Oct-21 Inflation: Concerns begin to brew

KEY TAKEAWAYS

- CPI inflation rose marginally in Oct-21 to 4.48%YoY from 4.35% in Sep-21.

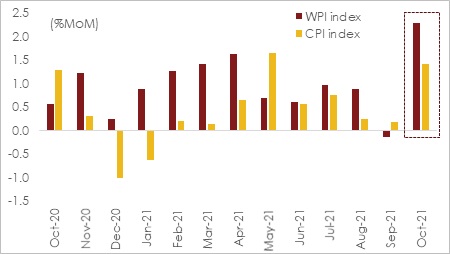

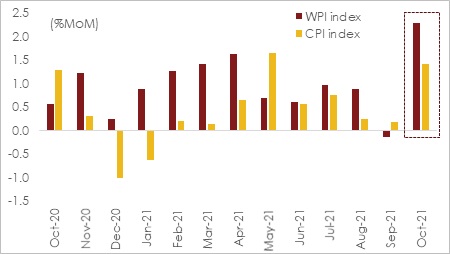

- The annualized print however nearly masked a strong and broad-based sequential uptick in momentum at 1.41%MoM vs. 0.18% in Sep-21.

- WPI inflation soared to a 5-month high 12.54%YoY in Oct-21 from 10.66% in Sep-21, on the back of a broad-based sequential increase of 2.3%MoM, the fastest pace on record.

- Going forward, comfort on food inflation with an expected record Kharif output along with recent reduction in excise/VAT on petrol and diesel are likely to keep headline inflation and household inflation expectations on a leash.

- However, escalating price pressures in case of commodity prices along with likely demand side pressures (as lockdown restrictions ease and vaccinations progress) on the anvil could play an offsetting role.

- For FY22, we continue to expect average CPI inflation to print at 5.5% (within RBI’s tolerance band), moderately lower vis-à-vis the 7-year high level of 6.2% in FY21.

- From monetary policy perspective, given the continuation of benign inflationary trajectory until Q3 FY22 and RBI’s approach of ‘gradualism’ in monetary policy changes, the likelihood of the postponement of reverse repo rate hike onto next quarter is on the rise.

India’s CPI inflation rose in Oct-21 to 4.48%YoY from 4.35% in Sep-21, marginally higher than market expectations of 4.3-4.4%. The modest uptick in annualized print (after a gap of 4 months) masked a strong sequential momentum (at 1.4%MoM) in the month, amid continued support from favorable base. The headline inflation thus remained well within the RBI’s policy target band for the fourth consecutive month, continuing to offer comfort.

Key highlights: CPI Inflation

- The sequential momentum was broad-based in Oct-21, with every sub-category in the index witnessing a pick-up vis-à-vis Sep-21.

- Bulk of momentum was driven by food prices, which rose by a sharp 2.3%MoM in Oct-21. A combination of excessive rainfall in Sep-21 (which weighed on standing crop yields along with a late withdrawal in Oct-21), festive season related demand and higher fuel and transport costs appear to have played a role. At a granular level, price pressures were led by Vegetables (14.2% MoM), Sugar & Confectionery (1.8% MoM), and Oils & Fats (1.3% MoM). On annualized basis however, food inflation remained largely subdued at 1.82% vs. 1.61% in Sep-21 owing to a favorable base (Oct-20 had too seen a spike in food index).

- Fuel price momentum increased to 0.98%MoM vs. 0.74% in Sep-21, led by Diesel (5.5%MoM), Kerosene (3.2%MoM), Coal (2.7%MoM), LPG (1.5%MoM), and Firewood prices (1.0%MoM). On annualized basis, fuel inflation remained at a series high of 14.35% reflecting an adverse base, higher domestic taxes, and the recent run up in global crude oil prices.

- Core inflation (i.e., CPI ex Food & Beverages, Fuel & Light and Pan tobacco & intoxicants) increased by 0.69%MoM in Oct-21 compared to 0.20% in Sep-21. The upside was broad-based, with strong ascent seen in Housing and Miscellaneous including transport and communication that got impacted due to elevated pump prices. Annualised core inflation rose to breach the 6.0% handle yet again after a gap of 2 months, coming in at 6.2% compared to 5.6% previously (see Table1).

Key highlights: WPI inflation

- WPI inflation soared to a 5-month high of 12.5 %YoY in Oct-21 from 10.7% in Sep-21, on the back of a broad-based increase. On sequential basis, the index jumped up by 2.3%MoM, the fastest pace of monthly increase on record.

- Among the internals, consolidated fuel (comprising of crude petroleum and Fuel & light index) rose by 8.8%MoM, led by surge in crude petroleum (9.5% MoM), Lignite coal (20.2%MoM), Electricity (18.8%MoM), Naphtha (+12.8%MoM) and ATF prices (14.3%MoM), reflecting the shortage in domestic coal availability and spillovers of global energy crisis in the month.

- In line with that in CPI inflation, consolidated wholesale food prices (comprising of food articles and manufactured food products) also rose by a strong 3.1%MoM, of which, fruits and vegetables standalone recorded a jump of 22.4% MoM in the month.

Points of comfort

- Notwithstanding the jump in prices in Oct-21, food inflation is likely to remain broadly comfortable over the coming months. Estimates of a record Kharif output as per Government’s first advance estimates, late withdrawal of Southwest monsoon supporting Rabi sowing, along with administrative interventions (on edible oils and pulses) are likely to help keep a lid on food inflation over the next few months, in addition to a favorable base.

