KEY TAKEAWAYS

The bi-monthly review of Monetary Policy Committee of the Reserve Bank of India (RBI) held between Aug 4-6, 2021, expectedly witnessed a status quo for the seventh time in a row on policy rates with Repo Rate at 4.00%, Reverse Repo Rate at 3.35%, and Marginal Standing Facility Rate at 4.25%.

The MPC "also decided to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward”.

While the decision on rates was completely unanimous decision backed by a 6-0 voting outturn, the one on the accommodative stance saw a lone dissent with 5-1 voting outturn.

Economic Assessment

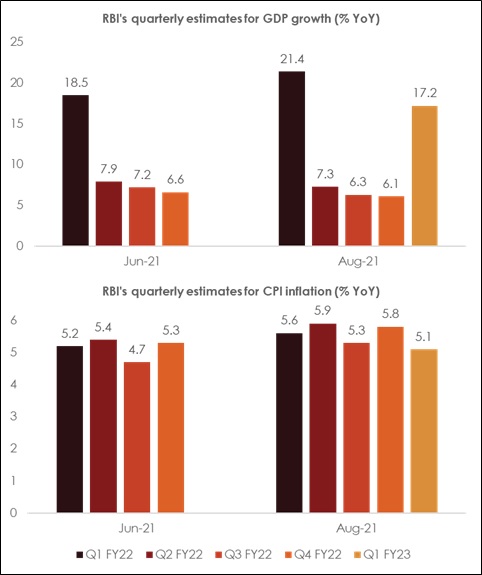

The central bank retained its forecast for FY22 GDP growth at 9.5% amidst ongoing gradual unlock by most states and the likelihood of south-west monsoon being normal (cumulative rainfall between Jun 1 and Aug 6 stood 3% lower vis-à-vis the long period average). While the former would help to restore supply side disruptions from the second wave, the later would support another healthy kharif crop, and thereby rural demand.

Meanwhile urban demand is expected to find support from revival in contact intensive sectors, the recently announced DA/DR hike for central government employees, and a relatively faster progress in vaccination.

Further, buoyant demand for exports along with the expected pick-up in public spending would provide impetus to overall aggregate demand, including investments.

RBI’s FY22 growth projection is marginally lower vis-a-vis our own estimate of 10.0% with some downside risk.

On inflation front, the RBI revised upwards its FY22 average CPI inflation forecast by 60 bps to 5.7%, close to our estimate of 5.5%.

Liquidity and Credit Measures

The central bank announced the following key measures to manage liquidity and facilitate credit growth, with a focus to ensure more equitable access to liquidity across sectors.

Outlook on monetary policy

The Governor in the post policy press conference stated that the RBI continues to remain in "whatever it takes” mode for providing support for nurturing nascent growth impulses. This highlights the unambiguous policy desire to backstop growth till Covid related economic and financial uncertainties remain. Greater clarity on durability of recovery is likely to emerge with the progress of vaccination and scope/severity of any further wave of Covid infection.

While future waves of Covid cannot be ruled out basis ongoing mutations, the spread in vaccination could hopefully taper the severity. India has been able to partially vaccinate nearly 29.6% of its population (as of Aug 8, 2021), this is likely to get extended to at least 60%-70% of the population before the end of Dec-21. We believe this would play a critical role in providing confidence to the RBI on the durability of economic recovery, and thereby pave the way for gradually reprioritizing the inflation objective.

In our opinion, the policy review of Aug-21 has a subtle shade of policy normalization in the form of the scale up of the VRRR auctions for temporary deployment of excess liquidity since it can lead to some firming of short term rates and realignment of the yield curve. However, we continue to expect the central bank to start normalization of the policy rates by increasing reverse repo rate from 3.35% currently to 3.75% by end of Q3FY22 or during Q4FY22, followed by a 25 bps hike in the repo rate to 4.25% in Q1FY23.

Annexure

Chart 1: Revised GDP and CPI inflation estimates from RBI