Jun-22 Trade Data: Crude pushes deficit further

KEY TAKEAWAYS

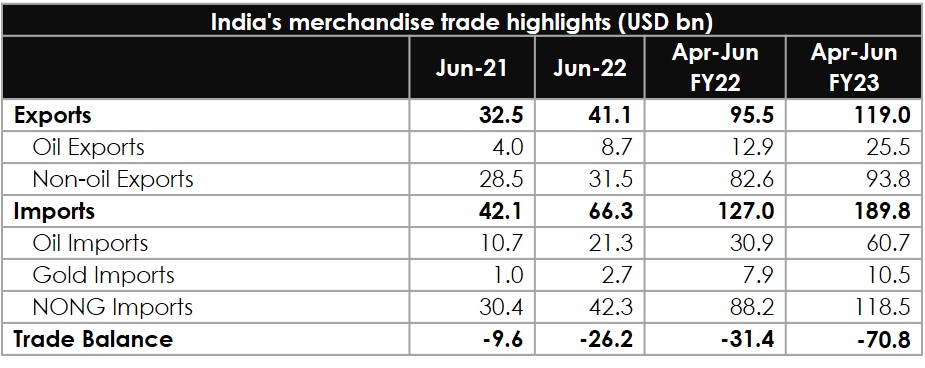

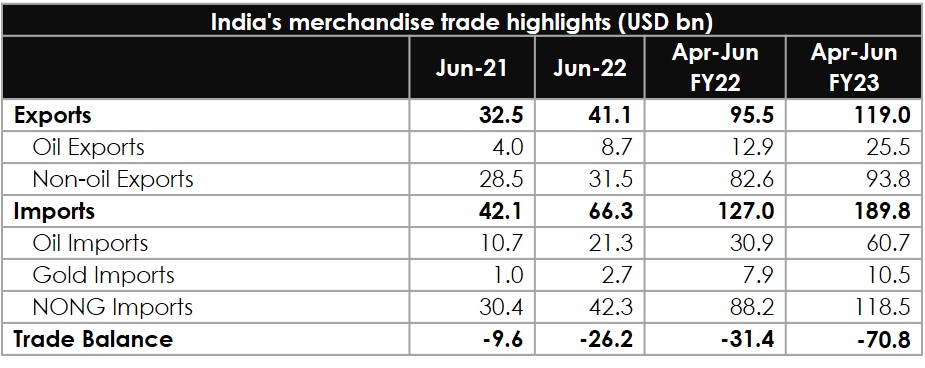

- India’s merchandise trade deficit widened to a record high of USD 26.2 bn in Jun-22 vis-à-vis USD 24.3 bn in May-22.

- While both exports and imports increased sequentially, a wider trade deficit resulted from a relatively higher expansion of imports vis-à-vis exports.

- The increased pressure on merchandise trade deficit is a confluence of three factors – elevated crude oil prices and mounting oil import bills, domestic pent-up demand that is driving non-oil imports and the slowdown in global economy that has started to impact export growth.

