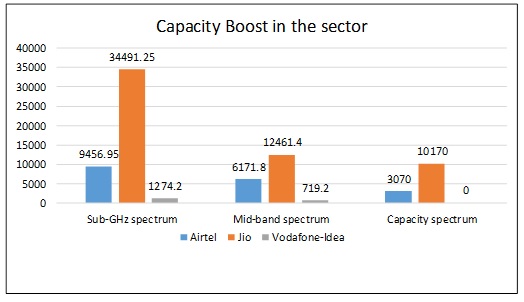

Acuité believes that the latest spectrum auction albeit relatively muted, will further accelerate the ongoing consolidation in in the telecom sector. It will also lead to an increased switch of users from the legacy 2G and 3G to 4G networks which will facilitate better data quality and higher demand for value added services. Expectedly, this will also translate into a continuing rise in ARPU (average revenue per user) for the major three industry players although that may still not be adequate for any immediate improvement in the currently weak debt coverage indicators. The high burden of debt and deferred payment liabilities to the Government may also not permit the incumbent players to bid aggressively for the upcoming 5G spectrum auction albeit a limited rollout of 5G services is likely in the near term by refarming the existing spectrum.

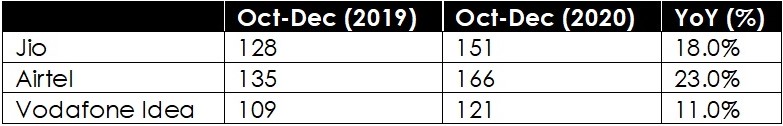

India’s first auction of telecom spectrum in five years was concluded on March 2, 2021 after a relatively short two-day process with six rounds of bidding. Government through DoT garnered Rs. 77,815 Cr by sale of an aggregate 855.60 MHz of spectrum. While a total quantum of Rs. 3.92 Lakh Cr at reserve price was up for bidding, the aggregate investment has been 20% of the maximum amount and 38% of the total spectrum put up for auction. The spectrum sale, therefore, has been relatively muted as compared to the auctions in 2014 and 2016 where the proportion of sold spectrum was over 80% and 40% respectively. Given the consolidation in the telecom sector, the existing 3 large telecom companies (telcos) namely Bharti Airtel, Reliance Jio and Vodafone Idea participated in the auction process as against 7 players in the previous auction held in October 2016. The final spectrum price is equal to the reserve prices across bands i.e. there was no intense bidding over the reserve price. However, the final mobilisation has still exceeded the government’s expectation of Rs 45,000 Cr.

The telcos are expected to exercise the option of making an upfront payment of 25 per cent for spectrum won in 800 MHz & 900 MHz bands and 50 per cent for 1,800 MHz, 2,100 MHz and 2,300 MHz with the balance amount schedule to be paid in 16 equated annual instalments after a moratorium of 2 years. Of the total Rs. 77,815 Cr, the government therefore, is expected to get Rs. 27,602 Cr upfront with the immediate payments from Reliance Jio, Bharti Airtel and Vodafone Idea amounting to Rs. 19,9389 Cr, Rs 6,985 Cr and Rs. 678 Cr.

The auction was majorly led by Reliance Jio which bought 492.10 MHz of the total 855.60 MHz, followed by Bharti Airtel with 351.70 MHz and Vodafone-Idea with 11.80 MHz While Reliance Jio and Bharti Airtel bought spectrum higher than what was required for renewal, Vodafone-Idea’s response was subdued, which bought 76 per cent less than the spectrum required for renewal.

