Cautious pause on interest rates, proactive step on asset resolution

The primary mandate of India’s Monetary Policy Committee (MPC) of RBI is to maintain inflation (within a range of 2%-6%) and stimulate growth. In order to meet this objective and given the weak economic trajectory followed by the Covid lockdown, significant steps have been taken by RBI not only on monetary policy but also on developmental and regulatory matters in its policy statement of August 2020.

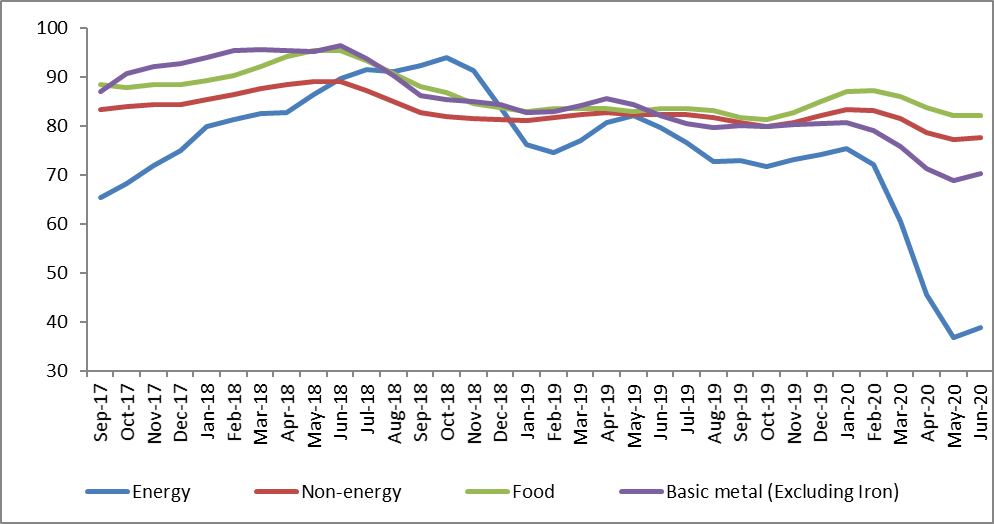

We note that over the last 18 months, the MPC has cut interest rates by 250 bps in order to keep borrowing costs low, which can potentially revive consumption and investment. Further, the rapid deployment of liquidity via the LAF window as well as Open Market Operations (OMOs) by RBI, on its part, have effectively strengthened the liquidity position in the monetary system. Additionally, special liquidity tools in the form of targeted long term repo operations (TLTROs) and additional refinance facilities were made available to ensure that there is no funding crisis in the financial sector.

While there was a moderate expectation that the MPC would opt for a further rate cut of 25 bps or expand the policy corridor further, it has decided to maintain the status quo for now given the current inflation print and also to preserve adequate ammunition for future contingency in an uncertain economic environment.

Inflation Assessment

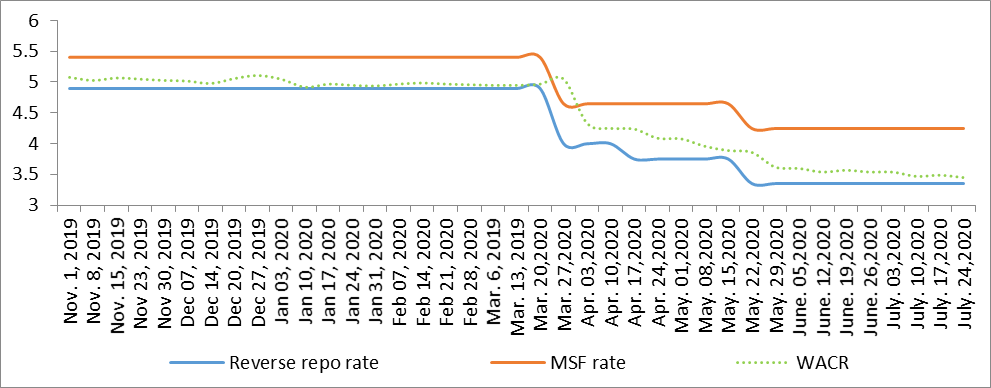

It was clear that the MPC’s decision on interest rates was a rather tough one this time given the mixed signals emanating from macro variables, especially the inflation print (CPI). Despite poor consumer demand, June CPI recorded 6.1%, 30 bps higher than a month earlier. It is known that the food basket has been experiencing upward pressures lately due to supply shocks pertaining to vegetables and protein based items such as poultry. While there is an expectation that these pressures will taper September onwards with the expectation of a good kharif crop and the mitigation of the unfavourable base effect, there seems to be a concern on the cost push factor.

We observe that while the committee expects inflation to be below its 4% threshold in H2 of the current financial, households expect strong inflationary impulses over the next three months. As the MPC’s forward view on inflation is influenced by the household expectation surveys, it might also have been a factor in RBI’s ‘hold’ decision.

