domestic players particularly in a few sectors.

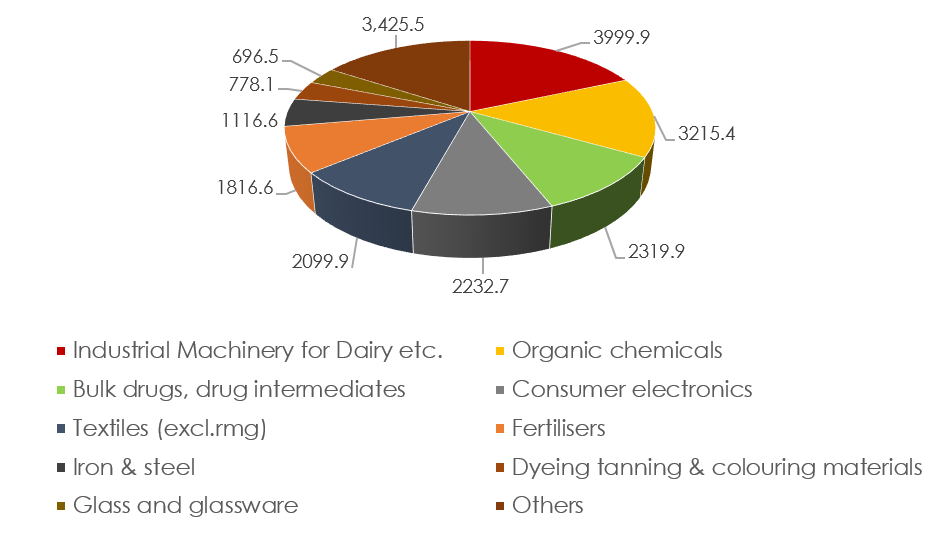

Acuité Ratings has conducted an analysis on the current import portfolio from China to understand the scope for import substitution in the near term. In our opinion, there are nearly 40 sub-sectors that have the potential to lower their import dependency on China. Collectively, these sectors contribute to $33.6 billion worth of imports. Without any significant additional investments, these sectors can easily reduce their dependency on China in a phased manner as such production capabilities already exist in the domestic market. If the domestic manufacturing sector can substitute 25% of the total imports from the specified sectors under consideration (please refer to Annexure - I) in the first phase, the country can potentially reduce $8.4 billion worth of trade deficit in a single year. Clearly, this would have a positive cascading effect on the economy as the equivalent quantum of revenues would not only be added to the turnover of domestic enterprises (primarily MSMEs) but is also likely to translate to benefits through forward and backward linkages and importantly, enhancing the scope of employment generation.

The sectors where there is a significant scope of import substitution in the initial phase include chemicals, automotive components, bicycles parts, agro based items, handicrafts, drug formulations, cosmetics, consumer electronics and leather based goods. Higher scale of operations brought about by import replacement is expected to help the companies including MSMEs in these sector to not only enhance their cost competitiveness but also cater to export markets and thereby, build a geographically diversified business franchise.

The chemical industry is a case in point; India is the world’s sixth largest chemical manufacturer and is responsible for $15.6 billion worth of exports annually. Yet, India’s annual chemical and related items (primarily methanol and phenol) imports are in the vicinity of over $10.2 billion. Imports of plastic related categories (primarily artificial resins and intermediate plastics), another derivative of the chemical industry are to the tune of $1.9 billion. India can potentially save nearly $3 billion import bill of such items even if we exclude some specialized chemicals, manufacturing capability of which are yet to develop in India.

Pharmaceuticals and drugs category is another potential foreign exchange saver that deserves attention. The estimated $80 billion Indian pharmaceutical industry imports bulk drugs (API) and other intermediate raw materials worth over $2.6 billion annually. We believe that in the first phase, India can potentially reduce its import by $0.6 billion annually in the category without incurring significant investment in capacity creation and acquisition of specialized technology.

Furthermore, certain other industry segments such as bicycle parts, handicrafts and spices should force a policy rethink in India apart from being merely assessed for import substitution potential. The bicycle and bicycle parts industry, which has witnessed $100 million worth of items from China needs to be revived and its cost competiveness enhanced since it surely has the necessary manufacturing capabilities and the skillsets.

While India has been historically the largest exporter of spices, India imported some $87.4 million worth of spices from China in FY20 without exporting anything in return. Handicrafts is another import category that is a surprise not just because India imported $431 million worth of items under the category from China but because it also didn’t have any significant reciprocal exports. Indian handicraft items are world renowned, enjoying great demand from abroad and are an important export category to the US and the EU nations. A strategic push is all that is required to nudge the sector forward in the export market.

Table 1: Import Substitution Sectors: China (in Million $)

| Category | Total Imports from China FY20 | Potential Reduction Target in First Phase |

| Industry Machinery for Dairy etc. | 3,999.9 | 1000.0 |

| Organic chemicals3,215.4 | 3,215.4 | 803.9 |

| Bulk drugs, drug intermediates | 2,319.9 | 580.0 |

| Consumer electronics | 2,232.7 | 558.2 |

| Textiles (excl. readymade garment) | 2,099.9 | 525.0 |

| Fertilisers | 1,816.6 | 454.2 |

| Iron & steel | 1,116.6 | 279.2 |

| Dyeing tanning & colouring materials | 778.1 | 194.5 |

| Glass and glassware | 696.5 | 174.1 |

| Inorganic chemicals | 599.5 | 149.9 |

| Moulded and extruded goods | 563.4 | 140.9 |

| Ceramics and allied products | 458.3 | 114.6 |

| Handcrafts (excl. handmade carpets) | 431.2 | 107.8 |

| Wood & wood products | 251.5 | 62.9 |

| Readymade garments | 328.9 | 82.2 |

| IC engines and parts | 242.3 | 60.6 |

| Leather and leather products | 236.4 | 59.1 |

| Cosmetics and toiletries | 166.0 | 41.5 |

| Bicycle and parts | 100.4 | 25.1 |

| Carpets | 27.2 | 6.8 |

| Processed fruits and juices | 20.4 | 5.1 |

Source: Government of India; CMIE

Graph 1: India's Trade with China: An Evolution ($ Million)

Source:CMIE

Graph 2: Segment Wise Imports from China (Million $)

Source:CMIE