Jun-21 CPI Inflation: Comforting but risks remain

KEY TAKEAWAYS

- Despite CPI inflation remaining unchanged at 6.26% YoY in Jun-21 vis-à-vis 6.30% in May-21, the print turned out to be 34 bps lower than the median market expectations.

- On sequential basis, the headline index moved up by 0.56% MoM in Jun-21, lower than previous month’s lockdown induced sharp jump of 1.65% MoM.

- Sequential easing was nearly broad based, seen across food, fuel, and core inflation categories albeit to a moderate extent.

- While easing of sequential momentum in inflation on the back of unlock measures is a positive development, we need to be watchful of monsoon developments, crude oil prices, and possibility of a demand surge as vaccination acquires a critical mass.

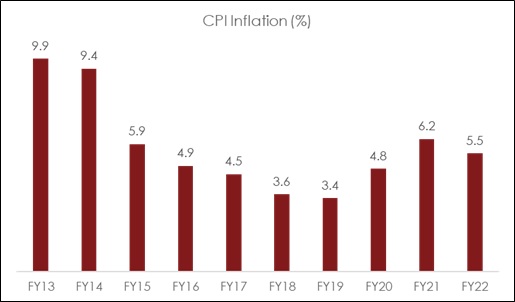

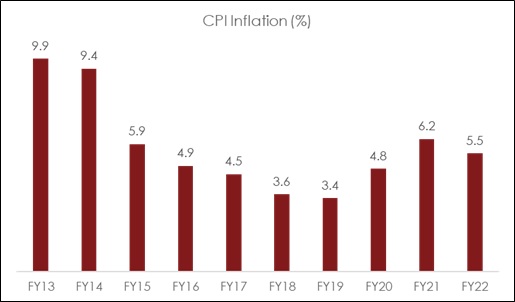

- For FY22, we expect average CPI inflation to print at 5.5%, moderately lower vis-à-vis the 7-year high level of 6.2% in FY21.

CPI inflation left a bittersweet aftertaste in Jun-21. At one end, headline inflation printed above 6%, the upper threshold for policy tolerance for second consecutive month, while also exceeding MPC’s Q1 FY22 forecast of 5.2% by 40 bps. At the other end, headline inflation coming in at 6.26% YoY posted a downside surprise of nearly 34 bps vis-vis consensus expectation of 6.6%, thereby allaying market anxiety with respect to further build-up of pricing pressures in the near term.

On sequential basis, the headline index moved up by 0.56% MoM in Jun-21, lower than previous month’s lockdown induced sharp jump of 1.65% MoM. From a longer-term perspective, the sequential change in CPI in Jun-21 also happens to be significantly lower than the 10-year average of 0.96%, seen for the month of June.

Drivers of Jun-21 CPI

- Food inflation registered a sequential increase of 1.18% MoM, lower than previous month’s print of 1.71% MoM. The relative moderation was led by Cereals, Meat & Fish, Milk, Oils & Fats, Fruits, Pulses, Sugar, Spices, and Non-Alcoholic Beverages. However, price pressures firmed up sequentially in case of Eggs, Vegetables, and Prepared Meals & Snacks. Gradual unlocking, expectation of a favourable monsoon outturn, and few supply side interventions by the government (easing imports while imposing stock holding limits for pulses, temporary reduction in excise duties on select edible oils, and free distribution of foodgrain under the PMGKY scheme) could keep price pressures at moderate levels in the coming months.

- Fuel and light prices registered a sober sequential increase of 0.31% MoM post the strong uptick of 2.44% MoM seen in the previous month. Sequential fall in electricity and LPG costs were seen to offset build-up of momentum in case of Kerosene, Diesel, Coke, and Charcoal. Despite the easing of incremental pressure, annualised inflation rate continued to climb. Taking into account fuel components in the Miscellaneous index, the consolidated fuel inflation stood at 15.2% YoY in Jun-21, the highest in the current series. With international crude oil prices carrying an upside bias since Jun, fuel inflation pressures could remain elevated in the near term, unless government decides to partially roll back taxes or duties on fuel components to provide relief to consumers.