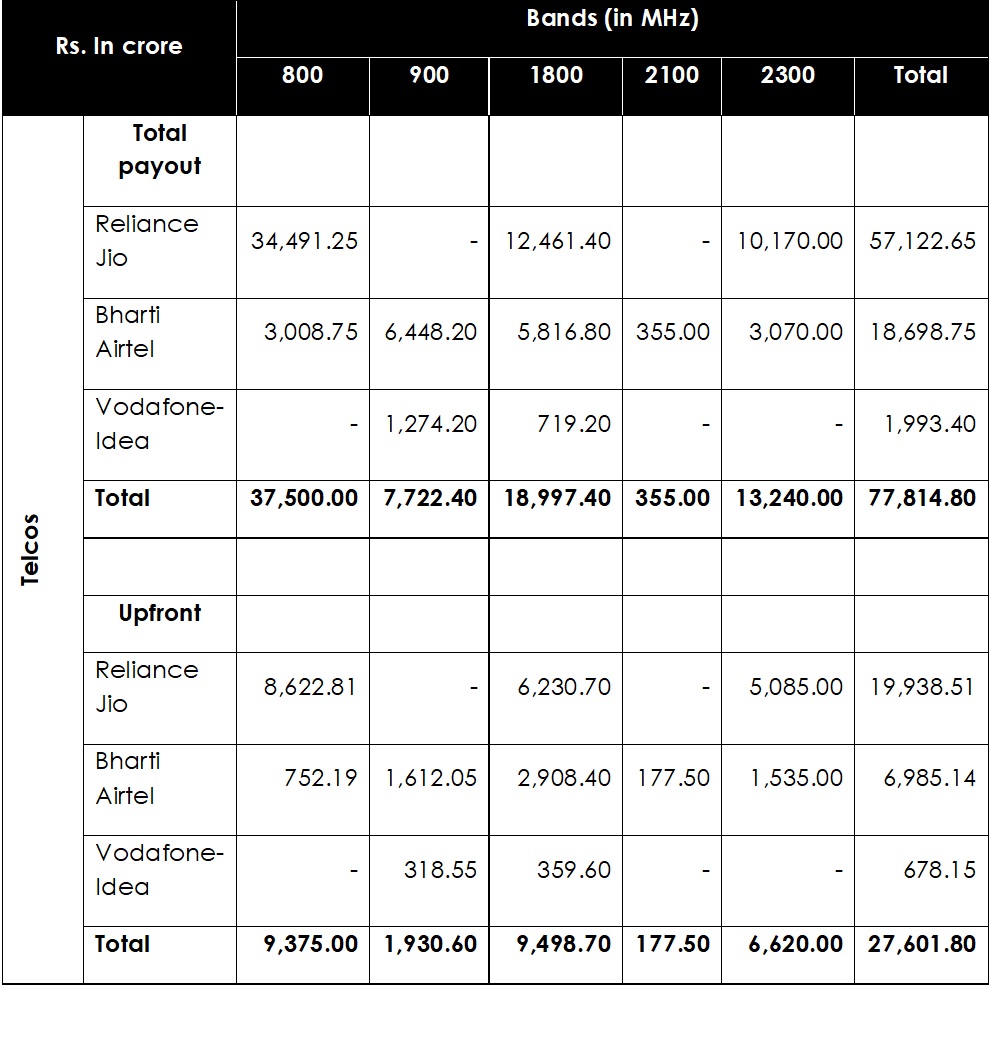

At the end of the auction, Bharti holds 176.5 MHz in sub-GHz spectrum, 488.85 MHz in mid-band spectrum and 790 MHz in capacity spectrum. Reliance Jio holds 148.75 MHz in sub-GHz spectrum which is 15.72 per cent lower than Bharti Airtel’s holding; 221 MHz in mid-band spectrum and 880 MHz in capacity spectrum. Vodafone-Idea holds 141.2 MHz in sub-GHz spectrum; 550.9 MHz in mid-band spectrum and 400 MHz in capacity spectrum. (Note: Sub-GHz spectrum includes 800 MHz and 900 MHz; Mid-band includes 1800 MHz and 2100 MHz; capacity spectrum includes 2300 MHz)

The telcos have been prudent and have focused on maximization of returns from every MHz of purchased spectrum. It is interesting to note that there were no bids for the 700 MHz and the 2500 MHz since the reserve prices were found to be high by the telcos. While the 700 MHz is considered to be an efficient spectrum band given its higher penetration, wider coverage and better effectiveness in broadband services, there has been no purchase in this band in both the auctions of 2016 and 2021. Nevertheless, we expect a healthy demand for this band in the subsequent 5G auctions along with the 3.3-3.6 MHz given its suitability in 5G networks.

Implications of spectrum auction

Outlook

Given the increasing transition of the customer base to 4G network and the higher demand for data services which will be facilitated further by the concluded spectrum auction, the industry ARPUs and the operating margins are expected to improve over the medium term. The consolidation in the industry with 2 stronger players and a relatively weaker player in terms of financial performance, will also facilitate a moderate increase in the telecom tariffs going forward. Nevertheless, Acuité expects the financial flexibility of the industry to be partly constrained (except for Reliance Jio given the strong group support) given the high direct debt as well as deferred obligations to the DoT. While the players may launch 5G services in a limited manner in the near term by optimising some of the existing spectrum, a comprehensive 5G roll out is set to get delayed beyond 2022 given the modest capacity of the incumbent players to bid aggressively in the upcoming spectrum auctions specifically for 5G networks.

Table 1: Spectrum Auction Details

Chart 1: Spectrum Sale Details (Rs Cr)

Table 2: ARPU – Industry Trends (Rs/Month)