June 2020 trade surplus mainly a reflection of economic disruption

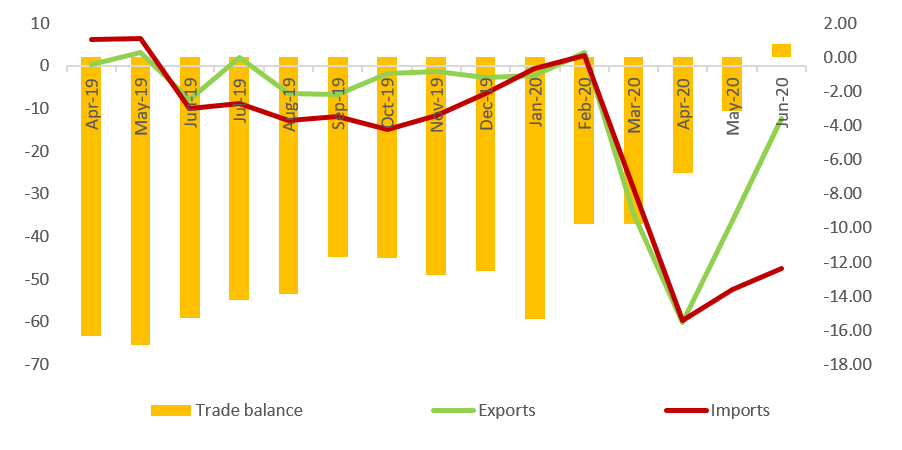

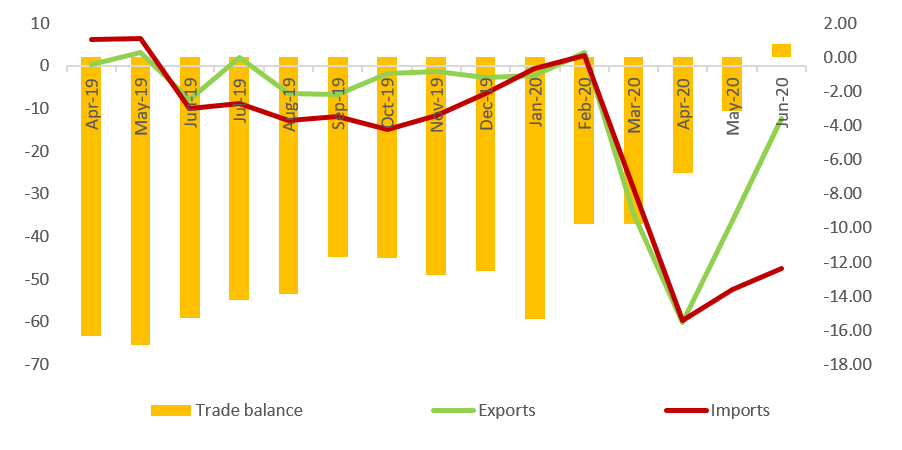

India has recorded a monthly surplus trade balance in June 2020, the first time in 24 years since April 1996. During the month, India’s merchandise exports stood at USD 21.9 billion with a YoY contraction of 12.4% while the monthly import bill was pegged at USD 21.1 billion with a far sharper YoY contraction of 47.6%. As a result, merchandise trade balance showed an unusual surplus of USD 0.8 billion for the month. While the net trade deficit in goods for Q1 FY21 as a whole has been reported at USD 9.1 billion, India is estimated to have an overall trade surplus of USD 11.7 billion due to a significant surplus in the services sector.