- The recent reduction in central excise duty on petrol and diesel, along with cut in VAT by several states in quick succession should help ease CPI inflation to the tune of 25-30 bps (direct and second order impact combined) beginning Nov-21.

- Both of the above, will help assuage household inflation expectations, which in the last three rounds of RBI survey have remained northwards of 10%.

Points of discomfort

- Globally commodity prices continue to remain elevated. To be specific, India crude basket stands close to USD 83 pb (as of 11 Nov-21) – a rise of over 7.0% since Sep-21 end. The continued and swift increase in input costs (as reinforced by wholesale inflation) is beginning to get passed on to consumers in a calibrated manner across various industries such as FMCG, electronics, automobiles etc.

- The recent recovery in consumption as a combination of pent-up, vengeance and festive demand can be expected to continue as lockdown restrictions are eased further and vaccination coverage improves. This could keep goods inflation elevated.

- Demand for services is also seeing a strong pick-up. Not surprisingly, PMI services soared to over a decade high of 58.4 in Oct-21 compared to 55.2 in Sep-21. This could trigger a faster upward adjustment in services inflation, which so far has remained benign and ranged (~4.5%). More so, services inflation is seen to be stickier historically, which could provide further downward rigidity to core inflation.

Looking ahead, amidst favorable base factor at play in the near term, the ongoing comfort on inflation is likely to persist well into Q3 FY22. However, inflation trajectory is set to firm up in Q4 FY22 hovering close to upper tolerance threshold of RBI’s inflation targeting band on narrowing output gap and imported price pressures. Overall, while we continue to maintain our FY22 CPI inflation forecast at 5.5%, there could be some upside risks to that figure if high commodity prices and raw material shortages persist.

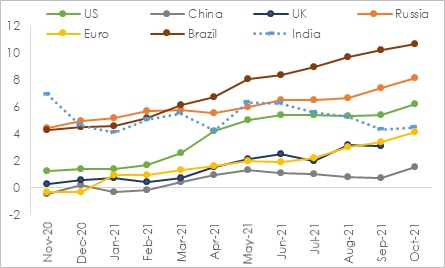

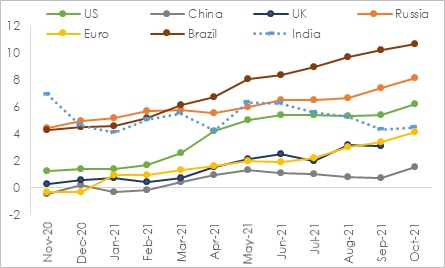

On global front, continued surge in commodity and raw material prices, persistence of supply bottlenecks, along with demand push inflation following the easing of Covid lockdowns worldwide have remained the major cause of concern causing inflation rates in many countries to go up sharply (Chart 2). Inflation rate in the US surged to a 31-year high of 6.2% YoY in Oct-21. Similarly, in China, the producer price index rose to 13.5% YoY, the fastest pace in 26 years, amidst shortages of coal, electricity and other raw materials. With rising inflationary pressure in most DMs and EMs many central banks have started to reconsider their earlier belief of inflation being ‘transitory’ and are now coalescing around higher inflation rate to be enduring. This has forced few central banks to start considering normalization of pandemic era accommodative policies. To recall the Fed has already begun tapering their bond buying programme by USD 15 bn per month from USD 120 bn per month. Amidst high inflationary pressures, BoE is also on the course to be the first major central bank to hike interest rates.

From India’s monetary policy perspective, taking comfort from the current moderation in CPI inflation, the RBI in its last MPC meeting continued to advocate the need for nurturing the nascent growth recovery thereby maintaining its accommodative stance. However, the central bank did make an attempt to nudge short term money market rates in upward direction (towards the LAF corridor) by calibrating the liquidity surplus through the expansion of the scope of VRRR auctions along with discontinuation of G-SAP operations. In our opinion, this is a precursor to interest rate normalization that we envisage to happen by Dec-21. However, given RBI’s approach of ‘gradualism’ and the expected benign inflationary trajectory in Q3 FY22, the likelihood of the postponement of an action in reverse repo rates onto next quarter is on the rise.

Annexure-1

Table1: Key highlights of CPI inflation

| CPI sub-components |

|

Sep-21

%MoM

|

Oct-21

%MoM

|

Sep-21

%YoY

|

Oct-21

%YoY

|

| CPI headline |

0.18 |

1.41 |

4.35 |

4.48 |

| Food |

0.06 |

2.26 |

1.61 |

1.82 |

| Pan, Tobacco & Intoxicants |

0.16 |

0.31 |

4.23 |

4.27 |

| Clothing & footwear |

0.55 |

0.61 |

7.22 |

7.53 |

| Housing |

-0.18 |

0.93 |

3.58 |

3.54 |

| Fuel & Light |

0.74 |

0.98 |

13.63 |

14.35 |

| Misc. |

0.25 |

0.63 |

6.38 |

6.83 |

| Core Inflation |

0.20 |

0.69 |

5.86 |

6.17 |

Chart 1: Both WPI and CPI prices record a strong sequential momentum in Oct-21

Chart 2: High inflationary pressures has spread across DM’s and EM’s (CPI YoY%)