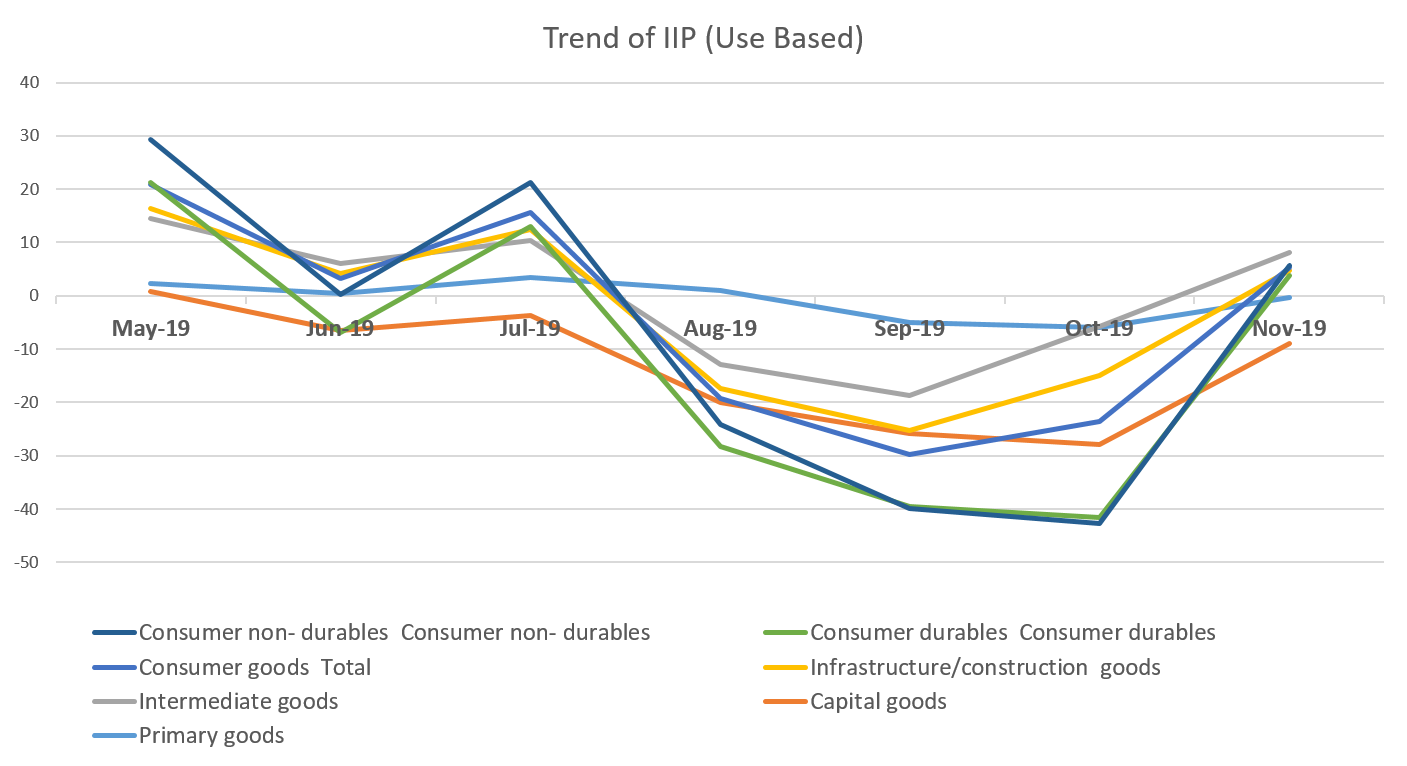

The industrial production (IIP), which was in a contractionary mode for the past three months has turned positive, expanding by 1.8% in November 2019. The growth was driven by sectors such as textile, pharmaceutical, chemical, and basic metal segment, hinting green shoots in the industrial sector.

Manufacturing of motor vehicles, the sector in limelight for the past few months maintained its negative outlook with (-) 12.6% contraction during the month. However, sales of passenger vehicles turned positive October onwards due to stock clearance discounts as well as fillip received from festive seasonal sales. Similarly, commercial vehicle and two/three wheelers segments have improved considerably albeit still contracting.

In a bid to exhaust inventories, most OEMs resorted to production cut downs towards the end of the calendar year; this was in addition to heavy discounts. A condition that has resulted in quick dry down of systemic inventory levels. Production is expected to start in Q4 FY20 along with a possibility of fresh capex cycle. A factor that supports this argument is the aforementioned recovery witnessed in automotive sales and basic metal segments. With the higher value added segments getting a breather, there is a strong indication that the entire ecosystem, especially the lower segments of the supply chain will start receiving newer orders. The phenomenon is reflected in the somewhat healthy manufacturing PMI numbers as well.

Nevertheless, we believe that the minor recovery in the IIP is primarily a function of a favourable base effect, which will continue to benefit until the end of the financial year. On these lines, manufacturing, which was contracting continuously for the previous three months has received a stimulus from the contraction in November 2018 (base year). Segments without such benefit have largely maintained their negative outlook, baring consumer non-durables (use based) – at least from the perspective of the index.

On a positive note, we

reckon that a recovery in growth of higher weightage sectors such as

pharmaceutical, chemical and automobile will speed up the GVA growth of manufacturing

segment as a whole in the coming months. It is known that in Q2, FY20, GVA

growth in manufacturing segment contracted to (-) 1.6% after nine quarters of

growth.

|

|

IIP |

By economic activity |

By economic activity |

By economic activity |

|

Month |

IIP |

Mining & quarrying |

Manufacturing |

Electricity |

|

May-19 |

4.55 |

2.42 |

4.46 |

7.41 |

|

Jun-19 |

1.17 |

1.53 |

0.23 |

8.19 |

|

Jul-19 |

4.3 |

4.92 |

4.15 |

4.75 |

|

Aug-19 |

-1.09 |

0.11 |

-1.23 |

-0.9 |

|

Sep-19 |

-4.27 |

-8.47 |

-3.88 |

-2.58 |

|

Oct-19 |

-3.84 |

-8.04 |

-2.09 |

-12.17 |

|

Nov-19 |

1.82 |

1.72 |

2.68 |

-5.02 |