The Monetary Policy Committee (MPC) has held on to the policy rate at 5.15%, despite market expectations of a rate cut. The reason behind the thinking being rising inflation, which would close the window for further rate cuts. Hence, February 6th was probably the last opportunity offered to the central bankers this financial year to further their 135 bps leeway to the market.

However, it was not the case as the MPC remained unsure about the prevailing growth-inflation dynamic. Perhaps, the committee has given due cognizance to non-core inflation, especially food items that have been fueling the headline number, much beyond the RBI’s threshold of 4%. With the aforementioned inflation number breaking the 7% level in December thanks to food items becoming more expensive by 12% in the period under consideration – a rate cut therefore seemed farfetched. The primary culprit of the situation has been the unseasonal rain fall in Q3, the peak of Kharif sowing and off course the rising consumption of protein based items such as meat, fish and dairy based. Seasonal vegetables were the most impacted, with Onions continuing to inflate in double digits.

Household surveys, which have been the RBI’s mainstay to base its inflationary expectations - have stayed inconsequential on the other hand. For much of H2 FY20, household expectations on prices showed marked elevations for both the 3 month and 1 year horizons. Households were particularly concerned by food and fuel inflation, which was in turn eating into their daily consumption expenditure. Nevertheless, the January 2020 survey has seen moderations of 60-70 bps for both the said horizons. The committee however pointed the expected rise in household expenditure in the short to medium term, which could further stoke inflation fears. While it is expected that the imbalances created during the Kharif, will be more or less compensated by the higher yields of Rabi, the future reading do look conservative in the short term at least. Consequently, the MPC has set the CPI target of 6.5% for Q4 FY20. The augmentation of fresh produce and stabilizing imports along with a healthy Rabi output would nonetheless normalize the situation, with CPI subsiding to 5-5.4% in Q1 – Q2 (H1) FY21 and further down to 3.2% in Q3.

Nevertheless the concerns pertaining to the non-core inflation creeping into core items are legitimate given the rising input prices in services and dairy. This could have worsened if not the lack of pricing power with businesses at the moment due to their inability to pass through the cost increases given poor demand conditions. Manufacturing businesses remained stressed, notes the MPC and the findings of the OBICUS serve a reality check. The capacity utilization levels are now sub 70% and far away from optimal; resultantly output gap has persistently been negative. Poor demand (and volatile supply) for credit is another factor that is weighing things down for the sector. Imports, even though contracting much faster than exports in these unstable times is a relief but from the aggregate demand perspective remains a negative. The mixed picture of the economy’s prevailing conditions therefore does not provide the MPC enough confidence to reduce rates until further clarity is seen.

In terms of the global situation, there appears to be deflationary conditions continuing in much of the developed world, with US, Japan and the EU experiencing less than usual private consumption and usually depending on their respective Government’s fiscal muscle. Even emerging market economies, which are in some way India’s peers have been experiencing low growth and an indecisive household sentiment. The development has led to the prevalence of an accommodative monetary policy across the board with a return of the Quantitative Easing (QE) of sorts. The resultant excess liquidity has been fueling the current valuations in Indian debt and equity markets with Net FPI inflow already hitting the $8.6 billion by February 1st week as compared to an net outflow of $14.2 billion, same time last year. Healthy FDI Equity inflows along with liberal usage of the voluntary retention scheme have been positives in this regard and have shored up the INR, which has lately been the worst performing currency among its EM peers.

The permanence of the situation however remains a dilemma given the low growth-high valuation façade created by the foreign yield chasing capital. Global events such as the ongoing Coronavirus threat to the manufacturing value chain along with the US-China trade war and the Iranian crises, are too large to ignore. These insecurities have been elevating the VIX index and renewed demand for US and other safe haven debt. Resultantly, US yields have significantly moderated since January on the back of these global insecurities and the yield on a 10 year US GSec has fallen from 1.82% on January 3rd to 1.57% as on January 31st. The situation is similar for German Bundesbonds and Japanese Government debt. While the RBI has played with the yield curve through its multiple open market operations, Indian 10 year GSecs are holding steady at the 6.85% level. The yield differential between India and US 10 year Government debt therefore continues to be over 500 bps because of falling American yields in a volatile time – which might reverse as the ongoing QE 3 unfolds, further infusing systemic liquidity. Given the yield competition from similarly rated sovereigns such as Indonesia, we believe the MPC was cognizant to a competitive differential.

