Jul-21 Inflation: Provides marginal respite

KEY TAKEAWAYS

- After printing above the policy tolerance threshold for two straight months, CPI inflation reverted to the target band with Jul-21 print at 5.59% YoY.

- On sequential basis, CPI rose by 0.74% MoM in Jul-21, higher than the previous month’s momentum of 0.56%. All key sub-categories barring Food & Beverages depicted a pickup in sequential momentum.

- We remain hopeful of a moderation in both retail and wholesale inflation pressures in the coming quarters basis a favourable monsoon performance and trajectory of international commodity prices.

- However, inflation risks still persist on the horizon, with possibility of upside pressure from any uneven distribution in rainfall and vaccine led temporary surge in pent-up demand.

- For FY22, we continue to expect average CPI inflation to print at 5.5%, moderately lower vis-à-vis the 7-year high level of 6.2% seen in FY21.

After printing above the policy tolerance threshold for two straight months, India’s retail inflation slipped back into the RBI’s target band of 2-6%. While market consensus expectation was pointing towards a moderation in CPI inflation towards 5.6-5.7% in Jul-21 from 6.26% in Jun-21, the actual print turned out to be marginally lower at 5.59% supported by a favourable statistical base (headline inflation stood at 6.73% in Jul-20)

However, on sequential basis, CPI rose by 0.74% MoM in Jul-21, higher than the previous month’s momentum of 0.56%. All key sub-categories barring Food & Beverages depicted a pickup in sequential momentum in Jul-21 vis-à-vis the previous month.

Drivers of Jun-21 CPI

- Food and beverages inflation registered a sequential increase of 0.86% MoM, which was however, lower than previous month’s print of 1.18% MoM. Over the last 10-years, this is the second lowest sequential increase in the F&B index seen in the month of July.

- Moderation in sequential price pressure was observed in case of Eggs

- More importantly, prices registered a month-over-month decline in case of Cereals, Oils & Fats, Fruits, Pulses, Sugar, Spices, and Prepared Meals/Snacks; for Oils & Fats, this was the first month of sequential decline in prices after a protracted 26 month period of a continuous rise in monthly prices

- On the other hand, price pressure firmed up in case of Meat & Fish, Milk, Vegetables, and Non-alcoholic Beverages

Overall, the summer seasonality has been less severe so far on the F&B index. In addition, government measures on incentivizing supplies in case of pulses and edible oils appears to be having some early impact.

- Fuel and Light index registered a sequential increase of 0.56% MoM in Jul-21, higher than previous month’s momentum of 0.25%. Compared to Jun-21, price pressures accelerated in case of LPG and Firewood while it moderated for Kerosene, Diesel, Coke, and Charcoal.

- Core index (CPI ex Food & Beverages and Fuel & Light indices) increased by 0.62% MoM in Jul-21, after remaining unchanged in the previous month. Sequential increase was led by Pan, Tobacco & Intoxicants, Housing, Household Goods & Services, Health, Education, and Personal Care items.

- The pandemic has resulted in stickiness in core inflation due to supply disruption and some evidence of pass through of escalation in input prices. The FYTD (Jul over Mar) build-up in price pressure for core inflation has been at 2.7% in FY22, similar to 2.8% seen in FY21 – this we note is much higher than the average build-up of 1.5% seen in the corresponding 5-year period between FY16-FY20.