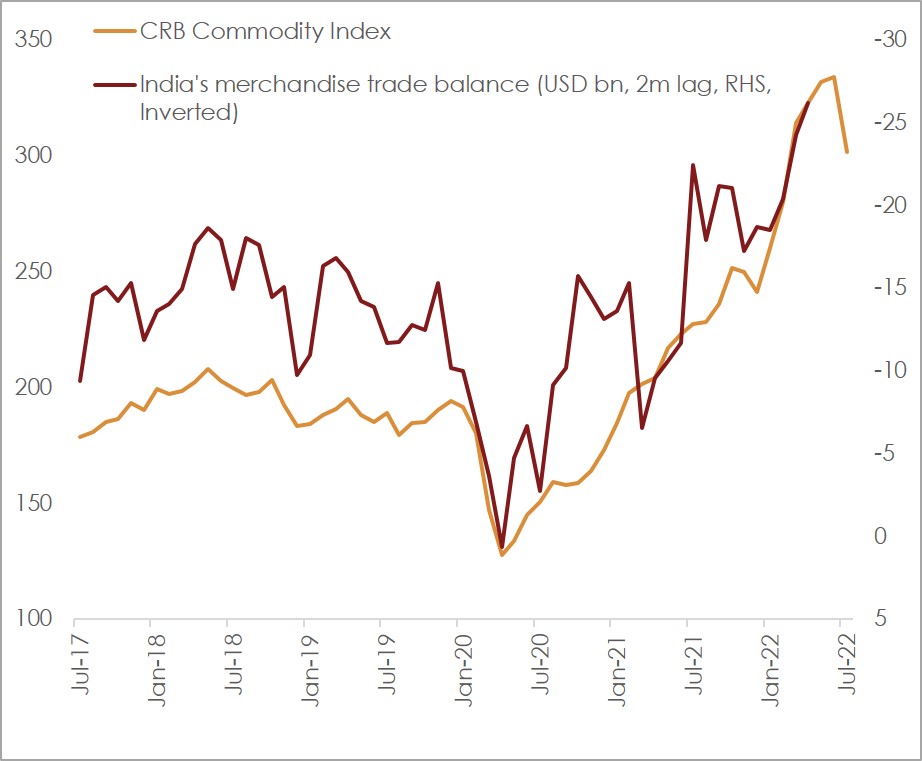

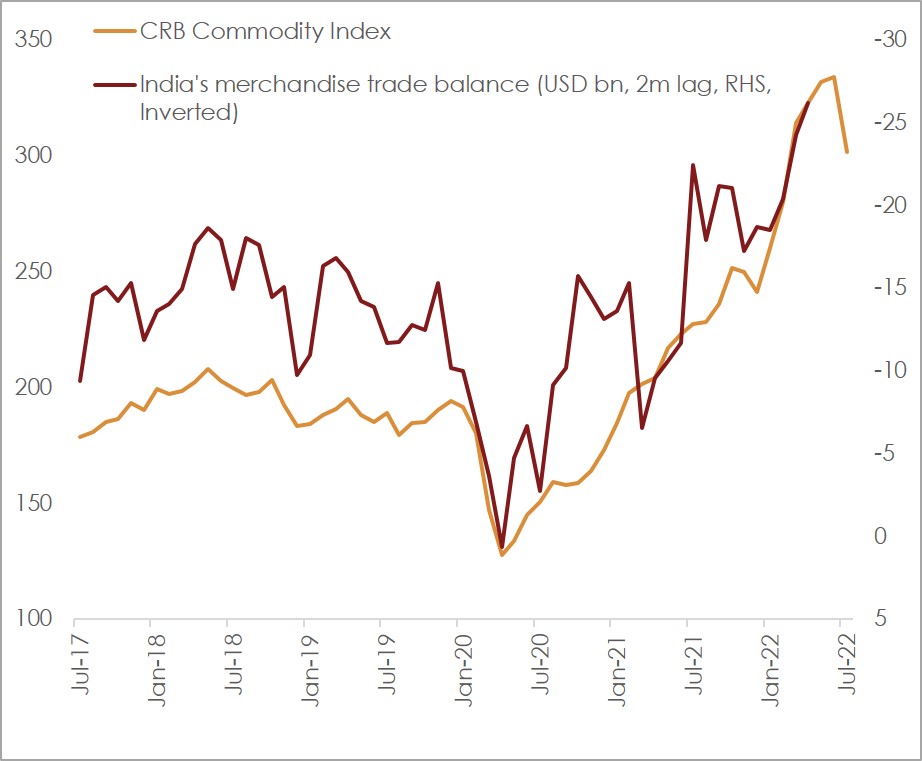

- While demand side factors could continue to put pressure on trade deficit, the recent decline in commodity prices including crude oil should help to moderate the extent of monthly trade deficit.

- Overall, we maintain our current account deficit forecast at USD 105 bn in FY23.

India’s merchandise trade deficit scaled a record high of USD 26.2 bn in Jun-22 vis-à-vis USD 24.3 bn in May-22. While both exports and imports increased sequentially, further expansion of trade deficit resulted from a relatively higher expansion of imports (4.9% MoM) vis-à-vis exports (3.1% MoM).

