Key Highlights:

Liquidity

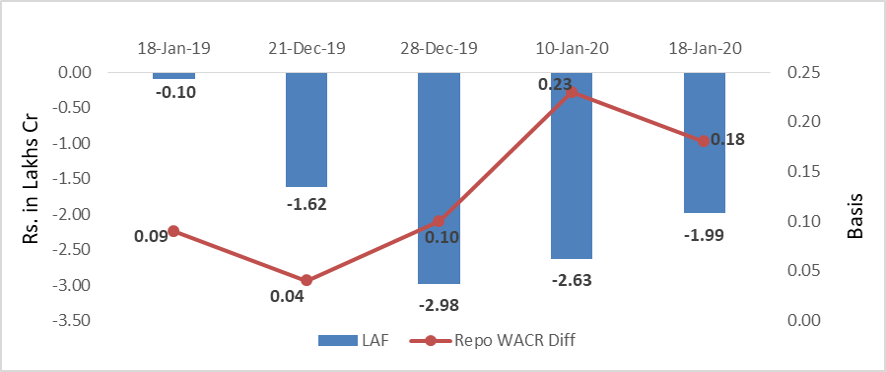

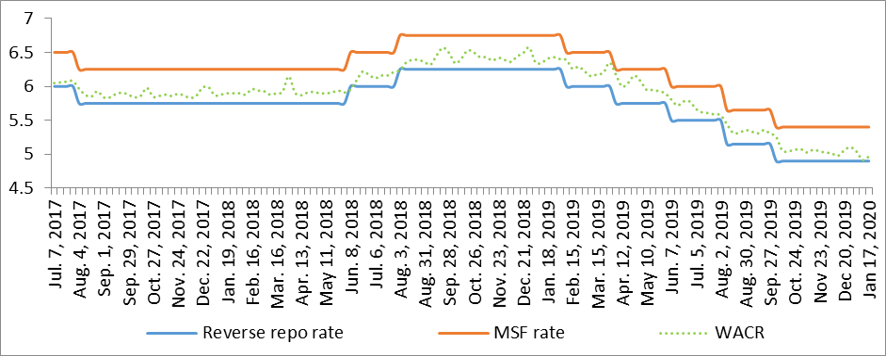

Liquidity in the banking system remains below Rs.2 lakh crore during the third week of January 2020. This amount was close to 3 lakh crore during the end of December 2019. The call money rate (weighted average) stands at 4.97%, which is 18 bps lower than the repo rate. The over-night lending rate is at the lower bend of the policy corridor. Over the week, forex reserve has also surged by $940 million to $462.15 billion – adding to the existing liquidity in the system.

Capital Market

In the domestic capital market side, the 10-yr sovereign yield has been trading at 6.84 for past two weeks. After the special OMO operations of RBI, the long-term yield had marginally softened to below 6.75% during the early weeks of this month. The yield is steady as government issuances declined amid of higher fiscal deficit. It is known that fiscal deficit for this financial year has reached Rs. 7 lakh crore by November 2019. This week’s major event for the market is union budget FY21, will be presented on this Saturday. Marker will keep a close eye on fiscal deficit target for FY21.

Currency Trend

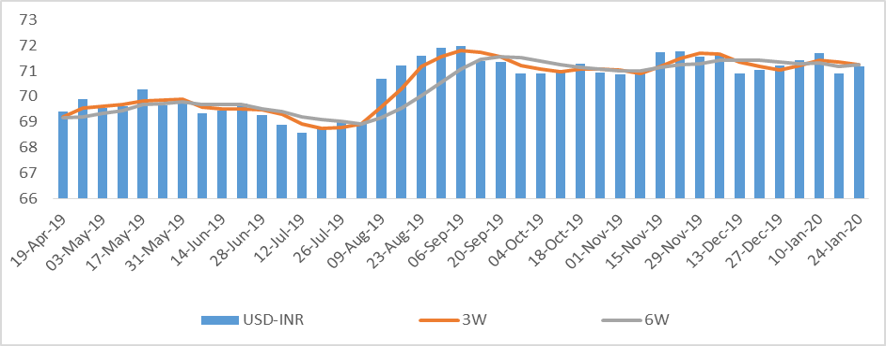

Talking about currency market, Indian rupee has depreciated by 0.39% to 71.19 against the US dollar over the week. Most of the Asian currencies are falling due to economic uncertainty in china over corona virus. At the same time, market is volatile due to two major events due this week; MPC meeting of Bank of England due on Thursday and India’s union budget for FY21 on Saturday.

