Change in unit production of higher value adding sectors impacting GVA. Higher Food Inflation is likely to further impair private consumption

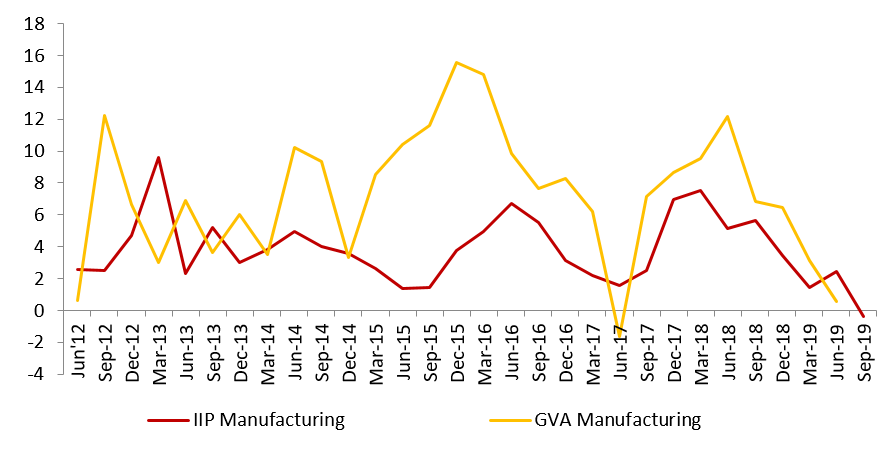

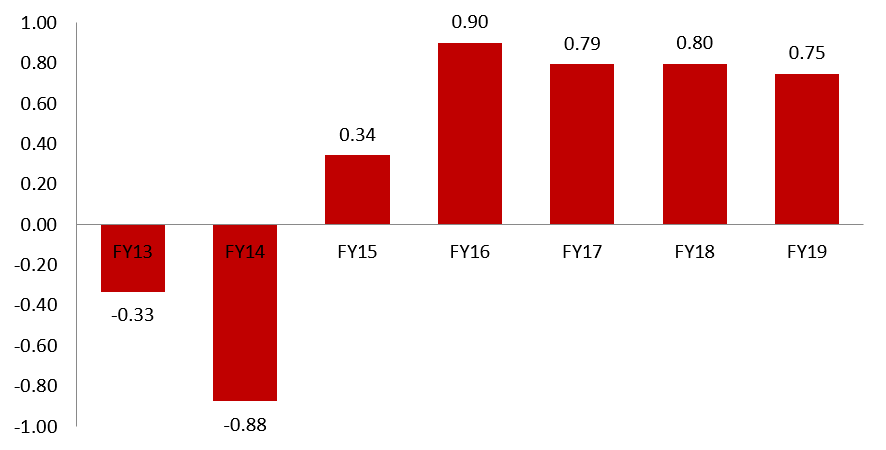

India’s GDP growth has been subdued for the past six quarters and has reached 4.5% in Q2FY20. The main culprit is manufacturing GVA, which is recording de-growth of (-) 1.0%. This sector has registered de-growth of (-) 0.36% in terms of IIP as well. The major concern is contraction in IIP growth in higher value adding sectors such as automobile and electronic goods and mild growth in pharmaceutical sector. This is consequently undermining the growth in the overall manufacturing GVA. We have observed a high correlation between manufacturing IIP and GVA, to the tune of almost 75%. As a result, any fall/rise in IIP (manufacturing) results in sharp fall/rise in GVA (manufacturing). Ultimately, this is change in unit production of higher value adding sectors is causing a substantial impact on the GVA.

On the other hand, public administration and other sector segment driven by strong government expenditure has recorded 11.6% and marginally offset the weak performance of the manufacturing sector. Here’s where the public consumption perspective becomes important as government expenditure increased by 15.6%, contributing 40 bps to the GDP growth. Private consumption on its part has shown signs of slight improvement as the growth has improved to 5% from 3.6%, recorded in the previous quarter. However, our major concern is sharp increase in food inflation that will adversely impact the expenditure on core items in coming months. The GFCF, a major component of GDP, has expanded by only 1% during the quarter – indicating no uptick in investment cycle. This is in line with RBI’s OBICUS Survey for Q2, which is indicating a substantial decline in capacity utilization levels (currently sitting at 68%), the slower than expected consumer demand (as mentioned) resulting in systemic inventories is another concern here. We note that continued fiscal expansion is not sustainable and cannot drive aggregate demand in perpetuity by itself.

On a positive note, as per our analysis based on high frequency data, only 9 out of 14 leading indicators are worse than the preceding year, in comparison. Moreover, only 7 indicators are performing better than the previous quarter – indicating a status quo scenario. Having said that, while considering the core IIP index, we note that a sharp contraction in steel and electricity production for October is hinting a further deterioration in the outlook, nevertheless.

Given these conditions, Acuité has slashed its FY20 forecast to 5.2%, from the erstwhile estimate of 6.1%. On this note, annual GVA will now expand by a little over 5.1%. Segment wise, Agriculture sector GVA will expand by 3.1% as compared to 2.9% recorded in FY19 and manufacturing, the most negatively impacted will expand by 4.7% as compared to 6.8% recorded in the previous year. Thanks to Government expenditure driven public administration and defence related segments, services will perhaps expand by 9.5% as compare to 7.5% in FY19. If the spurt in inflation continues with the prevailing conditions intact, we see minor upside in Q3 & Q4growtn figures. Nevertheless, if the economy remains in the sub 5.5% growth trajectory even in Q3, we may have to revisit our hypothesis.

GDP Q2 FY20

|

|

Sep-18 |

Dec-18 |

Mar-19 |

Jun-19 |

Sep-19 |

|

GVA |

6.9 |

6.3 |

5.7 |

4.9 |

4.3 |

|

Agriculture |

4.9 |

2.8 |

-0.1 |

2.0 |

2.1 |

|

Industry |

6.7 |

7.0 |

4.2 |

2.7 |

0.1 |

|

Manufacturing |

6.9 |

6.4 |

3.1 |

0.6 |

-1.0 |

|

Services |

7.3 |

7.2 |

8.4 |

6.9 |

5.9 |

|

Financial services and others |

7.0 |

7.2 |

9.5 |

5.9 |

5.8 |

|

Public admn and other services |

8.6 |

7.5 |

10.7 |

8.5 |

11.6 |

|

|

GDP |

PFCE |

GFCE |

GFCF |

|

Sep-18 |

7.00 |

9.79 |

10.87 |

11.82 |

|

Dec-18 |

6.58 |

8.08 |

6.51 |

11.74 |

|

Mar-19 |

5.83 |

7.25 |

13.11 |

3.6 |

|

Jun-19 |

5.01 |

3.14 |

8.85 |

4.04 |

|

Sep-19 |

4.5 |

5.1 |

15.6 |

1.0 |

IIP and GVA Manufacturing

Source: MOSPI; Acuité Research

Within year correlation between manufacturing IIP and GVA:

Source: MOSPI; Acuité Research