Key Highlights:

Liquidity

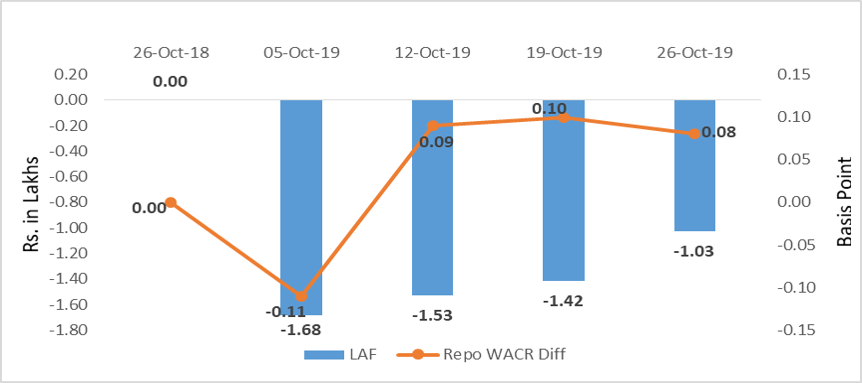

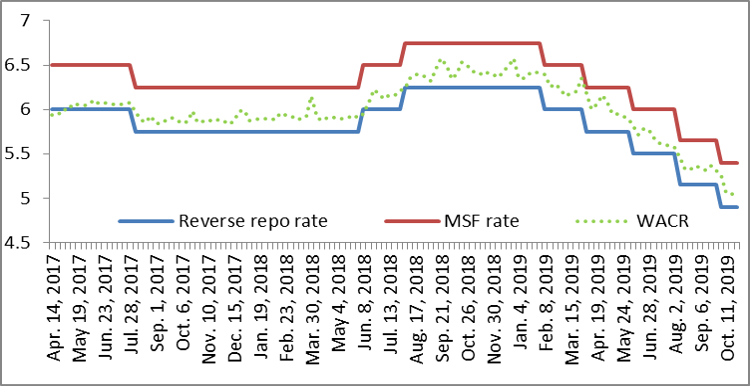

The spread between over-night call money rate and repo rate stands at 8 bps. The surplus liquidity in the banking sector continues to reduce for last three quarters. The amount stands at Rs. 1.03 lakh crore (weekly average) as on fourth week of October 2019. As RBI is absorbing Rs. 50,000 crores under variable rate reverse repo, the surplus liquidity is to be drained further in the coming weeks. Meanwhile, increasing capital inflows in recent weeks is further infusing liquidity during a time when offtake is weak. As far as daily average of systemic liquidity is concerned, as on November 1st 2019, the surplus liquidity in the system reached Rs. 2.82 lakh crore.

