Sep-21 CPI Inflation: Uneasy comfort

KEY TAKEAWAYS

- CPI inflation moderated to a 5-month low of 4.35% YoY in Sep-21 from 5.30% in Aug-21.

- This was accompanied by a significant deceleration in sequential momentum with CPI rising by a subdued 0.18% MoM in Sep-21 vis-à-vis 0.25% in Aug-21 and 1.10% in Sep-20.

- With support from subdued food inflation, headline retail inflation is likely to remain somewhat benign in Q3 FY22.

- However, escalating price pressures in case of manufacturing inputs along with further acceleration in energy prices may continue to play an offsetting role.

- Further, the possibility of upside pressure from vaccine led temporary surge in pent-up demand particularly during the festive months can keep core inflation sticky at elevated levels.

- For FY22, we continue to expect average CPI inflation to print at 5.5% (within RBI’s tolerance band), moderately lower vis-à-vis the 7-year high level of 6.2% in FY21.

India’s CPI inflation moderated to a 5-month low of 4.35% YoY in Sep-21 from 5.30% in Aug-21. Notwithstanding the supportive statistical base that pulled down the headline rate of annualized inflation, the month of Sep-21 also saw a material deceleration of sequential momentum which rose marginally by 0.18% MoM in Sep-21 vis-à-vis 0.25% in Aug-21 and 1.10% in Sep-20.

Drivers of Sep-21 CPI inflation

- Food and beverages index increased by a modest 0.06% MoM compared to (-)0.06% in Aug-21 and 2.15% in Sep-20. The month-over-month jump in price of 8 out of 12 items within the food and beverages basket got nearly offset by decline in prices of the remaining 4 items.

- Price pressures firmed up further for edible oils in Sep-21, taking the annualized inflation under this category to 34.2% YoY. The incessant price pressure seen in case of edible oils in the last one year and particularly in H1FY22 where the inflation averaged 32.0%YoY, is a global phenomenon (India nearly imports around 70% of its domestic oil demand) primarily linked to Covid supply disruptions as well as weather related disturbances. The government has slashed import duties on certain categories of edible oils by bringing them to a decade low in the month of Sep-21. This could provide a breather to the monthly price momentum in the near term.

- Meanwhile, sequential price pressures accelerated in case of Sugar & Confectionery, Pulses, and Prepared Meals & Snacks amidst the onset of festive season.

- On the other hand, prices dropped sequentially in case Fruits, Eggs, Vegetables, and Meat & Fish. For the first half of the current fiscal, the average inflation in the animal protein category i.e. eggs, fish and meat has come down appreciably to 9.7%YoY from 15.4%YoY in H1FY21, reflecting the easing of supply chain pressures. The inflation scenario has changed quite sharply for vegetables where the average deflation in H1FY22 stood at 10.6% vis-à-vis a record high of 12.8% in the first half of previous fiscal. In the case of fruits, the increase in prices during Mar-May has led to the average H1 inflation going up to 8.8% in the current year.

- Overall, the F&B index registered a 2.2% QoQ uptick in Q2 FY22. This is one of the lowest price increases seen on quarterly basis during Q2 in the current CPI series beginning 2011 (the average change in Q2 for the F&B series stands at 3.9%). Less severe summer seasonality (which typically impacts vegetable prices) and government interventions to provide relief from excessive price pressures in case of select food products such as edible oil and pulses have had some impact in moderating food prices.

- Fuel and Light index registered a sequential increase of 0.74%in Sep-21, up from 0.44% in Aug-21. Compared to the previous month, price pressures accelerated primarily in case of LPG and Kerosene, an impact of a lagged pass through from elevated international energy prices. In contrast, Petrol and Diesel prices (captured in the Transport & Communication part of the Miscellaneous index) saw a sequential decline. We believe this could be short lived as domestic oil companies have restarted upward adjustment in retail prices after the latest run up in price of India Crude Basket (from an average of USD 73 pb in Sep-21 to USD 80 pb in Oct-21 so far).

- Core index (CPI ex Food and Fuel) increased by 0.19% MoM in Sep-21, lower than the 0.25% jump seen in Aug-21. The deceleration was across the key categories of Pan, Tobacco & Intoxicants, Clothing & Footwear, Housing, and Miscellaneous.

