Key Highlights:

Liquidity

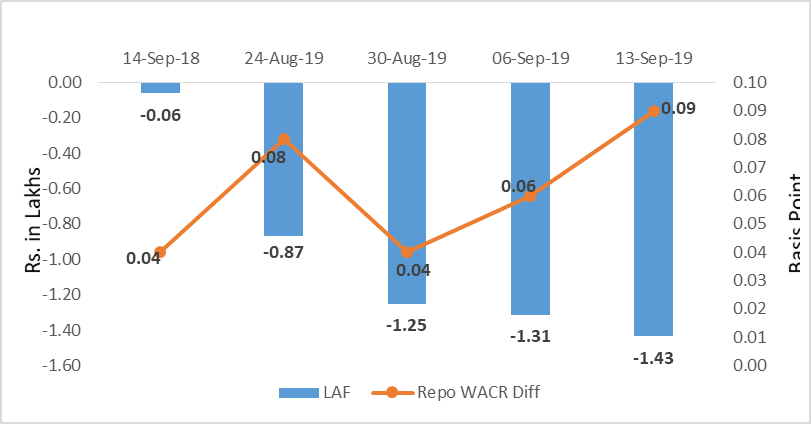

The overall liquidity in

the banking sector has increased to Rs. 1.43 lakh crore during the second week

of September 2019. As a result of surfeit in liquidity in the system, the

weighted average call money rate has further subsided to 5.31%. However, the

surplus liquidity in the system has declined to Rs. 43,000 as on September 23,

2019. The liquidity condition is likely to improve during the last week of

September on account of GST tax filling for the second quarter. Moreover,

credit offtake that has been subsiding for past few weeks is expected to

reverse with the upcoming festive season.

Capital

Market

In the global capital

market, the 10-year US sovereign yield has subsided from a seven-week high of

1.92% to 1.72% over the week period. As the FOMC has trimmed the fed rate by 25

bps during the last week’s meeting, the G-sec yield is expected to decline further.

On the domestic market side, the 10-year Indian sovereign yield has increased

to 6.77%. The domestic capital market is expected to remain volatile as

government’s booster package for the revival of economy is threatening the

fiscal target.

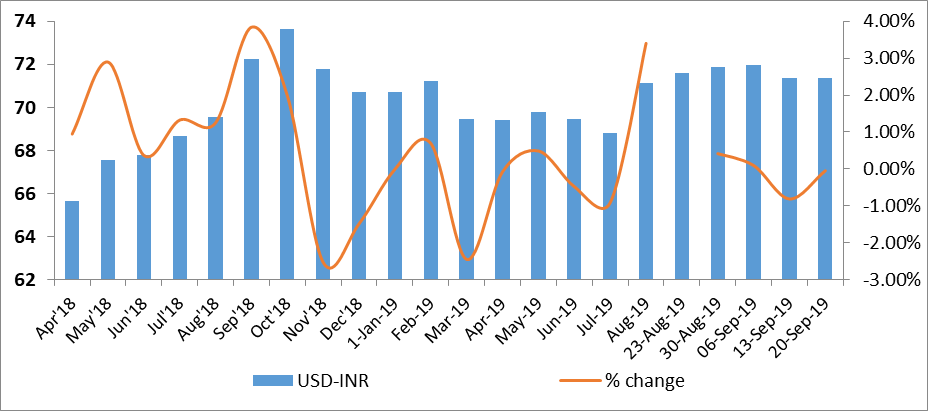

Currency

Trend

In

the currency market, the currency of emerging markets has been gaining against

the US dollar. The Indian rupee has been appreciating for past two weeks after

reaching multi weeks low of 71.9 during the first week of September. The

accommodative monetary policy in the west will lead to higher capital inflows

to the emerging markets. Therefore, currencies of the emerging markets are

expected to strengthen against the USD.

Interest rates and ratio:

|

Interest Rate |

Sep.,14 |

Aug.,16 |

Aug.,23 |

Aug.,30 |

Sep.,06 |

Sep.,13 |

|

2018 |

2019 |

2019 |

2019 |

2019 |

2019 |

|

|

Policy Repo Rate |

6.5 |

5.4 |

5.4 |

5.40 |

5.40 |

5.40 |

|

Call Money Rate (WA) |

6.46 |

5.32 |

5.32 |

5.36 |

5.34 |

5.31 |

|

364-Day Treasury Bill Yield |

7.68 |

5.77 |

5.74 |

5.72 |

5.69 |

5.65 |

|

2-Yr Indian G-Sec |

7.93 |

5.90 |

5.90 |

5.78 |

5.77 |

5.73 |

|

10-Yr Indian G-Sec |

8.07 |

6.69 |

6.57 |

6.70 |

6.73 |

6.77 |

|

10-Yr US G-Sec |

3.07 |

1.53 |

1.5 |

1.56 |

1.90 |

1.72 |

|

AAA (Indian corporate) |

8.92 |

7.61 |

7.37 |

7.70 |

8.01 |

7.85 |

|

Spread in bps (10Yr Indian- US) |

500.3 |

516 |

507 |

514 |

483 |

504.8 |

|

Credit/Deposit Ratio |

76.08 |

76.36 |

- |

75.75 |

- |

- |

|

USD LIBOR (3 month) |

1.9151 |

2.0959 |

2.0936 |

2.0866 |

2.0976 |

2.0883 |

|

Forward Premia of US$ 1-month |

4.85 |

3.7 |

4.02 |

3.85 |

4.18 |

4.57 |

|

US$ 3-month |

4.65 |

3.9 |

4.24 |

4.18 |

4.24 |

4.43 |

|

US$ 6-month |

4.48 |

3.96 |

4.22 |

4.24 |

4.28 |

4.48 |

Acuité Portfolio Debt Instrument Benchmark

Estimates (as on Sep 23rd 2019):

