The Financial Stability Report (FSR) of RBI in July 2020 rightly acknowledges the severe overhang of macro-economic risks on the stability of the domestic financial sector. With the global as well as the domestic economy on a contraction mode in the near term due to the persistent disruption from Covid-19, the recovery in domestic demand is likely to be gradual, translating to a resurgence of credit stress. The stress test undertaken by RBI on the banks’ advances portfolio indicates that the GNPA may climb up to 14.7% over the next year from 8.5% as on March 2020; such stress will necessitate the mobilisation of fresh capital, a trend that has already started among the larger private sector banks. Nevertheless, it needs to be recognised that the significant monetary stimulus measures taken up by RBI has clearly helped to ease the immediate Covid lockdown driven liquidity stress across financial, corporate and the household sector.

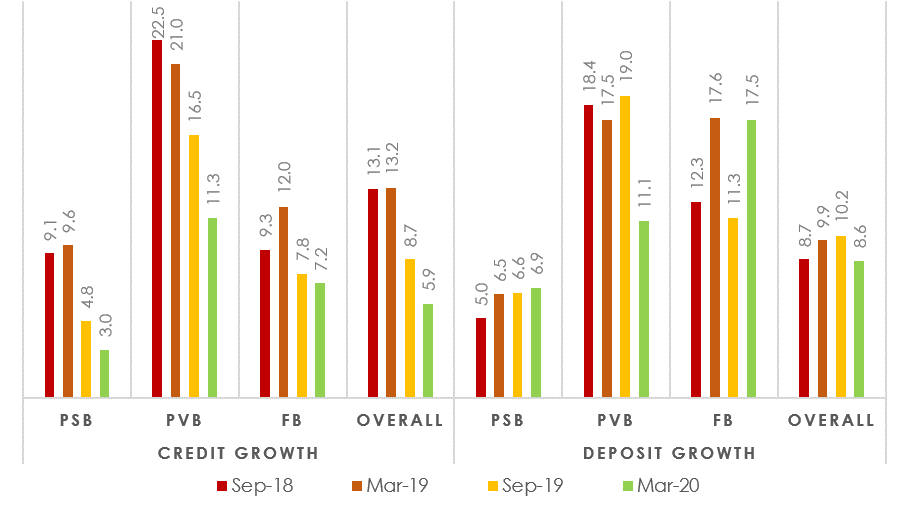

Given the economic slowdown in the pre-Covid quarters, the credit growth of scheduled commercial banks (SCBs) has moderated to 5.9% in March 2020 and continues to languish at those levels from 8.9% in September 2019. In particular, a steady decline in credit growth has been noticed in private bank category in the last four quarters, settling at 11.3% towards the end of Q4 FY20. In our opinion, credit growth is unlikely to witness any significant pickup in the near term due to the uncertain economic environment and the increased risk aversion.

While deposit growth has also witnessed a downward trend, it continues to be significantly higher than the credit growth figures. Further, the latest data from RBI indicates that there has been a recovery in y-o-y deposit growth to 11.0% as at the start of July 2020. Category wise, while public sector banks (PSBs) have posted a steady growth of 6.9%, private sector banks (PVBs) recorded a deceleration in their deposit mobilisation, growing at 11.1% during the reference period (March 2020 y-o-y). We believe that the concerns on governance in a few private sector banks have led to such a deceleration. Although foreign banks have seen their deposit growth picking up to 17.5% in March 2020 as compared to 11.3% recorded in September 2019, their share in the overall banks’ deposit base continues to be modest.

The growth banks’ in net interest income (NII) remains steady at 13% during both halves of FY20. However, it is unlikely that they can sustain such a healthy growth in the current year. It is important to observe that RBI has reduced repo rate by 100 bps during the second half of FY20 as against 60 bps during the first half. However, the commercial banks could not take adequate advantage of the lower policy rate as a result of weak credit offtake. It is observed that while average daily liquidity in the system remained less than Rs. 1 lakh crore during the end of September 2019, it has sharply increased to Rs. 3 lac crores by the end of March 2020. In H1 of FY21, average daily liquidity in the banking system has further doubled to Rs. 6.5 lac crores.

