RBI Monetary Policy : Steady on rates, salubrious on bonds

KEY TAKEAWAYS

- The MPC maintained status quo on monetary policy rates in Apr 2021 along with continuation of its accommodative stance.

- The central bank retained its FY22 GDP growth estimate of 10.5% despite the resurgence of the Covid pandemic. CPI inflation is projected to remain within 4.4-5.2% over Q1 FY22 and Q4 FY22, with average of 5.0% in FY22.

- Key highlight is the announcement of G-SAP program, a formal mechanism for purchasing bonds from the secondary market with upfront committed targets. For Q1 FY22, the target for G-SAP has been set at Rs 1 Lakh Cr. This will help anchor long term yields.

- We continue to expect the MPC to keep repo rate unchanged at 4.00% through 2021 even as yield management efforts would continue to take place during the next 4-quarters.

- Progress on vaccination and likelihood of tapering of QE by the US Fed would eventually lead to a 25 bps hike in the repo rate in Feb-22.

The policy review by the Monetary Policy Committee of the Reserve Bank of India held between Apr 5-7, 2021 saw the maintenance of status quo on Repo Rate (at 4.00%), Reverse Repo Rate (at 3.35%), and Marginal Standing Facility Rate (at 4.25%). The MPC "also decided to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward”. Both decisions of the MPC were backed by complete majority of 6-0 voting outturn.

The key policy rates and stance have remained unchanged since May 2020.

Economic Assessment

Despite the recent surge in Covid infections observed in few states and its concomitant impact through reimposition of certain lockdown restrictions, RBI retained its forecast for FY22 GDP growth at 10.5%. As of now, the following factors are expected to play an offsetting role and limit the downdraft from the second wave of infections:

- Record agriculture production in the Rabi season of FY21 bodes well for rural demand. In addition, early signals point towards the likelihood of a normal monsoon season in the upcoming Jun-Sep months.

- Urban demand has started to recover on improvement in mobility along with the steady progress in the vaccination drive. India has so far vaccinated (at least one shot) 6.3% of its population currently, up from 0.4% during the previous MPC review in Feb-21.

- Optimism with respect to global demand has improved post renewed fiscal push from the US government. The IMF recently upgraded its forecast for World GDP growth in 2021 and 2022 to 6.0% and 4.4% from 5.5% and 4.2% (provided earlier in Jan-21) respectively. This may improve global trade prospects and provide a healthy momentum to exports in FY22.

RBI’s growth projection is similar to our FY22 GDP growth forecast of 11.0%. Having said so, we do acknowledge the emergence of modest downside risk contingent upon the severity, spread and duration of the second wave of COVID infection.

On the inflation front, RBI continues to expect some moderation during FY22 vis-à-vis FY21. While the bumper foodgrain production is expected to soften the sequential food price pressures, elevated global commodity prices and increased transportation costs could pull up inflation in the coming months. Timely downward adjustment in duties and taxes on petroleum products and a favorable monsoon outturn in Jun-Sep 2021 season can however, help to keep price pressures at bay. RBI projects next 4-quarter average CPI inflation at 5.0% with a quarterly range of 4.4-5.2%.

The central bank’s forecast on CPI inflation is completely in sync with our base estimate of 5.0% average inflation in FY22. While this would indeed register a moderation vis-à-vis the estimated average of 6.2% in FY21, it would nonetheless be higher than the mandated inflation target of 4% (with a 2% band on either side), which recently got reinstated by the government for a period of five years, i.e. until Mar-26.

Liquidity and Credit Measures

The central bank announced the following key measures to augment liquidity and credit offtake:

- The RBI has introduced a secondary market g-sec acquisition program (G-SAP 1.0), wherein it will commit upfront a specific target for bond purchases to enable a stable and orderly evolution of the yield curve amidst comfortable liquidity conditions. For Q1 FY22, the target for G-SAP has been set at Rs 1 Lakh Cr (first leg of purchase for an aggregate amount of Rs 25,000 Cr will be conducted on Apr 15, 2021).

- Considering the excess liquidity, the RBI would start conducting longer maturity Variable Rate Reverse Repo Auctions in FY22. The Governor reiterated that this is a part of central bank’s liquidity management operations and should not be construed as tightening of liquidity.