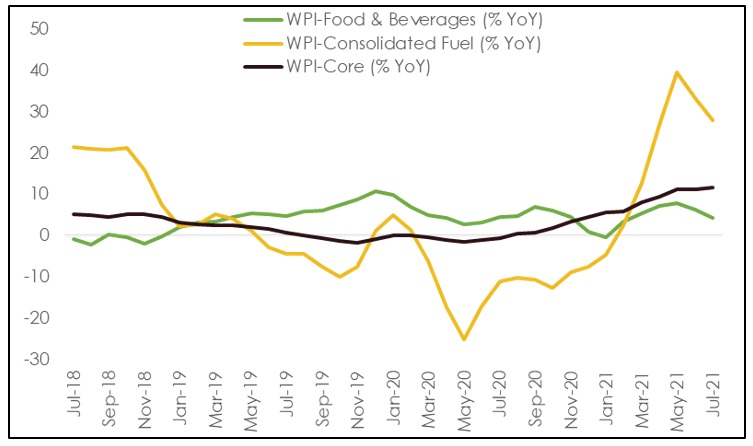

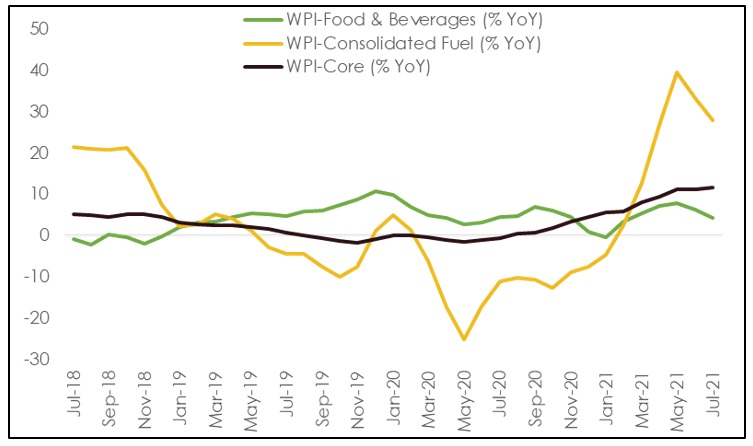

WPI inflation: Remains in double digit despite deceleration

- WPI inflation moved to a 3-month low of 11.16% YoY in Jul-21 from 12.07% in Jun-21. Despite the moderation in the headline inflation, the sequential momentum remained unchanged at 0.60% MoM over Jun-21 and Jul-21.

- Consolidated food & beverages inflation ticked up to 0.44% MoM in Jul-21 from -0.13% MoM in Jun-21. Nevertheless, the uptick appears to be moderate compared to the average build-up of 1.7% in F&B prices in the month of July (for series beginning 2011-2012).

- Consolidated fuel inflation posted another strong sequential print of 1.45% MoM in Jul-21 led by Crude Petroleum & Natural Gas (7.91% MoM) and Mineral Oils (5.41% MoM). Meanwhile, drop in electricity prices (-11.61% MoM) provided a marginal respite.

- In contrast, momentum in Core WPI (Headline excluding food & beverages and fuel components) eased somewhat to 0.39% MoM in Jul-21 from 0.54% in Jun-21. Nevertheless, the annualized print created a new series high of 11.65% YoY in Jul-21 on account of unfavourable base effect. High sequential pressure was observed in case of Primary-Non Food (2.35% MoM), Tobacco (2.09% MoM), Fabricated Metal Products (1.90% MoM), Machinery & Equipment (1.27% MoM), and Printing and Reproduction of Recorded Media (1.17% MoM).

Outlook

The month of July provided some respite to inflationary concerns that had seen a build-up in recent months after the outbreak of the second Covid wave. However, risks have not abated completely, and hence there is a constant need for policy vigil.

- Food price pressures appear subdued basis historical comparison. Record rabi output and a good start to monsoon has helped. However, rainfall performance has slipped in recent weeks – the cumulative rainfall up until Aug 16, 2021 stood 9% lower vis-à-vis the long period average. This points towards the likelihood of a below normal outturn unless rainfall activity gathers momentum in next 2-weeks.

- After a strong runup, international commodity prices have started to show signs of plateauing amidst supply adjustments in case of oil, administrative actions on select commodities by China, and renewed threat of Covid infections (from the Delta variant) in few countries. This could potentially temper the price impact in the coming months.

- Recently the central government took administrative steps to ease supply in case of pulses and edible oils. These include relaxing import restrictions and modifying the stock limits for pulses with traders and millers. At the state level, Tamil Nadu announced a cut in petroleum tax at its recently unveiled budget. Such policy interventions, scope for which still exists, would be important to calibrate the fiscal-inflation balance.

- If India inoculates at least 60% of the population before the end of 2021 with a single dose of vaccine, then it could lead to an upbeat consumer sentiment (as seen in case of few developed economies currently) and fan demand side pressures in the near term. This could potentially provide temporary downward rigidity to core inflation.

Overall, we see balanced risks to our FY22 average CPI inflation forecast of 5.5%.

Annexure

Table1: Key highlights of Jul-21 CPI inflation data

| CPI Inflation: By sub-components (%YoY) |

|

Jul-20 |

Jun-21 |

Jul-21 |

| Headline CPI |

6.73 |

6.26 |

5.59 |

| Food and Beverages |

8.50 |

5.58 |

4.46 |

| Pan, Tobacco & Intoxicants |

10.53 |

3.98 |

4.71 |

| Clothing & footwear |

2.78 |

6.14 |

6.46 |

| Housing |

3.25 |

3.75 |

3.86 |

| Fuel & Light |

2.66 |

12.61 |

12.38 |

| Miscellaneous |

6.81 |

7.21 |

6.71 |

| Core CPI |

5.61 |

6.09 |

5.77 |

Chart 1: Core WPI inflation stays firm even as non-core moderate somewhat