Capital Market

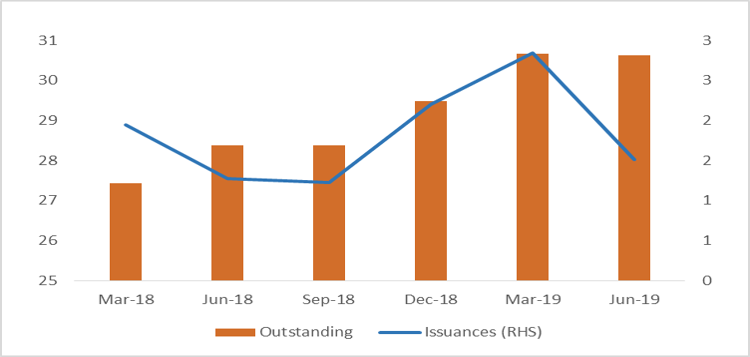

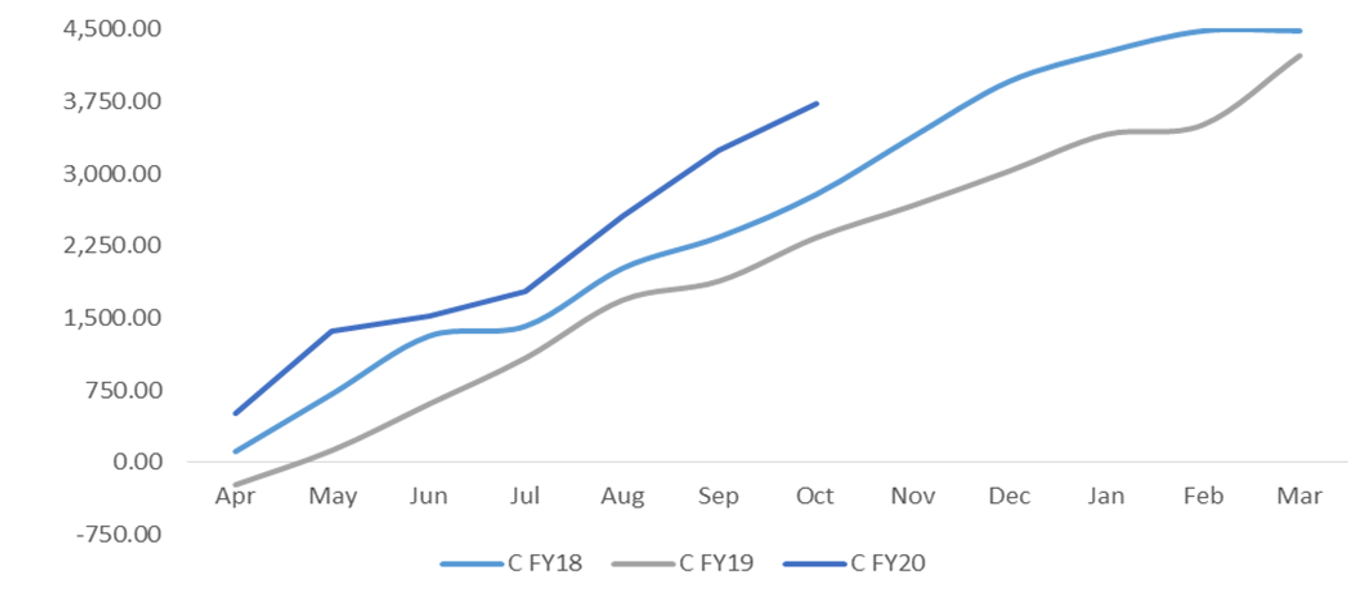

In the capital market, due to increases in foreign investors’ participation in the sovereign bond market, the 10-year Indian G-Sec yield has reduced by almost 30 bps over a month to 6.58% during 4th week of October 2019. As per calendar for issuance of government securities, debt issuances during H2 will be 2.68 lakh crore as against Rs. 4.42 lakh crore during the first half of the current financial year. It is understood that government had preponed the debt issuances to frontload the system. Consequently, the fiscal deficit has reached Rs. 6.5 lakh crore, which is 92% of the target for the overall financial year. Going ahead, sovereign yields are expected to soften due to lower issuances along with fall in 10-year US sovereign yield; differential pressures may therefore decline.

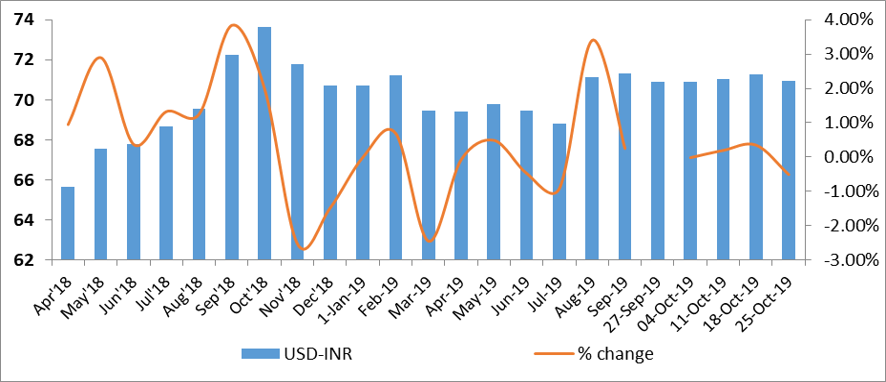

Currency Trend

With higher FII inflows the Indian rupee has been continuously strengthening against the US dollar. The USDINR currency pair has reached 13-week low of 70.85 during the last week of October 2019. The forex reserve has also reached all time high of $442.58 billion. As domestic currency is strengthening against the USD, forward premia has also been reducing substantially. Meanwhile, Fed is set to buy government securities in order to infuse liquidity in the system - an exercise that will further weaken the US dollar.