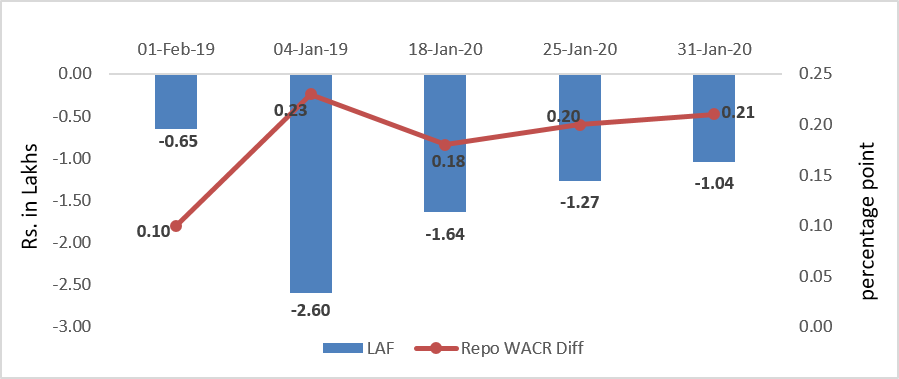

On the domestic liquidity market, deposits continue to outcompete the credit growth, resulting in liquidity glut in the banking sector. Incremental credit to deposit ratio has been therefore languishing at sub 50% level for much of H2, this financial year. Consequently, daily net absorption went up to nearly Rs. 3.18 lac crores under the LAF window, along with continued OMO operations. Even though this absorption has now reduced to nearly Rs. 1.04 lac crores over the past four weeks, the WACR has touched the lower bound of our policy corridor, i.e. near the reverse Repo, pegged at 4.94%. This is another reason why the MPC evaded the rate cut question as liquidity seems comfortable. The long term repo operations (LTRO), a route through which the RBI will infuse further liquidity of Rs. 100,000 crore will surely keep the commercial banks flush with money, which can be used to increase offtake and stabilize their balance sheets. Overall, the policy deliberation can be best described as a ‘wait and watch’ rather than ‘preparation’ for future eventualities. There are clearly mixed signals emanating from the macro economy and it’s perhaps best to pause at the moment.

Interest rates and ratio:

|

Interest Rate |

Feb 01 |

Jan 03 |

Jan 10 |

Jan 17 |

Jan 24 |

Jan 31 |

|

2019 |

2020 |

2020 |

2020 |

2020 |

2020 |

|

|

Policy Repo Rate |

6.50 |

5.15 |

5.15 |

5.15 |

5.15 |

5.15 |

|

Call Money Rate (WA) |

6.40 |

5.05 |

4.92 |

4.97 |

4.95 |

4.94 |

|

364-Day Treasury Bill Yield |

6.78 |

5.30 |

5.29 |

5.30 |

5.29 |

5.29 |

|

2-Yr Indian G-Sec |

6.70 |

5.69 |

5.75 |

5.70 |

5.67 |

5.77 |

|

10-Yr Indian G-Sec |

7.38 |

6.73 |

6.84 |

6.86 |

6.82 |

6.86 |

|

10-Yr US G-Sec |

2.70 |

1.82 |

1.83 |

1.69 |

1.51 |

1.57 |

|

AAA (Indian corporate) |

8.48 |

7.60 |

7.64 |

7.86 |

7.47 |

7.63 |

|

Spread in bps (10Yr Indian- US) |

468 |

491 |

502 |

517 |

532 |

529 |

|

Credit/Deposit Ratio |

77.78 |

75.97 |

- |

76.22 |

- |

- |

|

USD LIBOR (3 month) |

2.3848 |

1.5405 |

1.5270 |

1.5311 |

1.5318 |

1.5705 |

|

Forward Premia of US$ 1-month |

3.80 |

3.68 |

3.71 |

4.05 |

3.79 |

3.52 |

|

US$ 3-month |

4.22 |

3.93 |

4.11 |

4.16 |

4.15 |

4.25 |

|

US$ 6-month |

4.08 |

4.27 |

4.20 |

4.22 |

4.13 |

4.21 |

Liquidity Operation by

RBI:

Source: RBI, Acuité Research;

Note: Net injection (+) and Net absorption (-)

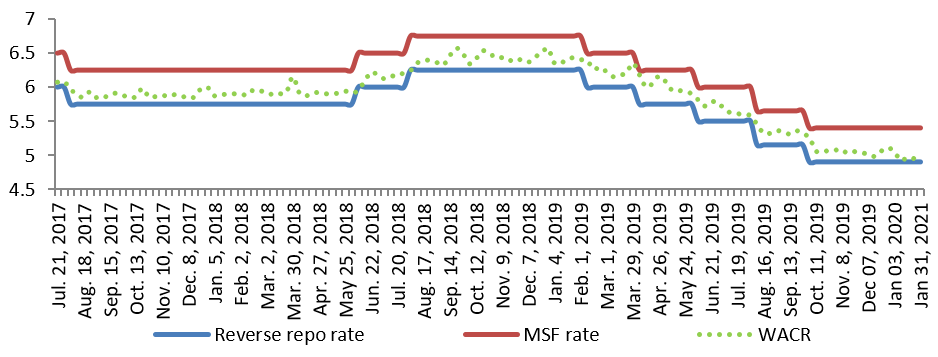

Policy Corridor and WACR: