The inflationary concerns and the risks of stagflation have started to seep into the domestic bond markets and in the government bond yields. The 10 year Gsec yields have climbed up rapidly by 35 bps over the last 3 weeks and may make borrowing costs higher for not only the government but also the corporates despite the ongoing accommodative monetary policy. While RBI has announced OMO to manage the yields, such a task may be increasingly difficult going forward given the current monetary environment and the twin concerns on inflation and fiscal deficit. Acuité believes that the rate cut window is virtually closed in the short term and there is a significant likelihood of a change in RBI’s accommodative policy over the next 3-6 months particularly if the CPI print doesn’t settle down within the central bank’s comfort band of 2%-6%.

The initial trigger for the spurt in the bond yields, clearly has been the decision of MPC in early August to hold the rates, highlighting the inflationary concerns in the short term. While the CPI trajectory has been on an uptrend since Q3 of FY20 primarily riding on food inflation, the expectations of a healthy agricultural growth alleviating such pressures couldn’t be met due to the supply constraints emerging from the protracted Covid lockdown. On the other hand, the continued prevalence of high food inflation has started to impact the core CPI basket due to cost push pressures, a weak economic environment nonetheless. Core inflation has actually moved up by 50 bps in July 2020, surprising the market participants who had been expecting that the base effect factor will start to moderate the inflation print in the short term. Such a scenario has enhanced the risks of stagflation, which implies a painful phase of high inflation but low or negative growth and aggravate the challenges faced by the Indian policy makers.

Clearly, the other significant headwind for the bond yields has been the increasing fiscal deficit and consequently, higher government borrowings. Although the initial budget estimates had projected a gross borrowing of Rs. 7.9 Lakh Cr, it has been subsequently revised upwards significantly by almost 50% to Rs. 12.0 Lakh Cr given the additional fiscal measures required and the expected shortfall in revenue receipts in a Covid environment. As on the second week of August, the Central Government has already raised 49% of the revised borrowing estimates; at Rs. 5.5 Lakh Cr, the gross debt mobilised rose 70% as compared to same time last year; similar trends can be seen among state issuances as well. The quicker pace in debt mobilisation may also enhance the concerns among market participants regarding the possibility of further fiscal measures and even higher fiscal deficit. While Acuité had estimated the central fiscal deficit for the year at 5.9%, this figure can be larger as a slow economic revival may translate into a sizeable GDP contraction and therefore, sharply lower tax revenues. The additional borrowings of the central government along with that of the state governments are likely to create an oversupply of sovereign papers in the domestic market, thereby putting pressure on bond yields and also crowding out corporate bond issuances to an extent. Since most of the banks already have excess SLR holdings, the continued participation of the FIIs will be a key factor in stabilising the government bond yields.