Interest rates and ratio:

|

Interest Rate |

Jan.,18 |

Dec.,20 |

Dec.,27 |

Jan.,03 |

Jan.,10 |

Jan.,17 |

|

2019 |

2019 |

2019 |

2020 |

2020 |

2020 |

|

|

Policy Repo Rate |

6.50 |

5.15 |

5.15 |

5.15 |

5.15 |

5.15 |

|

Call Money Rate (WA) |

6.41 |

5.06 |

5.11 |

5.05 |

4.92 |

4.97 |

|

364-Day Treasury Bill Yield |

6.83 |

5.27 |

5.30 |

5.30 |

5.29 |

5.30 |

|

2-Yr Indian G-Sec |

7.00 |

5.82 |

5.76 |

5.69 |

5.75 |

5.70 |

|

10-Yr Indian G-Sec |

7.32 |

6.81 |

6.74 |

6.73 |

6.84 |

6.86 |

|

10-Yr US G-Sec |

2.76 |

1.88 |

1.79 |

1.82 |

1.83 |

1.69 |

|

AAA (Indian corporate) |

8.57 |

7.63 |

7.56 |

7.60 |

7.64 |

7.86 |

|

Spread in bps (10Yr Indian- US) |

456 |

493 |

495 |

491 |

502 |

517 |

|

Credit/Deposit Ratio |

77.86 |

76.47 |

- |

76.04 |

- |

- |

|

USD LIBOR (3 month) |

2.3846 |

1.5340 |

1.5331 |

1.5405 |

1.5270 |

1.5311 |

|

Forward Premia of US$ 1-month |

4.22 |

3.88 |

3.96 |

3.68 |

3.71 |

4.05 |

|

US$ 3-month |

4.19 |

3.82 |

3.90 |

3.93 |

4.11 |

4.16 |

|

US$ 6-month |

4.13 |

4.33 |

4.38 |

4.27 |

4.20 |

4.22 |

Source: RBI, Investing.com

|

|

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Jan 03,2020 |

132.10 |

100.45 |

|

As on Dec 06,2019 |

131.06 |

99.35 |

|

As on Dec 21,2018 |

119.1 |

92.8 |

|

YTD (% change) |

0.79% |

1.11% |

|

YoY (% change) |

9.80% |

7.6% |

Source: RBI

Money Market Performance

|

Commercial Paper (Fortnight): |

Outstanding (In Rs. Billion) |

Amount issued (In Rs. Billion) |

|

30-Jun-19 |

5,039.40 |

1076.9 |

|

15-Jun-19 |

5,561.80 |

1078.7 |

|

30-Jun-18 |

4,918.30 |

1267.3 |

|

% Change (MoM) |

-9.39% |

-0.17% |

|

% Change (YoY) |

2.46% |

-15.02% |

Source: RBI

Indices

|

|

18-Jan-19 |

27-Dec-19 |

03-Jan-20 |

10-Jan-20 |

17-Jan-20 |

|

NSE Index |

10,906.95 |

12,245.80 |

12,226.65 |

12,256.80 |

12,352.35 |

|

NSE Index Return |

1.04 |

-0.21 |

-0.16 |

0.25 |

0.78 |

|

BSE Index |

36,386.61 |

41,575.14 |

41,464.61 |

41,599.72 |

41,945.37 |

|

BSE Index Return |

1.05 |

-0.26 |

-0.27 |

0.33 |

0.83 |

Source: RBI, Acuité Research;

Note: Net injection (+) and Net absorption (-)

Source: RBI

jan-27-20.png)

jan-27-20.png)

Source: Acuité Research, RBI

jan-27-20.png)

jan-27-20.png)

Source:

RBI, Acuité Research