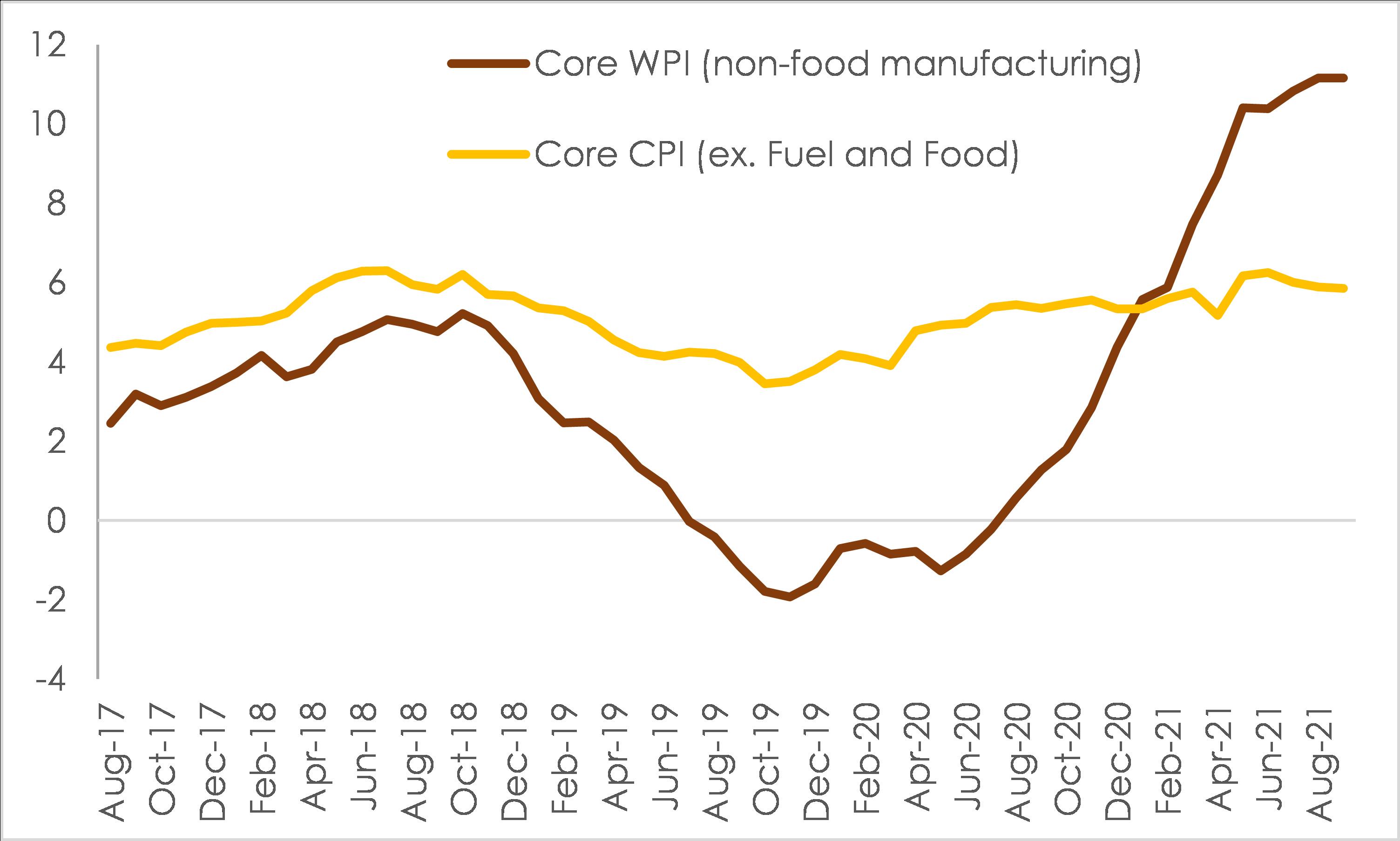

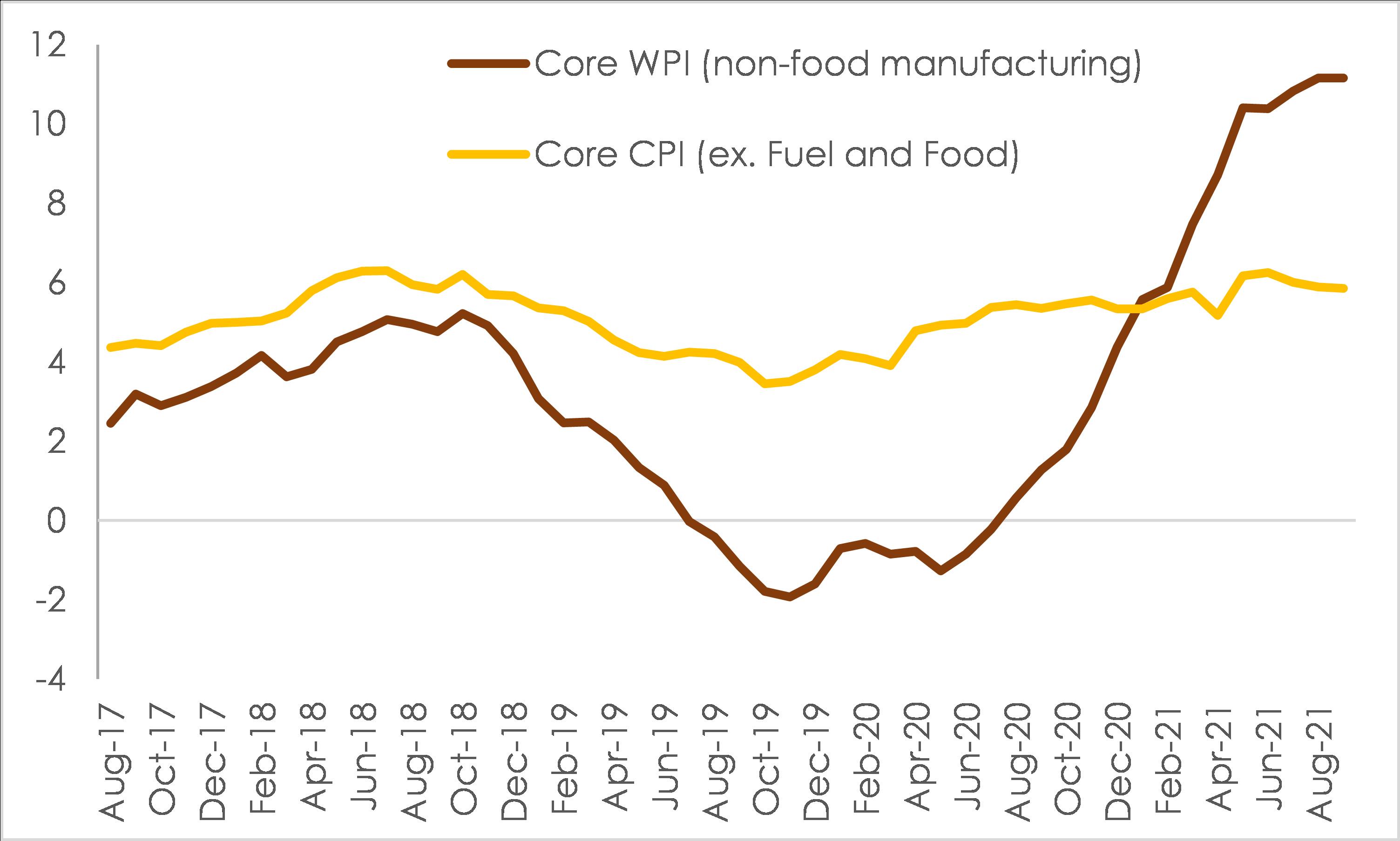

- Despite the steep fall in annualized headline inflation in last three months, the annualized core inflation has remained in a tight and elevated range of 5.8-5.9%. The pandemic has resulted in stickiness in core inflation due to supply disruption along with some evidence by manufacturers of pass through of escalation in input prices. The FYTD (Sep over Mar) build-up in price pressure for core inflation has been at 3.5% in FY22, similar to the levels seen in FY21 – this we note is much higher than the average build-up of 2.6% seen in the corresponding 5-year period between FY16-FY20.

