May-21 CPI Inflation: A deja-vu

KEY TAKEAWAYS

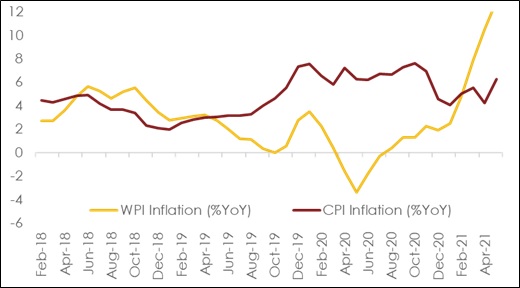

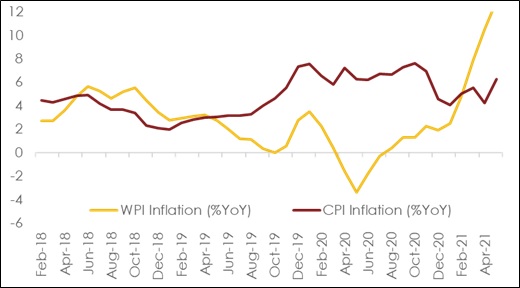

- In a surprising up move, headline CPI inflation accelerated to a 6-month high of 6.30% in May-21 versus 4.23% in Apr-21

- The momentum was broad based, with price pressures escalating across food, fuel and core categories with the exception of housing.

- Separately, while headline WPI inflation climbed up further to a new series high of 12.94% in May-21, on a sequential basis the momentum came off to 0.76% i.e., nearly half the average pace of rise over the previous three months.

- On a conjectural basis, in addition to supply side disruption from Covid lockdowns, pass-through of higher input prices and surge pricing by bigger players amidst curtailed supply/competition (especially from MSME) sector may be seen as factors responsible for strong sequential momentum in May-21.

- Being primarily supply-side/cost-push in nature, these price pressures would allow RBI to continue to focus on growth revival.

- Having said so, the significant inflation surprise in May-21 is likely to exert a material upside bias to FY22 inflation trajectory and our average CPI inflation estimate of 5.0%.

Headline CPI inflation accelerated to a 6-month high of 6.30% in May-21 (above RBI’s upper threshold of inflation band) versus a downwardly revised 4.23% in Apr-21 (from 4.29% earlier). On sequential basis, the index shot up by 1.65% to mark the sharpest pace of increase since last year’s nationwide lockdown in Apr-20, reflecting the impact of pervasive state-wide lockdowns on inflation. The momentum was broad based, with price pressures escalating across food, fuel and core inflation categories with the exception of housing. May-21 inflation print has indeed come as a strong surprise versus market consensus expectation in the range of 5.3-5.4%.

CPI inflation: Broad based price pressures

- Reflecting a combination of supply side disruption and onset of summer, food prices rose by 1.7%MoM in a near pervasive rise across sub-categories. Price pressures were exceptionally strong (compared to recent past trend) for oils & fats, pulses, cereals, eggs, spices and sugar – i.e., for staples, cumulatively accounting for nearly 40% of the food basket. Mercifully, momentum in price of perishables of fruits and vegetables though in positive, remained muted in comparison to past sharp gyrations.

- Fuel and light prices registered a strong uptick of 2.2%MoM, driving annualised fuel inflation into double-digits at 11.58%. Yet again, price pressures were broad based, not limited to only the expected items i.e petrol and diesel. Interestingly, two other heavy weights of – Firewood and chips and Electricity explained nearly 75% of the fuel upsurge.

- Core index (CPI ex Food & Beverages and Fuel & Light indices) jumped by 1.5%MoM, to mark the fastest sequential uptick since 2013. On annualised basis, core inflation climbed to a 7-year high of 6.5% amidst near broad-based price pressures.

WPI inflation: Respite on momentum

- While headline WPI inflation rose further to a new series high of 12.94%, on a sequential basis May-21 print saw some respite. WPI index rose by 0.76% MoM i.e., nearly half the pace of increase recorded in previous three months averaging at 1.35%.

- In another silver lining, primary prices contracted after a gap of 3 months by 0.86%MoM led by food prices compared to a significant build-up of 3.0% in Apr-21.

- Fuel inflation soared further to clock at 37.6%YoY but more so an outcome of an adverse base than a sequential uptick in prices. To put this in perspective, an unchanged fuel index in May-21 vis-à-vis Apr-21 would have translated into a fuel inflation print of 35.24%.

- Manufacturing prices rose by 1.24%MoM, almost in line with previous month’s increase of 1.17% and last 6 months average momentum of 1.21% reflecting the passthrough of escalating global commodity prices. Annual inflation for the category remained over 10.0% (at 10.83% compared to 9.01% in Apr-21) led by sub-categories of basic metals, furniture, fabricated metal products and electrical equipment. The inflation particularly for basic metals stood at 27.6%YoY with the mild steel segment recording 24.0%.

The Big Picture

May-21 CPI inflation is reminiscent of inflation prints from the first lockdown. Last year, not only did inflation spike owing to supply side disruptions but importantly, data collection also remained sub-par amidst the pandemic. The latest CPI reading is a deja-vu experience on both these counts.

Having said so, the magnitude of upward momentum is definitely surprising given that staggered and less pervasive state-wide lockdowns were perceived to be less stringent than last year’s nationwide lockdown. While we did anticipate impact of supply disruptions to play out on prices of perhaps a few items within the CPI basket, but the breadth of the price pressures has been quite broad.

On a conjectural basis, in addition to supply disruption from Covid, a mix of pass-through of higher input prices along with surge pricing by bigger players amidst curtailed supply/competition (especially from MSME sector) may have also been factors responsible behind the strong sequential momentum in May-21. Being supply-side/cost-push in nature, these price pressures would allow RBI to continue to focus on growth revival. Having said so, the significant inflation surprise in May-21 is likely to exert a material upward bias to FY22 inflation trajectory and our average CPI inflation estimate of 5.0% now under review.

Annexure

Table1: Key highlights of May-21 CPI inflation data

| CPI Inflation: By sub-components (%YoY) |

|

Apr-20 |

May-20 |

Apr-21 |

May-21 |

| CPI headline |

7.22 |

6.27 |

4.23 |

6.30 |

| Food |

10.47 |

8.37 |

2.60 |

5.24 |

| Pan, Tobacco & Intoxicants |

5.87 |

6.28 |

9.01 |

10.03 |

| Clothing & footwear |

3.47 |

3.39 |

3.49 |

5.32 |

| Housing |

3.94 |

3.66 |

3.73 |

3.86 |

| Fuel & Light |

2.93 |

1.57 |

7.98 |

11.58 |

| Misc. |

5.43 |

5.79 |

6.12 |

7.52 |

| Core Inflation |

4.84 |

5.00 |

5.39 |

6.55 |

Chart 1: While WPI inflation’s ascent was largely anticipated, the sharp uptick in CPI inflation came as a surprise in May- 21