|

Category |

10-Yr Corporate Yield to Maturity |

|

AAA* |

NA |

|

AA+ |

8.03% |

|

AA |

8.69% |

|

|

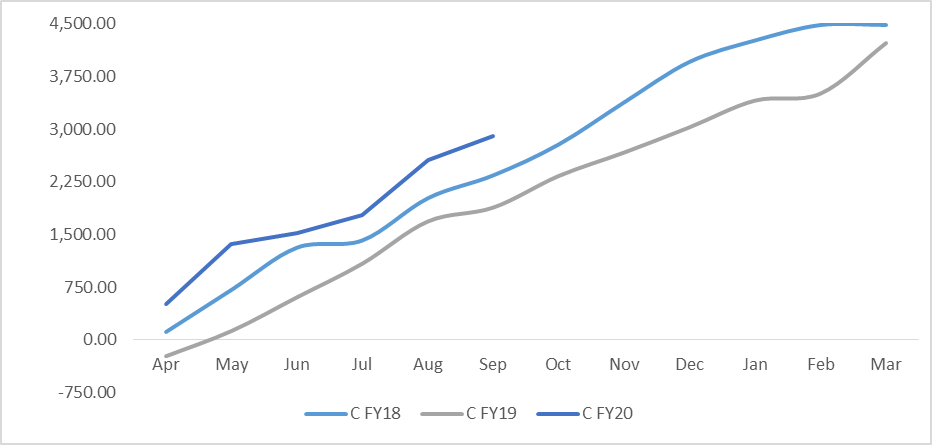

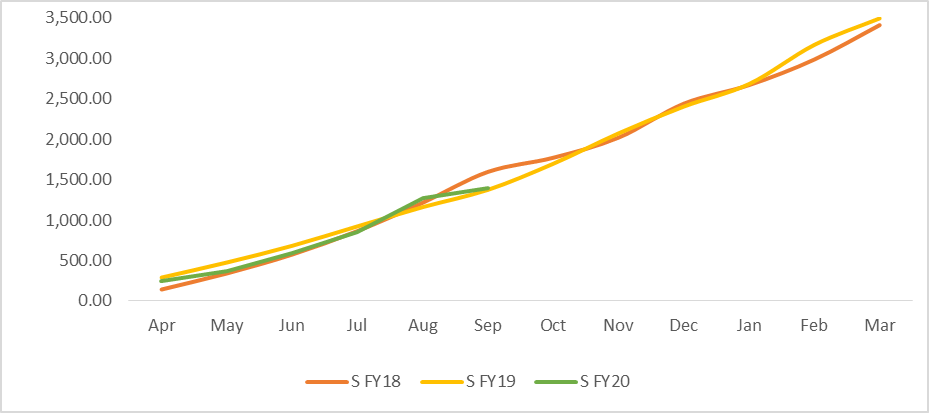

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Aug 30,2019 |

127.80 |

96.81 |

|

As on Aug 02,2019 |

127.45 |

97.29 |

|

As on Aug 31,2018 |

116.47 |

87.81 |

|

YTD (% change) |

0.28% |

-0.50% |

|

YoY (% change) |

9.73% |

10.25% |

Money Market Performance

|

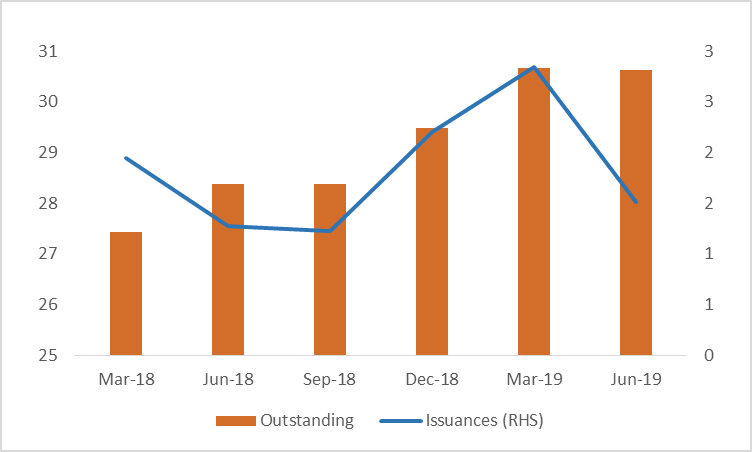

Commercial Paper (Fortnight): |

Outstanding (In Rs. Billion) |

Amount issued (In Rs. Billion) |

|

30-Jun-19 |

5,039.40 |

1076.9 |

|

15-Jun-19 |

5,561.80 |

1078.7 |

|

30-Jun-18 |

4,918.30 |

1267.3 |

|

% Change (MoM) |

-9.39% |

-0.17% |

|

% Change (YoY) |

2.46% |

-15.02% |

Indices

|

|

14-Sep-18 |

23-Aug-19 |

30-Aug-19 |

06-Sep-19 |

13-Sep-19 |

|

NSE Index |

11,515.20 |

10,829.35 |

11,023.25 |

10,946.20 |

11,075.90 |

|

NSE Index Return |

-0.64 |

-1.98 |

1.79 |

-0.7 |

1.18 |

|

BSE Index |

38,090.64 |

36,701.16 |

37,332.79 |

36,981.77 |

37,384.99 |

|

BSE Index Return |

-0.78 |

-1.74 |

1.72 |

-0.94 |

1.09 |

Birabrata Panda

Sr. Statistician/Economist