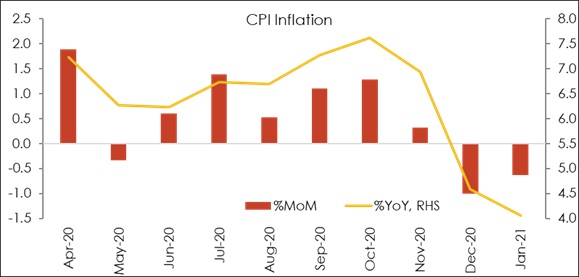

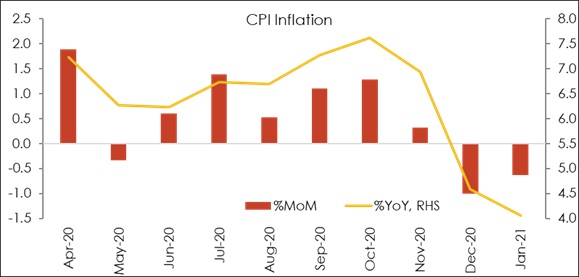

Jan-21 CPI Inflation: Finally at the 4.0% target!

KEY TAKEAWAYS

- CPI inflation continued to soften in the month of Jan-21, coming in at 4.06% YoY compared to 4.59% in Dec-20

- This marks the reversion of retail inflation to mid-point of RBI inflation target range of 4.0% after a hiatus of 16 months

- Once again, the downside was led by food prices, overshadowing the strong sequential increase in fuel prices for the second consecutive month

- Core inflation, which reflects underlying demand conditions in the economy, remained unchanged from previous month at 5.65% in Jan-21

- Looking ahead, while we expect food prices to continue to offer comfort in the coming months, we will remain watchful of non-food prices especially global commodity prices (crude oil and metals) and demand side pressures as a vaccine-led recovery gains momentum heading into FY22

- For FY22, we expect CPI inflation to average close to 5.0%, a significant moderation versus likely FY21 average of close to 6.0%, largely a fallout of COVID idiosyncrasies.

CPI inflation continued to soften in the month of Jan-21, coming in at 4.06%YoY compared to 4.59% in Dec-20. This marks the reversion of retail inflation to mid-point of RBI inflation target range of 4.0% after a hiatus of 16 months. Recall, for much of the current fiscal year, inflation continued to rein above RBI’s comfort level, averaging at 6.9% over the months of Apr-Nov. It was only in Dec-20 that inflation hit a point of inflection, paving way for more comfortable readings in CY21.

Anatomy of inflation

- Inflation moderation in Jan-21 was once again led by food prices, of which, vegetables drove the downside primarily. The near 15%MoM drop in vegetable prices came on the heels of an equal magnitude of decline recorded in Dec-20. While there has been a modest moderation in prices of Meat, Eggs (amidst the avian flu outbreak) and Pulses, a sequential rise in price of Oils & fats and Non-alcoholic beverages has also been visible.

- On the other hand, rise in fuel prices continued to cap the inflation downside. Combined fuel inflation (i.e., fuel and light along with transport within miscellaneous) rose to 5.66% in Jan-21- a near 2 year high, reflecting the steep rise in global crude oil prices. In USD terms, since Nov-20, India crude basket has risen by nearly 40%, exacerbating further, the pressure on already elevated retail fuel prices carrying the burden of excise duty hikes effected in May-20.

- Core inflation, i.e., Headline ex. Food and Fuel, reflecting underlying demand conditions in the economy, remained unchanged from previous month at 5.65% in Jan-21.

- Further, given the disproportionately higher share of food, the decline in rural CPI continued to outpace urban inflation for the second consecutive month. While Rural inflation eased by nearly 85 bps in Jan-21, urban inflation in comparison moderated by only 10 bps, continuing to remain above 5.0%.

Outlook

CY21 has begun on an optimistic note at least on CPI inflation front. We expect this comfort to continue in the coming months amidst a salubrious impact on food prices from winter seasonality, Kharif output, good progress on Rabi sowing, along with a positive statistical base. RBI in its recent MPC statement, anticipating this softness, had revised lower its Q4 FY21 CPI inflation forecast to 5.2% from 5.8% earlier. On the non-food prices, we remain watchful of the pass-through of the rise in global commodity prices of oil and other industrial metals to domestic inflation, along with demand-side pressures as a vaccine-led economic recovery gradually gains impetus in FY22.

For FY22, we expect CPI inflation to average close to 5.0%, a significant moderation versus likely FY21 average of close to 6.0% - largely a fallout of COVID idiosyncrasies. Nevertheless, we expect the central bank to start the normalization of the monetary policy and expect a 25 bps hike in repo rate within the next one year, somewhat ahead of the expected tapering of current quantitative easing by the US Fed. This back-ended approach should provide ample time for economic recovery, aided by the prompt vaccine roll-out, to get entrenched.

Annexure

Table1: Key highlights of CPI inflation data

| CPI Inflation: By sub-components (%YoY) |

|

Q1 FY21 |

Q2 FY21 |

Q3 FY21 |

Jan-21 |

| CPI headline |

6.57 |

6.90 |

6.38 |

4.06 |

| Food |

8.92 |

8.86 |

7.62 |

2.67 |

| Pan, Tobacco & Intoxicants |

7.81 |

10.81 |

10.57 |

10.87 |

| Clothing & Footwear |

3.19 |

2.84 |

3.32 |

3.82 |

| Housing |

3.72 |

3.06 |

3.22 |

3.25 |

| Fuel & Light |

1.66 |

2.88 |

2.22 |

3.87 |

| Misc. |

5.76 |

6.90 |

6.83 |

6.49 |

| Core Inflation |

5.06 |

5.70 |

5.75 |

5.65 |

Chart 1: CPI inflation softens to midpoint of RBI’s comfort range of 4.0% in Jan-21