Covid-19 intensifies headwinds for NBFCsAccess to bank lines critical to manage liquidity, profitability under real threat in FY21

NBFCs have been an integral component of the Indian lending eco-system apart from banks particularly over the last two decades. An increasing number of NBFCs have become systemically important through a consistent balance sheet growth over the period 2009-19 and many of them are larger in scale today as compared to the median private sector bank in India. Needless to say, their sustainability in the current context is an important aspect in the overall domestic financial stability.

Although NBFCs had witnessed a favourable operating environment since the end of the global financial crisis in 2008, they faced serious headwinds from September 2018 with the credit event in IL&FS Group, an infrastructure conglomerate which was closely followed by successive defaults in 2-3 large NBFCs and HFCs. Clearly, this had a severe impact on the financial flexibility and liquidity position of the NBFC sector at large, constraining their growth and profitability. As the economy went into a slowdown mode in FY20, cracks have started to surface in their erstwhile healthy asset quality position, particularly in the wholesale and the SME segments. However, the government and RBI took some significant measures to improve the NBFCs’ access to funding such as the partial credit guarantee mechanism to facilitate securitisation transactions.

While the liquidity position of the NBFCs with a long track record and a solid business franchise were starting to return to comfortable levels in H2FY20, the Covid-19 outbreak hit both the global and the Indian economy with an unprecedented lockdown scenario and wide spread economic disruption. We believe that the impact of Covid-19 on the overall NBFC sector will not only be limited to their liquidity position and their ability to manage debt servicing in the short term but there also will be a longer term impact of the shutdown on their asset quality, business volumes and profitability levels.

Acuité Ratings has undertaken a comprehensive analysis of the retail NBFC sector to understand the impact of Covid-19 on their immediate liquidity position and the outlook on their asset quality and profitability in FY21. While the gross advances of the NBFC sector stood at Rs.22.76 Lakh Cr as on March 31, 2019, retail NBFCs constituted Rs.14.48 Lakh Cr or 64 % of gross advances and the selected 11 NBFCs together constitute 43% of these retail NBFC portfolio as on March 31, 2019.

The loans of Retail NBFCs are granular in nature and largely cater to self-employed borrower segment where the cash-flows highly are correlated to the economic activity levels and therefore, inherently more volatile as compared to that of salaried individuals. One important segment in retail NBFCs is new or used vehicle finance for transport operators, small businesses, farmers and self-employed individuals. Their lending portfolio also include small and medium enterprises where the ticket size is higher, typically up to Rs. 5 Cr. Clearly, the economic disruption brought about by the Covid lockdown will have a severe impact on the incomes of such borrowers for several months depending on the intensity of the outbreak. Since RBI has provided a 3 month moratorium framework (March – May, 2020) for banks and NBFCs, almost all retail NBFCs are expected to provide such a moratorium to their borrowers. While this is likely to provide a temporary reprieve to the retail borrowers of the NBFCs, it is likely to have significant implications for their liquidity and businesses in our opinion in FY21.

Acuité believes that the immediate implication for the retail NBFCs is the lack of clarity on their debt servicing ability in the near term i.e. Q1FY21. With collections coming to a standstill both due to the social isolation norms and the moratorium announcement, the primary cash flows of the NBFCs have been completely disrupted. While we can presume that most banks will provide back to back moratorium, there is no indication that it will be applicable for the non-bank lenders or investors unless there are specific bilateral arrangements. This implies that the bond holders, CP investors and also the FD holders (applicable for deposit taking NBFCs) in all likelihood, will insist on maintaining the existing repayment schedule.

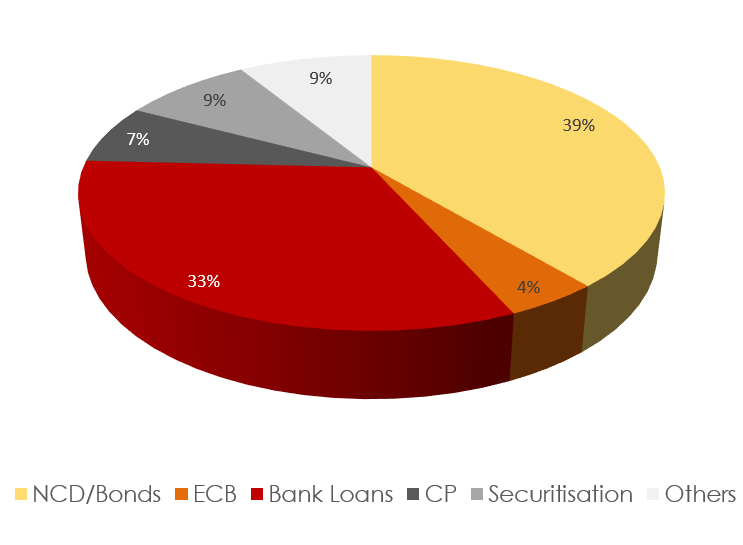

Acuité’s analysis of the top 11 retail NBFCs in India highlights that almost 60% of their borrowings (excluding securitisation) are from non-bank sources and require continuity in debt servicing. With minimal collections, the NBFCs can only depend on their cash reserves and any backup credit lines from banks, if available for servicing such debt. The aggregated debt repayment (including interest) for this set of NBFCs in the current quarter i.e. Q1FY21 is estimated to be between Rs. 40,000 Cr- Rs. 60,000 Cr while the cash reserves are estimated to be around Rs. 45,000 Cr. It is apparent that many of these NBFCs would find it difficult to manage their cash flows including their operating expenses during the next 3 months unless they get access to additional bank lines or refinance. Acuité Ratings estimates the refinancing requirement for these 11 retail large NBFCs at around Rs. 10,000-20,000 Cr to avoid any challenges in their debt servicing and to sustain their operations.

