Gradual unlocking along with the measures by RBI and Govt may provide relief

The impact of the second Covid wave has again raised concerns over the recovery of the microfinance (MFI) and the small NBFC sector, which was already battling the elevated credit stress and declining assets under management (AUM) in FY21. A study by Acuité Ratings shows that out of 13 issuer downgrades by credit rating agencies during Q1FY22 in the financial sector, 10 issuers are smaller MFI and NBFCs catering to unsecured MSME loans, personal loans and vehicle finance segment. A further analysis undertaken for the MFIs and smaller NBFCs rated by Acuité indicates that the collection efficiencies which were seen recovering above 90% in March 21 have dropped to 65-85% levels in this segment during Q1FY22. While the gradual ‘unlock’ measures by the State Governments will help to normalise collections, the monetary and fiscal measures taken to improve access to funds through government guarantees and other incentives to banks along with enabling restructuring of underlying borrower loans should ensure that the credit quality for the sector doesn’t deteriorate further.

The sector was staging a comeback with marked improvement in disbursals, collection efficiency levels as well as funding avenues opening for smaller players. Disbursals too had been gradually rising since Q3 2021, leading to healthy disbursals in H2 2021. However, with second wave of Covid forcing many states to impose strict lockdowns, the sectoral recovery has been interrupted and led to deterioration in credit quality.

An analysis of rating movements during the first quarter of FY22 shows that out of 13 issuer downgrades by rating agencies in the financial sector, 10 issuers are MFIs and smaller NBFCs engaged in providing microfinance, unsecured MSME and personal loans. Among the downgraded companies, it is noted that six issuers have been downgraded from investment grade to non-investment category and out of that, 3 entities have defaulted on their debt obligations. Similarly, transition in securitisation transactions reveals that out of the 13 pool transactions which have been downgraded or put on rating watch negative during Q1FY22, 8 pool transactions have underlying exposure towards microfinance and unsecured MSME loans.

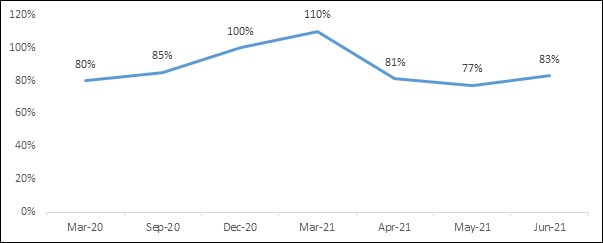

The collection efficiencies of the MFIs and small NBFCs in Acuité’s rated portfolio had improved above 90% in Mar-21 but the fresh lockdowns across most states and its impact on the borrower segment have led to collections declining sharply to 65-85% levels. While there has been some improvement in collection efficiency levels during the month of Jun-21, delinquencies are expected to rise during Q1FY21. Sequentially, delinquencies for smaller MFIs are expected to be in the range of 4.5%-5.0% by June 21 end.

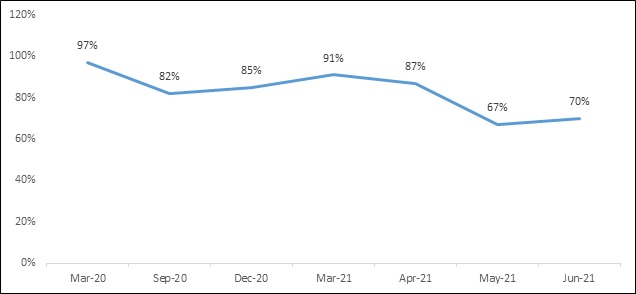

The impact of second wave of Covid has been more pronounced on collections efficiencies in the asset classes of both microfinance and two-wheeler finance as compared to the first cycle. Even as two-wheeler as an asset class fared better during the first wave of lockdowns, the impact has been clearly greater during the second cycle on account of the spread of the pandemic in rural areas and the stress on the borrowers’ cash flows due to loss of income as well as high medical expenses. Given the intermittent nature of economic activities in the wake of Covid-19 spread, the borrower income streams, particularly of those serviced by smaller NBFCs/ MFIs have been severely impacted in the current cycle thereby exacerbating the asset quality stress for these lenders. These developments along with absence of collection efforts on the ground, has hit the smaller NBFCs catering to microfinance, CV, two-wheeler and unsecured MSME asset classes. The blanket moratoriums provided last year during the period of Mar-Aug 2020 had helped the lenders in bridging the liquidity gaps which softened the impact of the first wave to an extent. However, the absence of moratorium has made the borrower stress more visible in this cycle and along with lack of adequate funding, the deterioration in liquidity and therefore, credit quality for smaller NBFCs and MFIs was almost inevitable.