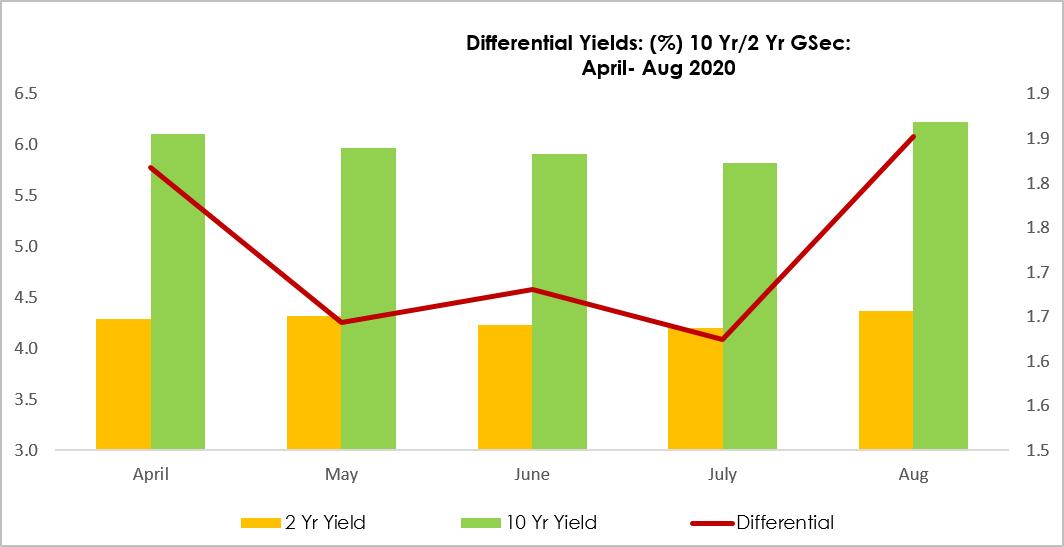

We observe that the yield differential between 2 year and 10 year Government securities has significantly increased since the start of the monetary stimulus programmes from April 2020. It is noted that the yield differential between the two instruments is back to April levels after having contracted over four months. As on August 24th, the yield differential between the instruments in question was recorded at over 180 bps, similar to the level seen on April 24th. Moreover, the effective annualized forward rates for a 2 year and 10 year zero coupon instrument are substantially higher (over a 1 year horizon) are higher by 66 bps and 32 bps respectively, highlighting the market participants’ concerns on the longer term impact of inflation. In our opinion, these are early signs of the yield curve adjusting itself to a higher level.

Acuité nonetheless, expects RBI to respond to such concerns of an oversupply of government securities and inflationary pressures through an array of monetary tools. Recently, RBI has decided to conduct ‘Operation Twist’, a kind of open market operation to control the widening differential between the short and the long term bond yields. The central bank aims to normalise the yield curve which has been steepening since early August through a swap of long term government securities aggregating to Rs. 10,000 Cr with an equivalent amount of very short duration papers due to mature over the next few months.

The current scenario will complicate the challenges faced by RBI in the face of persistent inflationary pressures, growth weakness and higher government borrowings. While the economy may need a further boost through the continuation of the accommodative monetary policy, any further monetary action has to take into account the inflationary uncertainty and the mandate of the MPC to maintain CPI within a comfortable band. Additionally, higher borrowing requirements of the government may make the management of the yield curve further difficult. Even in a scenario where deficit financing is considered by RBI, the consequent impact on money supply will need to be taken into account.

Table 1: Duration-Wise India Government Securities Yields (MoM)

|

Duration |

24-Jul |

24-Aug |

Differential |

|

2 Year |

4.174% |

4.369% |

+20 bps |

|

5 Year |

4.941% |

5.469% |

+53 bps |

|

10 Year |

5.817% |

6.221% |

+40 bps |

|

14 Year |

6.154% |

6.509% |

+36 bps |

|

30 Year |

6.420% |

6.735% |

+32 bps |

Source: RBI

Graph 1: Duration-Wise India Government Securities Yields (MoM)

#Yield Date (24th of Each

Month)

Table 2: Zero Coupon Annualized Forward Rates (Macaulay Duration Method)

|

Duration |

Yield (24-Aug) |

Forward Rate (Annualized) |

Differential |

|

2 Year |

4.33% |

4.99% |

+66 bps |

|

5 Year |

5.62% |

6.11% |

+49 bps |

|

10 Year |

6.50% |

6.82% |

+32 bps |

|

14 Year |

6.72% |

6.96% |

+24 bps |

|

30 Year |

6.72% |

6.83% |

+11 bps |

Source: Acuité Research

Table 3: Centre’s Gross Debt Raised (As on August 2nd Week)

|

|

FY21 |

FY20 |

FY19 |

|

Gross Debt Raised (Rs. Cr.) |

5,50,000 |

3,23,000 |

2,16,000 |

|

Percent of Budget Estimate Utilized |

46% (RE)* |

42% |

33% |

|

YoY Growth (% Growth) |

+70% |

+50% |

-23% |

Source: RBI *RE = Rs. 12 Lakh Cr (BE = Rs 7.9 Lakh Cr)

Table 4: States’ Gross Debt Raised (As on August 2nd Week)

|

|

FY21 |

FY20 |

FY19 |

FY18 |

|

Gross Debt Raised (Rs. Cr.) |

2,45,076 |

1,55,779 |

1,22,214 |

1,18,416 |

|

YoY Growth (% Growth) |

57% |

27% |

3% |

32% |