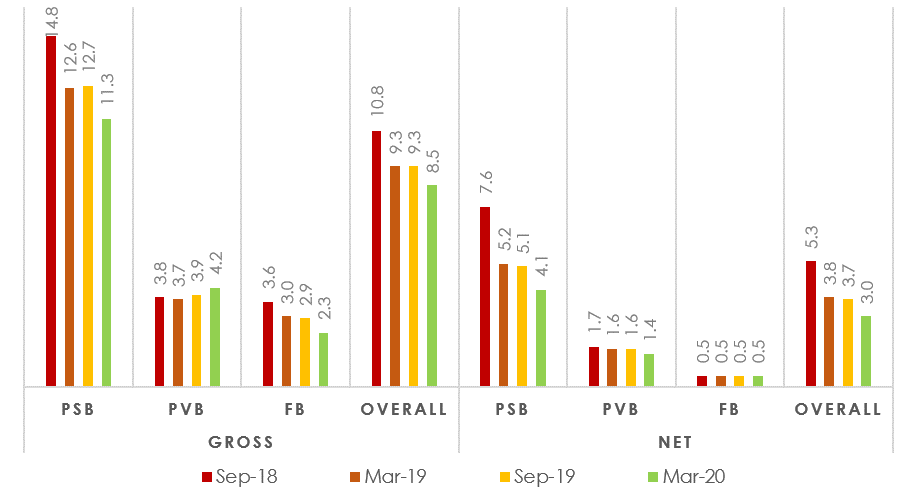

Indian banking system had been going through a prolonged NPA cycle. Interestingly, the gross NPA ratio has slightly reduced by 80 bps to 8.5% in March 2020. The GNPA in public sector banks, which is typically higher as compared its private sector peers, has reduced by 140 bps to 11.3%, reflecting some efforts in recovery. Based on borrower size, the share of the large borrowers in NPA continued its downward trend - reaching 78.3%. In our opinion, the share of MSME and retail in aggregate NPA is likely to rise over the next few quarters given the current economic challenges; it may be noted that RBI has already extended a restructuring scheme for MSMEs to December 2019, that were in default but standard as on January 2019.

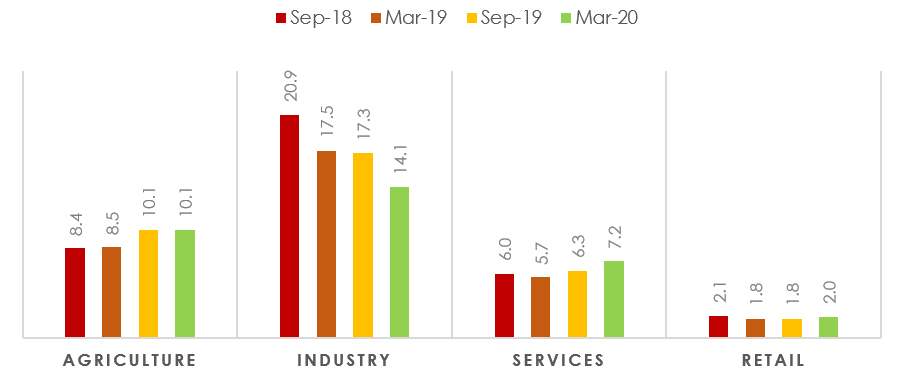

A sub-sector level trend analysis shows

that Gross NPA ratios of mining, textile, infrastructure, electricity and basic

metal have recorded significant decline from a very high level. The gross NPA

ratio in basic metal industry has reduced to 16.2% in March 2020 from almost

25% recorded in September 2019 due to resolution of a few large exposures. We

note that the industry accounts for 11.3% in overall credit to industry. In

contrast, gems & jewellery and construction sector witnessed a spike in NPA

ratio. Under the current scenario, the NPA level is expected may deteriorate

further not only in these two sectors but in others as well; auto components,

aviation, transport and retail are specifically vulnerable to NPA generation.

Chart 1: NPA Ratio:

Chart 2: Sector wise GNPA ratio:

Chart 3: Bank group-wise Credit/deposit growth:

Source:

RBI, Acuité Research;