Beyond the immediate liquidity challenges, the key challenge for these NBFCs would be to prevent a sharp deterioration in the delinquency levels subsequent to the expiry of the 3 month moratorium. While the Covid lockdown may be gradually removed over the next few weeks, the impact on the businesses of the self-employed and SME borrowers is likely to be severe. Hence, we expect the collections to be severely impacted over the next 6 months with the 3 month moratorium only providing temporary relief. Further, job losses in the unorganised sector and likely migration of a section of borrowers from urban to rural areas will also lead to higher delinquencies in FY21.

Clearly, the profitability outlook for the retail NBFC sector is fairly negative in such a scenario where the business volumes are likely to shrink in H1FY21 along with the risk of sharply increased delinquencies. As part of its analysis on the sector, Acuité has worked out a profitability (RoAA) vulnerability matrix for the retail NBFC sector depending on the leverage levels and the expected delinquency (or Stage 3) levels.

The vulnerability analysis indicates that NBFCs with leverage of 3x or more have a significant likelihood of incurring losses in FY21 if the stage 3 delinquencies or NPAs increase to the band of 8%-10% or higher. In particular, those NBFCs with capital adequacy levels of 20% and lower are likely to be more impacted as the buffer to absorb any losses will be lower vis-à-vis regulatory threshold. Even if the deterioration in asset quality is not that sharp and it increases only up to the band 5%-8%, the impact on the profitability of the players will be very significant given the low business volumes particularly in the first half of FY21 and the high operating costs of the larger players. The impact of the Covid-19 disruption on particular asset classes in qualitative terms is provided in Table-2. Our analysis expects the disruption from complete or partial lockdown to subside completely by Q2FY2021, which if prolongs, can have a more severe impact and raise concerns on their sustainability.

Another area where clarity is yet to emerge consequent to the moratorium on borrower loans is in securitised loan pools. Retail NBFCs have been accessing funds through securitisation and Direct Assignment (DA) transactions for maintaining their liquidity and capital position. These securitisation and DA deals are essentially of ‘true sale’ in nature, implying the securitized assets/receivables are technically transferred to investors (i.e. pool buyers), while the NBFCs (i.e. originators) continue to service these receivables. Given the current economic scenario, stress will clearly be felt on both on balance sheet and off balance sheet exposures which may disrupt the securitisation market in the near term. While RBI has allowed banks/FIs to provide a moratorium period of three months to retail loans, any decision with regards to restructuring of scheduled payouts in pass through certificates (PTCs) will require the concurrence of investors. The stance of investors approving extension of similar dispensation/restructuring of these securitized pools will be a significant factor in deciding the future trajectory of securitisation market and future rating actions on these PTCs. The utilisation of the cash collateral (CC) is a significant possibility in such transactions over the next 6 months and therefore can have an additional impact on NBFCs’ profitability. However, the direct assignments of loans to banks are likely to witness the application of the loan moratorium in the first 3 months and any subsequent asset quality risks are expected to be borne by the latter.

Graph

1: Borrowing Pattern-11 Retail NBFCs

Table

1: Aggregate Estimates-11 Retail NBFCs: Cash Flow Gap: Q1FY21

|

Rs Cr |

|

AUM |

638,024 |

|

Total Borrowings |

549,382 |

|

Cash & Bank |

44,822 |

|

Q1 Repayment [E] |

|

|

NCD |

14,238 |

|

ECB |

1,210 |

|

CP |

24,653 |

|

FD/STL |

3,216 |

|

Total Repayment [E] |

43,316 |

|

Interest Payment |

6,978 |

|

Total Debt Service: Q1FY21 |

50,294 |

|

Operating |

5,000 |

|

Cash Flow Gap: Q1FY21* |

-10,472 |

* Please note that

these are broad estimates

Table-2: Asset

Quality Impact – Retail Asset Classes

|

Asset

Class |

Key Players |

Key Aspects:

Asset Quality |

Asset Quality Impact |

Explanation* |

|

Gold

Loan |

Muthoot Finance, Manappuram Finance |

· Any regulatory policies regarding

dilution of LTV norms.

· Lockdown will impact business

continuity and ability to acquire new clients significantly |

|

Loans

supported by highly liquid assets hence minimal impact |

|

SRTO/ CV |

Shriram Transport Finance Company, Sundaram

Finance, Mahindra & Mahindra Financial Services |

· LCV/MCV, particularly used vehicles

primarily used for supply of essential goods, less affected as compared to HCVs |

|

Linked

to revival in economy hence, severe impact possible |

|

SME/LAP |

Bajaj Finance, HDB Financial Services, Aditya

Birla Finance, Tata Capital; Edelweiss Financial Services, JM Financial |

· Traders in FMCG goods segment to be

less impacted

· Manufacturers with low labour

intensive industries to be less impacted

· Service oriented industries with high

fixed costs are likely to be highly impacted

· Geographically diverse portfolio will

have moderately low impact

· LAP with low LTV ratio will have

moderate impact |

|

High

vulnerability of cash flows, nature of impact may vary cluster to cluster |

|

Personal

Loans |

Aditya Birla Finance, Bajaj Finance |

· Less impact if higher exposure to

salaried borrowers |

|

Non-salaried

segment to be hit hard |

*This

is based on assumption that the impact of COVID-19 will start moderating in the

first quarter and revival is expected from beginning of Q3FY2021

|

Adverse |

|

|

Moderately Adverse |

|

|

Highly Adverse |

|