- The TLTRO On Tap Scheme (introduced on Oct 9, 2020) now stands extended by a period of 6-months, i.e. until Sep 30, 2021. This is expected to benefit all 26 stressed sectors identified by the Kamath Committee along with NBFCs.

- Special refinance window of Rs 50,000 Cr would be provided to the All India Financial Institutions for incremental lending during FY22. Under this, NABARD will receive Rs 25,000 Cr to support agriculture and allied activities, rural non-farm sector, and NBFC-MFIs; NHB will get Rs 10,000 Cr to support the housing sector; and SIDBI will receive Rs 15,000 Cr to meet the funding needs of MSMEs.

- Bank lending to registered NBFCs (other than MFIs) for on-lending to Agriculture, MSME and Housing was permitted to be classified as PSL (between Aug 13, 2019 till Mar 31, 2021). This dispensation is now extended for another six months up to Sep 30, 2021.

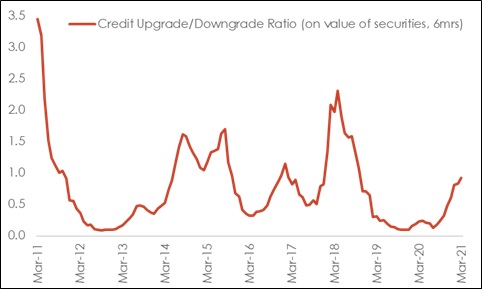

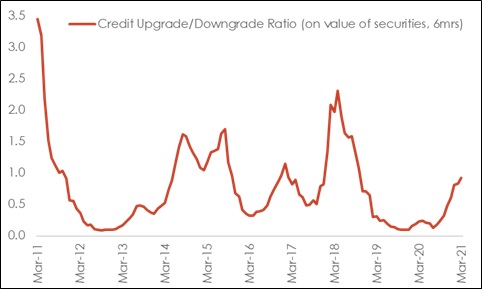

The combination of surplus liquidity and supportive regulatory dispensation is expected to prop up bank credit offtake in FY22. Moreover, the anticipated recovery in Nominal GDP from an estimated (by the NSO) contraction of 3.8% in FY21 to 15.0% in FY22 will drive working capital requirement, as well as demand for fresh credit for new infrastructure projects, supported by the record low level of lending rates. We believe that a gradual improvement in credit conditions, as reflected in a sequential increase in the Credit Ratio among the Credit Rating Agencies would also dovetail into an improved credit appetite among lenders. Overall, we expect bank credit growth to improve towards 8-9% (with upside risk) in FY22 from the subdued range of 6.0-6.5% in FY20 and FY21.

Other Measures

In addition, the RBI also made the following key announcements:

- As per the recommendations of Shrivastava Committee, the RBI revised the WMA limit for states to Rs 47,010 Cr as against the current limit of Rs 32,225 cr. In addition, the enhanced interim WMA limit of Rs 51,560 Cr provided to states as an emergency relief measure on account of COVID is extended for period of 6-months, i.e., until Sep 30, 2021.

- To further the goal of financial inclusion and to expand the ability of Payments Banks to cater to the growing needs of their customers, the current limit on maximum end of day balance of Rs 1 lakh per individual customer is being increased to Rs 2 lakh with immediate effect.

- The RBI will constitute a committee to undertake a comprehensive review of the working of ARCs and recommend measures to enable them to meet the growing requirements of the financial sector.

Chart 1: Credit environment is gradually showing some improvement

Source: CRA Reports

Outlook on monetary policy

The outcome and projections from the Apr-21 policy review reinforces the need for maintaining accommodative policy stance to nurture the nascent recovery in economic growth. This assumes importance as there has been a sharp uptick in Covid infections in few states, which could impart a mild downside risk to Q1 FY22 GDP growth momentum. As such, we continue to expect the central bank to keep repo rate unchanged at 4.00% until the end of 2021. This along with the formal effort towards anchoring long term yields (via G-SAP program) would help to curb uncertainty, promote financial stability, and help sustain the early growth impulses.

Going forward, we continue to believe that the first hike in repo rate in Q4FY22 is still a live option (RBI’s omission of time-based calendar reference for maintaining accommodative policy stance in FY22 is to be noted) as:

- Progress on vaccination likely to gain critical mass of about 50% (of population coverage) in next 3-quarters, thereby boosting demand outlook considerably.

- EMs could potentially face some volatility from anticipation of Fed taper towards the middle of 2022.