WPI inflation: Core creates a new record high

In line with the deceleration in CPI inflation, headline WPI inflation moderated to a 6-month low of 10.66% YoY in Sep-21 from 11.39% in Aug-21. Meanwhile, WPI inflation for Jul-21 saw an upward revision to 11.57% YoY vs. 11.16% reported earlier. The down-move in annualized rate of inflation in Sep-21 was accompanied by a subdued sequential momentum of 0.07% MoM vis-à-vis 1.04% in Aug-21.

- Sequential momentum in consolidated food & beverages inflation remained moderate at 0.13% MoM in Sep-21, unchanged from the previous month. Barring the surge in Apr-21 on account of summer seasonality and lockdown impact, food prices have followed a restrained trajectory so far.

- Fuel inflation posted a sequential decline of -1.12% MoM in Sep-21 driven by Mineral Oils (-1.75% MoM). Although prices of coal and electricity remained broadly unchanged from the previous month, we expect this comfort to be short lived given the recent surge in global crude oil prices currently trading at a one-year high of USD 84 pb. Additionally, the latest energy crisis triggered by lower coal supplies could further lead to a rise in coal and electricity prices thereby keeping overall fuel inflation elevated.

- Momentum in Core WPI (non-food manufacturing) rose by 0.58% MoM in Sep-21, lower compared to 0.72% increase seen in Aug-21. Despite the sequential moderation in momentum, the annualized core inflation print created a new series high of 11.2% YoY in Sep-21. High sequential pressure was observed in case of Wearing Apparel (1.20% MoM), Rubber & Plastics (1.15% MoM), Fabricated Metals (1.01% MoM), Basic Metals (0.96% MoM), Furniture (0.95% MoM), Chemicals (0.84% MoM), and Machinery Equipment (0.75% MoM).

Outlook

The moderation in CPI inflation over the last quarter has provided considerable comfort with headline inflation now getting close to the mid-point of the policy target band. The 4-5% range is likely to persist in Q3 FY22 as overall food inflation is expected to remain benign on account of recovery in kharif sowing in Aug-Sep along with quantity and price-based policy interventions by the government in select food items.

However, see this as a brief reprieve, with CPI inflation projected to climb up thereafter towards 5-6% range in Q4 FY22 and Q1 FY23. The drivers for this include:

- Energy inflation is expected to accelerate further in the coming months, predominantly on account of elevated energy prices with some push also coming from the recent bout of currency weakness. India Crude Basket has seen over 14% jump in price since end Aug-21. In addition, the tightness in global coal supply has begun to have a spill over impact on domestic coal prices and power tariffs.

- Some bit of elevated energy inflation will carry a second order impact on the non-energy inflation. In this context, we note that this would coincide with ongoing sequential pick-up in economic activity on account of progress on both state level almost complete unlock status as well as significant vaccination coverage (that stood at almost 50% for first dose recipients as of Oct 13, 2021). With expectation of nearly 75% of the population getting partially vaccinated before end Dec-22, a temporary spike in demand side inflation remains a distinct possibility as economic activity normalizes. This in turn could keep core inflation pressures firm.

As such, we continue to stick to our call of 5.5% CPI inflation in FY22 vis-à-vis 6.2% in FY21.

Annexure-1

Table1: Key highlights of CPI inflation

| CPI Inflation: By sub-components (%YoY) |

|

Sep-20 |

Aug-21 |

Sep-21 |

| Headline CPI |

7.3 |

5.3 |

4.3 |

| Food and Beverages |

9.8 |

3.7 |

1.6 |

| Pan, Tobacco & Intoxicants |

10.7 |

4.0 |

4.2 |

| Clothing & footwear |

3.0 |

6.8 |

7.2 |

| Housing |

2.8 |

3.9 |

3.6 |

| Fuel & Light |

2.8 |

12.9 |

13.6 |

| Misc. |

6.9 |

6.4 |

6.4 |

| Core CPI |

5.4 |

5.9 |

5.8 |

Chart 1: Record Core WPI inflation could pose risks for Core CPI inflation (%YoY)