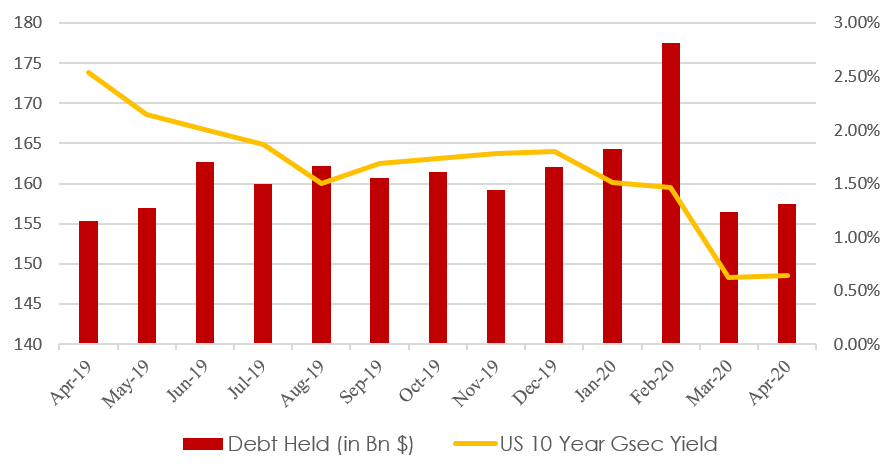

Acuité believes that excess liquidity in the global markets has been a key factor behind the foreign exchange reserves of India breaching the USD500 billion mark in June 2020. The excess liquidity has been driven by an accommodative policy in most developed countries including USA particularly with the onset of Covid-19. The prevailing conditions have led to the appreciation of the central bank’s foreign assets including the US Treasury and currency holdings. Gold, which is also part of foreign exchange reserves is another important reserve element has risen in value due to increasing uncertainties and risk-off investment behaviour.

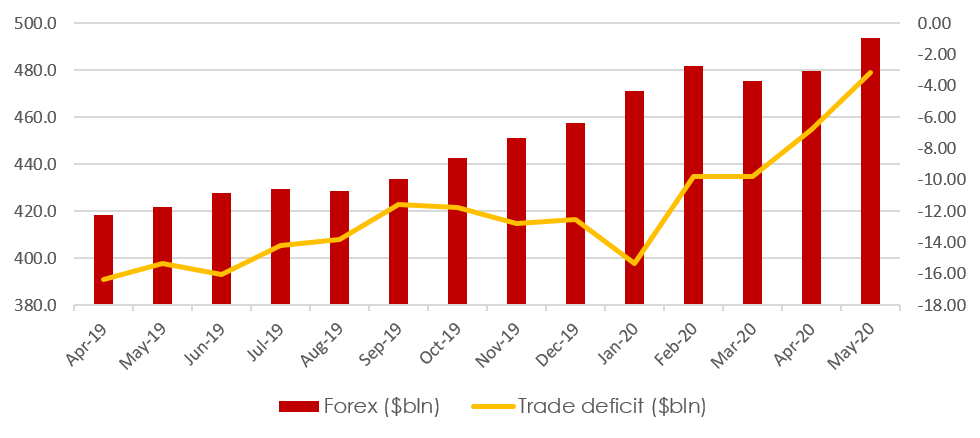

The data analysed by Acuité Ratings highlight that RBI’s foreign currency assets gained $78.15 billion in a period of one year (June 2019 - June 2020). This figure includes the value gains of US Treasury holdings, which are worth $157.4 billion as on April 30, 2020. Since September 2019, the US Federal Reserve increased its weekly purchases of fixed income securities and yields started to fall benefiting the bond holders. Consequently, the RBI’s Treasury holdings had topped out in February at $177.5 billion by value. However, just before the crises induced lockdown, over $20 billion worth of those securities were sold in order to increase USD stockpiles.

US Treasuries have augured well for the bank’s foreign assets portfolio, given the falling yields on the back of a massive quantitative easing by the Federal Reserve. As yields fall, fixed income securities gain value – adding to the revaluation gain, which is then adjusted via an entry of the same name on the RBI balance sheet’s liability side. In order to fairly understand the true gains, one may consider the value of a US 10 year Government Security, which would have gained $0.55 in value as yields fell by 1.79% in a year (April YoY comparison).

Gold, the all-important commodity used as a hedging tool by the central banks also helped shore up RBI’s reserves. The value of gold reserves has increased by $9.39 billion over a one year period as on June 5, 2020. Despite some selling seen over the past weeks, the commodity has added significant value to the RBI coffers and helped the total foreign exchange reserves to breach the half a trillion mark.

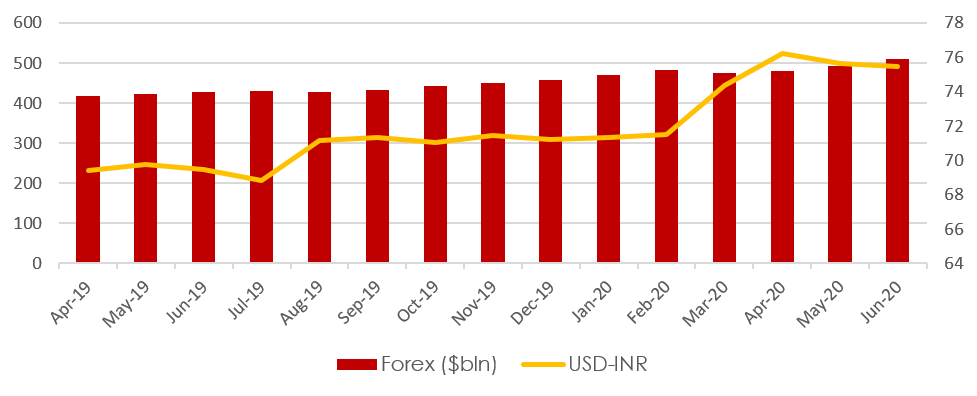

A slowing macro economy has also been a boon in disguise for the country’s balance of payment and that has in turn saved precious foreign currency holdings from a domestic perspective. Along with much lower crude prices, as demand for consumer and capital goods declined, India’s import bill went down dramatically. This in turn has reduced the deficit position in the current account. In the month of May, while India’s exports recorded a contraction of 36.5%, imports contracted by a much larger 51.0%. Most notable among these numbers is the 72% contraction recorded by crude oil and petroleum product imports during the month, significantly reducing the burden on foreign exchange. We note that the current account deficit has consequently come down from $15.36 billion in May 2019 to $3.15 billion in May 2020; dramatically reducing by $12.21 billion year within a one year period.

Given the above facts, we believe that

the foreign reserve position has been vastly aided by the prevailing market liquidity

and volatility, which generally has a positive effect on the USD, US Treasury

and Gold. Domestic demand dynamics has further helped preserve foreign currency

reserves. It is important that India continues to maintain such healthy

reserves which will continue to demonstrate its resilience on the external

front. Having said that, as the global situation normalizes, the status of safe

haven asset classes will change. We therefore expect that RBI will use the

foreign exchange assets optimally to safeguard national interests during these

transitionary times.

Graph 1: India's US Treasury Holding Vs. 10 Year US Gsec Yields

Graph 2: Forex Reserve ($ Bn) Vs. USD-INR Exchange Rate

Graph 3: Forex ($ Bn) Vs. Trade Deficit ($ Bn)