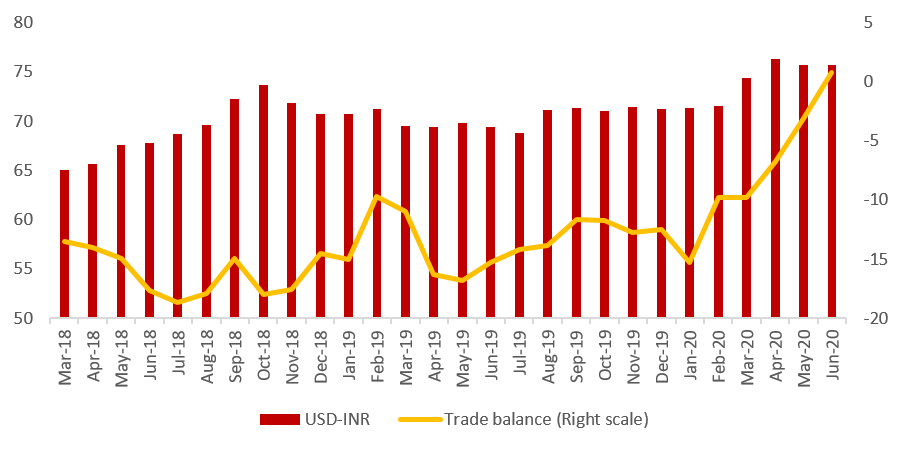

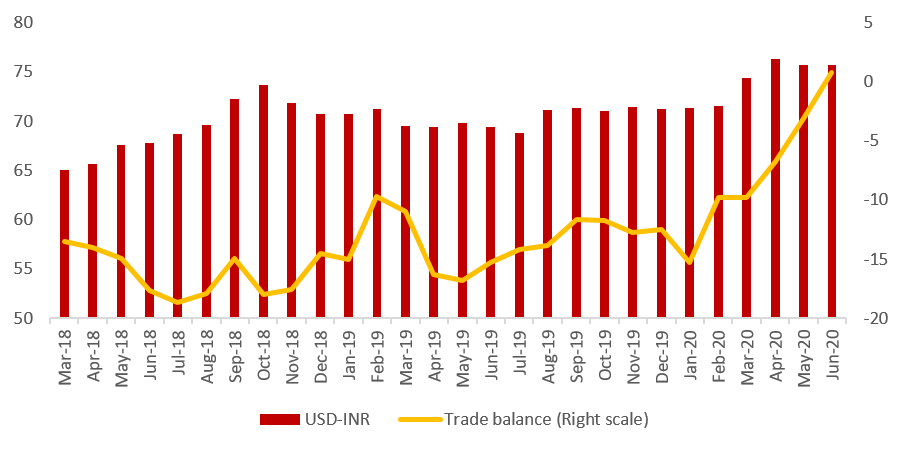

Given the weak growth trajectory in India in the past few pre-Covid months, the country’s merchandise trade deficit has been steadily declining from USD 15.3 billion in January 2020 to USD 3.1 billion in May 2020 before it turned into surplus in June 2020. Clearly, the severe economic disruption both on the supply and the demand side resulting from the Covid lockdown has led to a sharp drop in imports and has also contributed to the surplus scenario in June 2020.

The imports of goods dropped gradually over the next 3 months since January 2020 (USD 41.1 billion), reflecting the pre-Covid slowdown and then sharply in April 2020 (USD 17.1 billion) due to the lockdown that severely impacted the movement of goods to India and within the country. While the value of imports has again risen in May-June 2020, it is still far away from the monthly average levels of USD 39.4 billion witnessed in FY20.

We believe that there are two fundamental factors that will continue to keep the import bill low over the next few months; one, the lower value of crude oil imports which declined sharply from USD 13.0 billion in January 2020 to a low of USD 3.5 billion in May 2020 before slightly recovering to USD 4.9 billion in June 2020. The drop in crude imports has been both due to the pre-existing high inventories with the domestic oil companies and the decline in the global oil prices since January 2020. The average global crude oil prices (equal weightage of Brent, WTI and Dubai) slipped from USD 61.6 per barrel in January 2020 to a low of USD 21.0 per barrel in April 2020 before partly recovering to USD 39.5 in June 2020 due to the agreement on supply cuts by OPEC.

The second factor behind the sharp decline in imports is clearly the disruption in both domestic industrial production and demand from the Covid lockdown. Compared to a level of USD 28.1 billion in January 2020, the non-crude oil imports have also dropped to slightly more than half at USD 16.2 billion in June 2020. Many manufacturing firms would have kept their regular import schedule on hold in the last 3-4 months. Given that the capacity utilization in the industrial sector will take time to ramp up to the average levels of last year, we believe that the non-oil imports will continue to witness modest month-on-growth over the next few months.

Another factor that may have played a role in lower imports in the last 2-3 months is the border conflict with China and its impact on Indo-China trade. Given the pronouncements of self-reliance and higher focus on indigenous manufacturing capabilities, there has been a larger scrutiny of the imports arriving from China. It is known that India’s trade deficit with China accounts for around 40% of its overall trade deficit. Hence, a reduction of imports from the northern neighbour will have a substantial impact on India’s import bill; Acuité has already estimated that import substitution to the extent of USD 8 billion from China is feasible over the next 12-18 months without any significant investment in the manufacturing sector.

On the export front, the scenario however, has been encouraging so far since the Covid outbreak. While exports of goods from India did drop steadily over the January-March period and then quite sharply due to the lockdown impact, it has quickly recovered in May and at USD 21.9 billion in June, has already exceeded the levels in March 2020.

An industry wide analysis of the export figures indicates that there has been a significant pick up in iron ore (63%), pharmaceuticals (9.8%) and agro-commodities (oilseeds (50%), pulses (32%) and rice (32%)) exports on a YoY basis during June 2020. Given the performance of these segments, the overall non-oil category exports have limited its contraction at 10% YoY. Since a part of the surge can be attributed to the pent-up demand or accumulated orders for the lockdown period, the sustainability of such export growth is in question. While a section of the Indian exporters will benefit from the depreciation in the rupee over the last few months, the overall export growth is likely to remain in negative territory for FY21 in the context of a contraction in global economic output and low commodity prices.

In the near term with no surprises on crude oil prices, the merchandise trade balance is expected to be modestly in deficit if not in surplus zone primarily driven by the lower volume of imports. Clearly, the key assumptions herein are oil prices in the sub USD 45 per barrel and no significant respite from the intensity of the Covid outbreak till September. A decline in trade and therefore current account deficit may strengthen the Indian rupee if it continues for a longer period; however, one can expect RBI to intervene to maintain the rupee in a stable band of Rs 74-78/USD in the current year.

Graph 1: Monthly Trade Balances, Export-Import YoY Growth

Graph 2: USD-INR Exchange Rate, Monthly Trade Balance: