RBI Monetary Policy: Unwaveringly accommodative

KEY TAKEAWAYS

- The MPC expectedly, maintained status quo on interest rates in June 2021 along with a strong reaffirmation of its accommodative policy stance.

- The central bank lowered its FY22 GDP growth estimate by 100 bps to 9.5% in the backdrop of the impact from the second Covid wave. CPI inflation estimate was nudged upwards to 5.1% from 5.0% earlier.

- RBI continues its deployment of various monetary tools to control bond yields. for Of the remaining tranche of G-SAP 1.0 announced earlier for Q1FY22, 25% of the amount earmarked to SDLs. G-SAP 2.0 for Q2 announced and pegged at Rs 1.2 Lakh Cr.

- A separate liquidity window of Rs 15,000 Cr carved for contact intensive services sectors that continue to bear the brunt of Covid.

- We continue to expect the MPC to keep repo rate unchanged at 4.00% through FY22 even as yield management efforts would continue to take place during the remainder of the fiscal year.

- Progress on vaccination and likelihood of tapering of QE by the US Fed may eventually lead to a 25 bps hike in early FY23.

- We await release of MPC minutes to gauge commentary and tone of individual members especially on growth downside and outlook.

The bi-monthly review of Monetary Policy Committee of the Reserve Bank of India (RBI) held between Jun 2-4 2021, expectedly saw a status quo on rates with the Repo Rate at 4.00%, Reverse Repo Rate at 3.35%, and Marginal Standing Facility Rate at 4.25%.

The MPC "also decided to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward”. Both decisions of the MPC were backed by complete majority of 6-0 voting outturn. The key policy rates and stance have remained unchanged since May 2020.

Economic Assessment

RBI acknowledged the downside risks to growth momentum in Q1 FY22 owing to the second Covid wave which has weighed on both urban and rural demand. However, it assesses impact on supply side to be relatively contained in Q1 FY22 compared to Q1 FY21 when economy came to an abrupt standstill on account of the stringent nationwide lockdown.

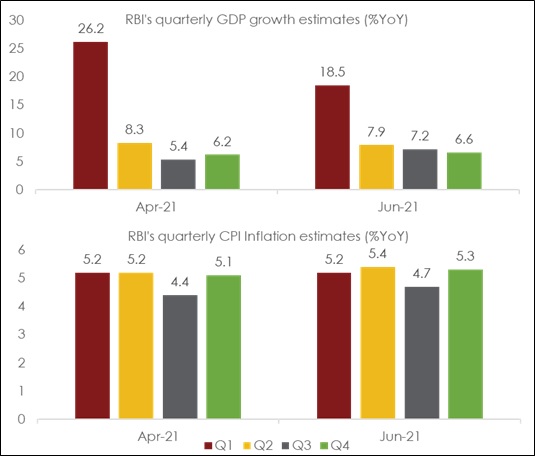

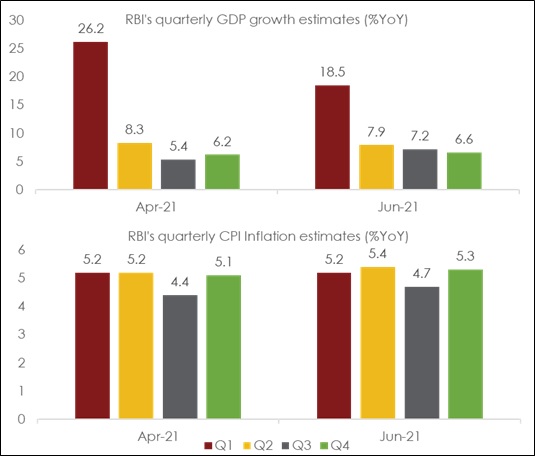

- As such, RBI revised its FY22 GDP growth estimate by 100 bps lower to 9.5%. On a quarterly basis, growth for Q1 and Q2 was revised lower (see chart 1) while that for H2 was revised upwards.

- Nevertheless, RBI expects FY22 growth to draw support from (i) accommodative monetary and financial conditions (ii) pick up in vaccination programme (iii) global growth supporting exports and (iv) normal monsoon

- RBI’s growth projection for FY22 now stands marginally lower versus our own growth estimate of 10.0%. While we continue to hold our forecasts, we do acknowledge the possibility of modest downside risks to our estimate contingent upon the longevity of curbs on economic activity. While select states have begun to ease restrictions with the taper down of the second wave, the withdrawal of containment measures is expected to be gradual given the perceived risks of another wave.

On the other hand, RBI nudged CPI inflation estimate for FY22 higher to 5.1% vs 5.0% earlier, with marginal upward revision to estimates for Q2 to Q4 by 20-30 bps compared to Apr-21 assessment (see chart 1).

- In RBI’s assessment, inflation continues to remain a function of supply disruptions and higher commodity prices.

- The central bank’s forecast on CPI inflation is in sync with our estimate of 5.0% average inflation in FY22. While this would indeed register a moderation vis-à-vis the estimated average of 6.2% in FY21, it would nonetheless be higher than the mandated inflation target of 4% (with a 2% band on either side).

Chart 1: Revised GDP and CPI inflation estimates for FY22

Liquidity and Credit Measures

The central bank announced the following key measures to augment liquidity and credit growth, with a focus to ensure more equitable access to liquidity across sectors. These measures need to be seen in conjunction with those announced on 5th May-2021.

- A timeline for the remainder of Rs 40,000 Cr of the GSAP 1.0 (scheduled for 17th Jun-21), of which a quantum of Rs 10,000 Cr earmarked towards SDLs

- Announcement of GSAP 2.0 at Rs 1.2 Lakh Cr to be conducted over Q2 to enable a stable and orderly evolution of the yield curve amidst comfortable liquidity conditions

- A separate liquidity window of Rs 15000 Cr till 31st Mar-21 for contact intensive services sectors with tenors of up to 3 years at the repo rate

- An additional special liquidity facility of Rs 16,000 Cr to SIDBI for on-lending/ refinancing through novel models and structures to MSMEs

- Expanded Resolution Framework 2.0 under Covid-19 from the maximum exposure threshold of Rs 25 Cr to Rs 50 Cr, thereby ensuring the coverage of a larger number of MSMEs.

Outlook on monetary policy

The ferocity of the second wave since the policy review in April 2021 had reinforced the need to maintain the accommodative policy stance and nurture the nascent recovery in economic growth. The second wave which is currently in a taper mode, in RBI’s own admission has made a bigger dent on demand, while supply conditions have shown resilience. We await the release of MPC minutes to gauge the commentary and tone of individual members especially on growth downside and outlook.

Looking ahead, we continue to expect the central bank to keep repo rate unchanged at 4.00% until the end of FY22, with a possibility of a hike in reverse repo rate by 40 bps during Dec-Feb-22 in a bid to restore the width of the LAF corridor to 25bps. The progress on vaccination as well as volatility in markets that typically run up to anticipated Fed taper towards mid-2022 will be two factors that will be on close watch. The unchanged policy rate along with the formal effort towards anchoring long term yields (via G-SAP programme) would curb uncertainty, promote financial stability, and help revive the growth impulses that as per RBI are "still alive”.