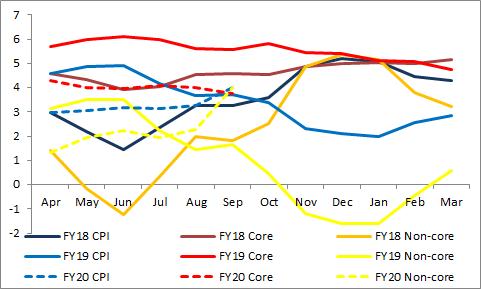

The consumer inflation rate for September 2019 has increased by 71 bps to 4%. The sharp increase in overall inflation rate is a consequence of increases in prices of food articles. In the non-core segment, food inflation has increased by 5.1% in September 2019 as compared to 3% in the previous year. Consequently, non-core inflation (food and fuel) is moving in a cyclical trend and expected to accelerate in H2 FY20. A sharp increase in food inflation is also a result of rising prices of vegetable (15%) and protein based items such as meat & fish (10.3). We reckon this to be an anomaly due to supply side factors.

The increase in price of food articles is marginally offset by the deflation in fuel prices (-2.8). Therefore, overall non-core inflation rate has clocked 4%, which is lower than expected. Going ahead, as the production pattern is shifting towards commercial crops (cotton and sugar) during the Kharif season, the food grain production is expected to remain lower than the previous year (for detail refer: https://www.acuite.in/Sector-alert-food-crop.htm). Furthermore, lower food grain production along with lower base will further escalate the price of food articles. On a positive note, the fuel price index is expected to remain low on account of weak global economic outlook, despite a possible US-China trade deal and a possible Brexit.

Considering the core category numbers, the inflation rate remains steady at 4.5%. Nevertheless, easing policy rate is expected to give fillip to the private consumption in the coming months, pulling the number up. It is clear that while the impact of accommodative monetary policy may retard by a few months as domestic economic outlook is weak, its impact on core inflation is inevitable. Therefore, we are expecting the inflation rate to remain above 4% in H2 of current fiscal year. The belief system stems from the fact that inflation rate is yet to react to the 135 bps rate cut in this year, despite this, inflation has already reached the 4% mark. Therefore, once the core inflation stat begins its upward trajectory to 5%, without doubt, the overall inflation will exceed the upper limit of the 6% level.

Category wise inflation movements during this financial year