Interest rates and ratio:

|

Interest Rate |

Oct 26 |

Sep 27 |

Oct 04 |

Oct 11 |

Oct 18 |

Oct 25 |

|

2018 |

2019 |

2019 |

2019 |

2019 |

2019 |

|

|

Policy Repo Rate |

6.50 |

5.40 |

5.15 |

5.15 |

5.15 |

5.15 |

|

Call Money Rate (WA) |

6.50 |

5.31 |

5.26 |

5.06 |

5.05 |

5.07 |

|

364-Day Treasury Bill Yield |

7.47 |

5.60 |

5.53 |

5.41 |

5.37 |

5.32 |

|

2-Yr Indian G-Sec |

|

5.78 |

5.75 |

5.67 |

5.64 |

|

|

10-Yr Indian G-Sec |

7.84 |

6.85 |

6.47 |

6.54 |

6.57 |

6.58 |

|

10-Yr US G-Sec |

3.18 |

1.53 |

1.73 |

1.75 |

1.80 |

1.80 |

|

AAA (Indian corporate) |

8.98 |

7.84 |

7.54 |

7.72 |

7.61 |

7.97 |

|

Spread in bps (10Yr Indian- US) |

784 |

532 |

474 |

479 |

477 |

478 |

|

Credit/Deposit Ratio |

76.75 |

75.67 |

- |

75.66 |

- |

- |

|

USD LIBOR (3 month) |

2.1743 |

1.8299 |

1.8224 |

1.7926 |

1.8381 |

1.8028 |

|

Forward Premia of US$ 1-month |

4.58 |

3.98 |

4.40 |

3.72 |

3.79 |

3.38 |

|

US$ 3-month |

4.36 |

3.95 |

3.87 |

3.80 |

3.71 |

3.61 |

|

US$ 6-month |

4.33 |

4.23 |

4.18 |

4.08 |

4.05 |

3.99 |

|

|

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Oct 11,2019 |

129.38 |

97.88 |

|

As on Sep 13,2019 |

127.23 |

97.12 |

|

As on Oct 12,2018 |

117.86 |

89.93 |

|

YTD (% change) |

1.69% |

0.79% |

|

YoY (% change) |

9.77% |

8.84% |

Money Market Performance

|

Commercial Paper (Fortnight): |

Outstanding (In Rs. Billion) |

Amount issued (In Rs. Billion) |

|

30-Jun-19 |

5,039.40 |

1076.9 |

|

15-Jun-19 |

5,561.80 |

1078.7 |

|

30-Jun-18 |

4,918.30 |

1267.3 |

|

% Change (MoM) |

-9.39% |

-0.17% |

|

% Change (YoY) |

2.46% |

-15.02% |

Indices

|

|

26-Oct-18 |

04-Oct-19 |

11-Oct-19 |

18-Oct-19 |

25-Oct-19 |

|

NSE Index |

10,030.00 |

11,174.75 |

11,305.05 |

11,661.85 |

11,583.90 |

|

NSE Index Return |

-2.65 |

-2.93 |

1.17 |

3.16 |

-0.67 |

|

BSE Index |

33,349.31 |

37,673.31 |

38,127.08 |

39,298.38 |

39,058.06 |

|

BSE Index Return |

-2.82 |

-2.96 |

1.20 |

3.07 |

-0.61 |

Source: RBI, Acuité Research;

Note: Net injection (+) and Net absorption (-)

Source: RBI

Birabrata Panda

Sr. Statistician/Economist