Besides the lower collections, the debt raising ability of these smaller players has been impacted with estimated 50% of players (having loan portfolio of <500 Cr) having received adequate funds. Larger players have continued to benefit from the bulk of funding received by the NBFCs. Constraints in raising both equity & debt coupled with sharp drop in securitization volumes on account of increased delinquency concerns, have resulted in a liquidity squeeze for smaller players. Acuité has noted that some of the players were not able to raise any incremental borrowings during Q1FY22. Amidst the dip in the collection rate, the limited ability to raise debt or equity at this juncture has accentuated the stress in the liquidity position of these players, which already had a limited headroom to the absorb the impact. In our opinion, the rating actions in the sector were driven primarily by weak liquidity and poor financial flexibility.

In the wake of declining collections and the challenging liquidity position, smaller MFIs and NBFCs have turned cautious towards fresh disbursements with many players focusing solely on collections. While FY21 disbursals for smaller MFIs had already reduced by 40-45%, Q1FY22 is also expected to be tepid. The AUM of these MFI players, however, has contracted only by 10%-15% on account of the loan moratoriums and restructuring which have resulted into relatively lower portfolio amortization. Further, smaller MFIs have been focusing on growing their off-book portfolio through BC partnerships which provides them access to fee based income.

However, the economic environment has clearly turned positive since the end of May with a steady reduction in daily case loads and mortalities along with the unlocking measures taken by almost all the states in June. The daily cases and deaths as on June 30, 2021 at 48,600 and 1,000 respectively have been nearly one third of the figures as on May end, confirming the taper down of the second Covid wave. Unlike last year, however, the unlocking measures have been calibrated so far given the risks of a third wave amidst a low proportion of vaccinated people. Nevertheless, the distinct improvement in the mobility indicators since Jun-21 augurs well for the MFIs/NBFCs. The government of India has also announced a few additional fiscal relief measures for the businesses and borrowers impacted severely by the second wave of the pandemic. The size of the ECLGS programme which was launched in May 2020 has been increased from Rs. 3.0 Lakh Cr to Rs 4.5 Lakh Cr. As per government sources, an aggregate amount of Rs 2.7 Lakh Cr has been disbursed under this programme by banks and NBFCs. Acuité has also noted that a substantial number of MSMEs in its rated portfolio has availed additional funding from ECLGS which is helping them them to maintain an adequate liquidity position and service its existing debt despite the challenging business environment. Additionally, another government guarantee programme of Rs 1.1 Lakh cr has also been approved for borrowers in the stressed sectors including tourism and a part of the lending under that is also expected to provide fresh funding to the MSMEs.

The other significant measure from the government is a credit guarantee scheme specifically for the MFI sector. The decision to provide upto 75% guarantee for bank loans to the MFI sector upto an aggregate amount of Rs 7,500 Cr is a timely step. In our opinion, this will not only support the continuity of credit flow to microfinance borrowers but also provide liquidity relief to smaller MFIs.

Earlier, RBI in Apr-21, had earmarked an additional Rs 16,000 Cr funding limit for SIDBI for lending to MSMEs, directly or indirectly over and above the quantum of Rs 50,000 Cr that was set aside for government financial institutions in the Apr-20 policy statement. While the banks’ appetite to take additional exposure to the stressed sectors remains to be seen, RBI has also attempted to create an incentive structure for taking fresh exposures to them. In order to provide further relief to the businesses hit by Covid 2.0, the newly announced restructuring window has been extended for all entities with outstanding credit up to Rs 50 Cr. Given the ongoing stress in the NBFCs’ portfolio, we expect a significant increase in the quantum of restructured loans in Q1/Q2 of FY22 which will provide some relief to both the borrowers and the lenders.

Acuité believes that the overall prospects for the MFI and small NBFC sector will improve with the gradual normalisation of the economy over the next few quarters. We expect to see a recovery in disbursement growth in H2FY22. However, some of the smaller players with low capital raising ability, higher leverage and low liquidity buffers may continue to face credit challenges in the near term.

Annexure

Table 1: Average Monthly Collection Efficiency- MFIs

Table 2: Average Monthly Collection Efficiency- Two Wheeler Lenders