KEY TAKEAWAYS

CPI Inflation rose further to a 4-month high in Mar-21, to end FY21 at 5.52%YoY compared to 5.03% in Feb-21, largely attributable to an adverse base. Sequential momentum although modest at 0.13% was driven primarily by Fuel and Light category, as price pressures in all other sub-categories remained muted.

Granularity of Mar-21 inflation

WPI Inflation

WPI Inflation for Mar-21 accelerated to a record high in the 2011-12 series, coming in at 7.39% versus 4.17% in Feb-21. Once again, price pressures were driven by fuel, with inflation in the category now in double-digits at 10.25% vs. 0.58% in Feb-21 reflecting the lagged passthrough of global crude prices. In addition, manufacturing too registered broad based price pressures led by sub-sectors of Chemicals, Pharma, Rubber & plastics, Basic metals, Non-metallic mineral products, Electrical equipment among others amidst some degree of cost pass through and pricing power among producers. Separately, food prices continued to offer comfort owing to the sequential contraction (led by vegetables) recorded in the month.

Outlook

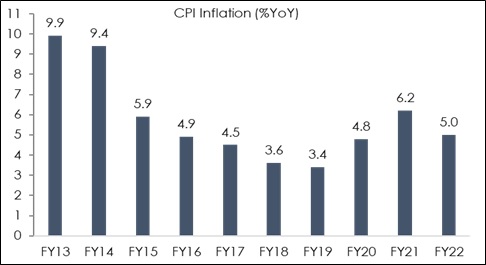

Despite the acceleration in Mar-21, average Q4 CPI inflation stands at 4.9%, a tad lower than RBI’s projection of 5.0% for the quarter. For the fiscal year gone by, average CPI inflation stands at 6.2%, in line with our expectations, but nevertheless the worst outcome in nearly 7 years as it breached RBI’s upper threshold of inflation band for the first time since the flexible inflation target regime was formally adopted in FY15.

Perhaps keeping in mind the idiosyncratic nature of FY21 inflation, an outcome of the pandemic, RBI’s mandate of maintaining inflation in the 4% +/- 2% band was reaffirmed by the Government further for a period of 5 years, up to FY26.

On inflation outlook, we retain our FY22 projection of 5.0% as we expect comfort on food inflation amidst robust agriculture output and early expectations of a normal monsoon in 2021 to sustain. Private weather forecaster SkyMet has pegged 2021 Southwest monsoon at 103% of LPA (Long Period Average). While crude oil prices have seen some softness in Apr-21 so far (-5% in USD terms), outlook on crude remains quite uncertain amidst global recovery, vaccine progress and OPEC gseopolitics. Any upside in crude price (with the rupee depreciation an additional risk factor) will add to inflationary pressures, unless countered by fuel tax reductions by the Central and the State Governments.

On inflation outlook, we retain our FY22 projection of 5.0% as we expect comfort on food inflation amidst robust agriculture output and early expectations of a normal monsoon in 2021 to sustain. Private weather forecaster SkyMet has pegged 2021 Southwest monsoon at 103% of LPA (Long Period Average). While crude oil prices have seen some softness in Apr-21 so far (-5% in USD terms), outlook on crude remains quite uncertain amidst global recovery, vaccine progress and OPEC gseopolitics. Any upside in crude price (with the rupee depreciation an additional risk factor) will add to inflationary pressures, unless countered by fuel tax reductions by the Central and the State Governments.

Having said so, CPI inflation is unlikely to trigger any action from the RBI given its commitment and need to support the nascent growth momentum. As our base case, we continue to expect the central bank to keep repo rate unchanged at 4.00% until the end of 2021.

Annexure

Table1: Key highlights of CPI inflation data on quarterly basis in FY21

| CPI Inflation: By sub-components (%YoY) | ||||

| Q1 FY21 | Q2 FY21 | Q3 FY21 | Q4 FY211 | |

| CPI headline | 6.57 | 6.90 | 6.38 | 4.87 |

| Food | 8.92 | 8.86 | 7.62 | 4.05 |

| Pan, Tobacco & Intoxicants | 7.81 | 10.81 | 10.57 | 10.46 |

| Clothing & Footwear | 3.19 | 2.84 | 3.32 | 4.15 |

| Housing | 3.72 | 3.06 | 3.22 | 3.32 |

| Fuel & Light | 1.66 | 2.88 | 2.22 | 3.97 |

| Misc. | 5.76 | 6.90 | 6.83 | 6.73 |

| Core Inflation | 5.06 | 5.70 | 5.75 | 5.83 |

Chart 1: CPI is expected to moderate in FY22 to 5.0%