The cut in corporate tax has come

as a massive boost to the struggling Indian economy, which has recorded one of

the slowest rates of growth in twenty years. Despite its obvious benefits, the

booster package comes at a cost. The Government of India estimates that it will

have to forego Rs. 1.45 lakh crore worth of annual revenue. This figure may

climb higher given the further rationalizations of the GST rate on the hotels

is considered. Consequently, given a lower realized revenue, the year’s revenue

deficit along with fiscal deficit may be adversely impacted.

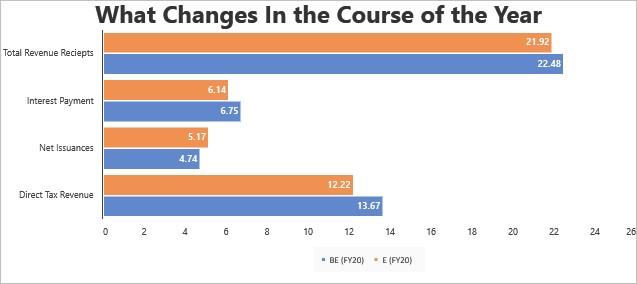

However, Acuité analysis reveals that the windfall gains from the RBI along with lower prevailing yields will provide the Government of India additional buffer of Rs. 1.17 lakh crore. If the Government choses to trigger the escape clause, which is 0.2% of GDP, an incremental Rs. 0.43 lakh crore will be available. In totality, this will take the total buffer to nearly Rs. 1.6 lakh crore versus the tax foregone amounting to Rs. 1.45 lakh crore.

In addition to the RBI windfall, lower yields will ease interest payment obligations

The estimates are based on the understanding that yields have fallen by over 50 bps since June 2019, when the budget estimates were formulated. Lower prevailing yields shaves off an estimated Rs. 0.59 lakh crores from the Government’s interest payment obligation. This in turn positively effects the four types of deficits, namely the budget deficit, revenue deficit, primary deficit and importantly fiscal deficit. On the other hand, it is already established that the windfall gains from the RBI in the form additional dividend receipts, amount to Rs. 0.59 lakh crores.

What is interesting however is the fact that the Government of India also has the option of using the fiscal responsibility and budget management act’s escape clause. The clause can be triggered in special circumstances and can be put at 0.2% (20 bps) of the GDP. Given the urgency of action and the state of the economy, the current situation qualifies as ‘special circumstances.’ The budget FY20 pegged the Indian GDP to be worth Rs. 213 lakh crores by the end of the financial year; using this number, we estimate that the clause will provide the Government an additional buffer of nearly Rs. 0.43 lakh crore. Additional issuances in this regard may exert upward pressure on yields, quantitative easing in developed markets will create enough demand for Indian sovereign debt.

Sub-optimal real and nominal growth may be treated as a caveat

These estimates are however dependent on the consistency of the rate of expansion. By the Government’s own admission, current GDP growth estimates for FY20 are lower than the benchmarks used in creating the budget estimates. Its not only the real GDP expansion that is a constraint here because lower than usual growth in consumer prices will lower nominal growth rate – negatively impacting estimated tax collections even further. Even though these numbers may be reviewed as per the revised budget methodology, the initial estimates had pegged a growth of 14.3% in direct taxes and 12.4% in indirect taxes for the current financial year. If these figures ultimately come out to be smaller than estimated, the entire fiscal math may go haywire. Nevertheless, the buffers available from the mentioned sources will go a long way in alleviating the current impediments and provide fair opportunity for the reinvigoration of the investment and consumption cycle. If things turn out as expected, future growth will more than compensate today’s losses.