Exports

In value terms, merchandise exports increased to USD 40.1 bn in Jun-22 (3-month high and second highest on record) from USD 38.9 bn in May-22. This translated into a growth of 23.5% YoY.

- The sequential increase in value terms was led by exports of Agri & Allied Products (USD +0.4 bn), Chemicals & Products (USD +0.4 bn), Gems & Jewellery (USD +0.3 bn), and Electronic Items (USD +0.3 bn)..

- Meanwhile export of Petroleum Products, Organic & Inorganic Chemicals, and Cereal Preparations touched new monthly records respectively. Since most commodity prices peaked in Jun-22, with price of Brent averaging at USD 118 pb, there is bound to be a fair degree of price impact in these export values.

- On an monthly average basis, India exported petroleum products worth USD 8.4 bn in Q1FY23 which is significantly higher than USD 5.6 bn in FY22. However, such exports may slow down with the imposition of additional excise duty on exports of petroleum products from Jul-22.

Cumulative exports for the first three months of FY23 stand at USD 119.0 bn, an expansion of 24.5% compared to the corresponding period in FY22.

Imports

Merchandise imports touched a record high level of USD 66.3 bn in Jun-22 vis-à-vis USD 63.2 bn in May-22, translating into a growth of 57.5% YoY. At a granular level:

- Bulk of the sequential increase in value terms was driven by imports of Petroleum Products (USD +2.1 bn), Ores & Minerals (USD +1.4 bn), Chemicals & Products (USD +0.8 bn), Machinery Items (USD +0.5 bn), and Electronics Items (USD +0.4 bn).

- Five categories, viz., Ores & Minerals, Chemicals & Products, Plastic & Rubber Articles, Paper & Related Products, and Petroleum Products scaled a new monthly peak.

- Meanwhile, Gems & Jewellery imports fell sequentially on the back of decline in gold imports.

- NONG (Non-oil-non-gold) imports, a key indicator of domestic demand, picked up to USD 42.3 bn in Jun-22 from USD 38.0 bn in May-22.

Cumulative imports for the first three months of FY23 stand at USD 189.8 bn, marking an expansion of 49.5% compared to the corresponding period in FY22.

Outlook

The increasing pressure on merchandise trade deficit is a confluence of three factors. In ascending order of importance:

- Crude oil prices continue to remain elevated along with some other commodity prices on geopolitical uncertainty and persistent supply disruptions.

- Complete normalization of retail mobility post the Omicron wave along with vaccination drive gaining critical mass (with 70% of the population having received double dose) is supporting domestic demand for imports.

- The geopolitical crisis continues unfettered for the fifth consecutive month. The ongoing conflict has started to dampen world trade volume (recently the WTO scaled down its projection for merchandise trade volume growth for 2022 to 3.0% from 4.7% projected earlier). This has started to manifest in some moderation in India’s exports. In the near term, some impact on exports can also emanate from the imposition of export duties and restrictions by the government in case of select commodities like petroleum and wheat.

Of the above mentioned three factors, there has been considerable respite on the commodity price front in recent weeks. Increasing concerns over aggressive monetary policy tightening in several parts of the world and resurgence in Covid infections in few countries has started to result in paring down of global growth expectations for 2022 and 2023. This has led to sharp decline in many commodity prices in Jul-22 so far, with crude oil (Brent) price falling by around 10%. This, if sustained would help to moderate trade deficit pressures in the coming months. Overall, we maintain our current account deficit (CAD) forecast of USD 105 bn in FY23 on the assumption of crude oil averaging at USD 110 pb. However, we do acknowledge the uncertainty in projecting the CAD given the significant volatility in commodity prices.

Table 1: Highlights of merchandise trade balance

Note: Numbers may not add up due to rounding off and revision in headline exports and imports

Note: Numbers may not add up due to rounding off and revision in headline exports and imports

Chart 1: Recent decline in commodity prices to moderate pressure on trade deficit

* Only 2 months for FY23