- Core index (CPI ex Food & Beverages and Fuel & Light Group as well as the fuel and jewellery component in Miscellaneous Group) declined slightly by 0.06% MoM, marking the first sequential fall in 4 years. This resulted in annualised core inflation moderating to 6.02% in Jun-21 from a 7 year high of 6.58% in May-21. Sequential easing was led by the seasonal drop in Housing index, sharp decline in Pan, Tobacco, and Intoxicants and Recreation Services, coupled with moderation in price pressures for indices of Clothing, Household Goods & Services, Health, and Personal Care & Effects. Barring the last, which was driven by a fall in price for gold and silver, most others benefited from the incremental unlocking in Jun-21 that helped to gradually restore supplies.

WPI inflation: Climbing down the cliff

- WPI inflation decelerated from its record high level of 12.94% YoY in May-21 to 12.07% in Jun-21. However, the sequential momentum saw an increase of 0.75% MoM in Jun-21, up from 0.53% MoM in May-21.

- The sequential build-up in momentum was predominantly due to jump in price of fuel components. The consolidated fuel inflation saw a 2.79% MoM increase in Jun-21, thereby keeping annualised fuel inflation at an elevated level of 33.33%.

- Core WPI (headline excluding food & beverages and fuel components) also depicted strong sequential momentum of 0.78% MoM, taking the annualised inflation in this category to a record level of 11.23% in Jun-21.

- In contrast, food & beverages inflation provided solace. Sequential momentum was subdued for second month in a row, with the index remaining unchanged in Jun-21 vis-à-vis May-21. This bodes well for CPI food & beverages inflation in the coming months.

Outlook

It is encouraging to see sequential inflation drivers respond to the calibrated unlock measures taken by the state governments since the beginning of Jun-21.

However, inflation risks have clearly not abated.

- Monsoon in July needs to catch up to make good the shortfall seen since the third week of June.

- In the absence of tax relief by the government and supply adjustments by OPEC, fuel inflation could continue to carry an upward bias in the near term.

- If the government is able to inoculate at least 60% of the population before the end of 2021 with a single dose of vaccine, then it could lead to an upbeat consumer sentiment (as seen in case of few developed economies currently) and fan demand side pressures in the near term. This could prevent core inflation from moderating from elevated levels.

Having said so, we do acknowledge that food carries the highest weight of 45.9% in CPI, and favourable seasonal factors (monsoon led) and supply interventions by the government could help offset some of the upside risks to headline inflation, as highlighted above. Additionally, while the likelihood of revenge spending and a temporary spurt in demand led pressures cannot be ruled out, it also needs to be juxtaposed with the sharp deterioration in output gap since the onset of Covid.

From MPC’s perspective, our forecast of 5.5% average CPI inflation in FY22 is likely to provide incremental comfort compared to the 7-year high level of 6.2% seen in FY21.

Annexure

Table1: Key highlights of May-21 CPI inflation data

| CPI Inflation: By sub-components (%YoY) |

|

Jun-20 |

May-21 |

Jun-21 |

| Headline CPI |

6.23 |

6.30 |

6.26 |

| Food and Beverages |

7.92 |

5.24 |

5.58 |

| Pan, Tobacco & Intoxicants |

11.28 |

10.03 |

3.98 |

| Clothing & footwear |

2.71 |

5.32 |

6.21 |

| Housing |

3.55 |

3.86 |

3.75 |

| Fuel & Light |

0.50 |

11.86 |

12.68 |

| Misc. |

6.06 |

7.25 |

7.28 |

| Core CPI |

5.44 |

6.58 |

6.02 |

Chart 1: On average basis, CPI inflation is expected to moderate in FY22