Considering the non-food basket of the CPI, we believe that the committee has specific concerns at this stage on the fast changing dynamics in the commodities and industrial activity. While it is noted that the IIP is in a contractionary mode in June as well, there are signs of improvements none the less. Purchasing Manager’s Index (PMI) Manufacturing, a variable that precedes the IIP has already breached the 50 level and is thus in expansion.

Rural revival on the back of healthy monsoon and consequent growth in Kharif sowing is another important element as far as the inflation print is concerned. Based on previous observations, we note that rural inflation generally outperforms its urban counterpart because of weaker supply chains and a much smaller base. It is also worth considering that when there are higher chances of a good cultivation, rural folk tend to exhibit strong consumption patterns, which are also increasingly supported by availability of credit. Given the situation, it is prudent to consider the all-important rural factor while assessing the future inflationary outlook.

Currency Assessment

Signals from the external sector have been mixed as well. The committee notes that while net FPI inflow in the equity market is higher (YoY) was $1.2 billion during the April-July timeframe, the net outflow in the debt market was $6.4 billion. Similar to the fixed income market, FDI equity inflows also fell by $2.8 billion during the first two months of Q1. This reflects the increased volatility in capital flows in emerging markets such as India which is also influenced by the monetary actions in the advanced economies. Nevertheless, the committee was also quick to note the somewhat normalization of the foreign capital inflows towards the end of the first quarter and the consequent positive impact on the EM currencies.

RBI’s increased foreign reserves however reveals a different story as the incremental gain of $56.8 billion (during April-July period) is also influenced by the appreciation in gold reserves, foreign currency (mostly USD and Euro) and foreign sovereign debt. The appreciation in the value of foreign currency holdings as well as foreign sovereign debt signal a not very comfortable position for the value of the rupee. Such concerns notwithstanding, we believe that the rupee will continue to be broadly stable in the near term given the improved trade dynamics, lower current account deficit and the stabilization of foreign capital flows.

Financial System Assessment

The committee was appreciative of the stability provide by early monetary interventions in the form of Operation Twist (augmented yield management) and TLTROs. Such has been the positive effect that despite net foreign capital outflows during the crises, effective liquidity support has actually helped yields/ borrowing costs to come down significantly. The fall in the yield differential, in a matter of four months, between a 3 year gsec and equal duration AAA rated corporate debt that had spiked in March is a case in point. Notably, even lesser rated instruments such as those with a rating of BBB (-) saw their differential to fall by 125 bps. The conducive environment in the debt markets attracted many corporate borrowers, who were until recently shying away, to raise fresh debt worth over Rs. 2 lakh Cr in Q1FY21. The mutual fund industry, which was partly impacted by redemption pressures particularly in credit funds after the the closure of debt schemes of a prominent fixed income mutual fund, has revived as well, sporting a larger portfolio as on July end.

In order to ensure better credit flow to smaller lenders, the RBI has announced additional liquidity support in the form of Additional Special Liquidity Facility (ASLF) worth Rs. 5000 Cr each for NABARD and National Housing Board (NHB) for continued support to agriculture related financing, housing and micro finance NBFCs. Clearly, the monetary stimulus programmes introduced by RBO over the last 4 months have helped to alleviate Covid induced cash flow pressures in both financial institutions and business enterprises.

While banks and non-bank lenders had been permitted to offer a moratorium to all their borrowers up to 6 months ending on August 31, 2020, the continuing virulence of the pandemic, intermittent lockdown and consequently, a slow revival of the domestic economy have led to increased concerns on the asset quality of the financial sector and the need for a longer term solution. The Asset Resolution Framework announced by RBI is another very significant initiative that will permit commercial banks to work out a restructuring of those loan accounts that are under pressure because of the Covid 19 situation but are otherwise healthy businesses. Such accounts must be standard and not in default for more than 30 days as on March 1, 2020. Once invoked (anytime until 31st December 2020), the resolution plan must be implemented within 180 days. During this period, the account shall remain in the standard category. As a prudent practice, however the concerned banks must keep an additional provision of 10% on the debt (post resolution) of such accounts. Similar arrangements have also been announced for the vulnerable MSME sector as well.

As a step toward greater flexibility in cash management, the central bank has introduced the Flexible Automated Option for Managing CRR Balances initiative, which allows commercial banks to manage their reserve ratios through the e-Kuber system. In other words, commercial banks can decide the amount that they would like to deposit daily with the RBI in their current accounts. Consequently, the MSF and Reverse Repo bids will be generated based on these preset deposit amounts daily.

Overall, the MPC, as an RBI functionary of monetary

policy – has holistically assessed the macro economic situation to reach a

consensus on the interest rates and devise necessary liquidity support for the

system. The MPC has maintained its ‘Whatever it takes’ stance and is expected

to remain accommodative as long as it is necessary. With the risks of another

surge in NPAs in the financial sector, RBI has proposed a new asset resolution

framework with prudent checks and balances. Looking towards the near future, we

reckon that through initiatives pertaining to digitization, the monetary

institutional framework will be strengthened further leading to a more

effective response to a rapidly evolving situation.

Graph 1: Policy Corridor and WACR

Graph 2: Commodity Price Index (3 Month Moving Average):