Brief: A high correlation between IIP and CPI point towards a deflationary condition, however we believe that a base reversal post July will get things back on track

Impact: Negative

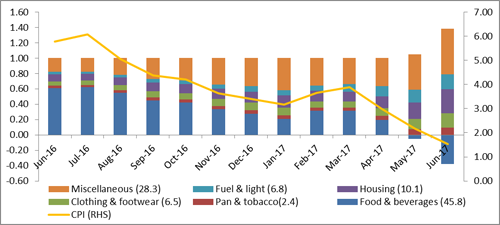

The consumer price index in India recorded 1.5% (YoY) growth in June, 2017, which is lowest in past four year. As per our estimates, miscellaneous items (personal care, transport, medical care and others) have shared 58% in the consumer inflation growth. However, contribution of this category has offset by the negative growth in food articles. The food and beverage category has contributed negatively by contracting (-) 38% in June, 2017.

Overall, the core inflation (excluding food and fuel) that accounts for 54% in Headline Inflation has stood at 3.9%. Therefore, despite the record declines, it is indicative that core inflation remains well within the RBI’s target level 4% (±2). Non-core category, on the other hand, is however reeling under price volatilities pertaining to commodities. SMERA attributes the negative food inflation to the surplus food production in FY17 and a higher base effect. We believe that the negative trend in food price is likely to continue till July as monsoon appears to be in line with expectations. A month on month comparison, on the other hand, gives a different outlook. The non-core has expanded by 1.05%, whereas core inflation has expanded by 0.06% for the said period. This indicates the price of the core category has remained stable in the short term, while being much higher on a YoY basis (long term horizon).

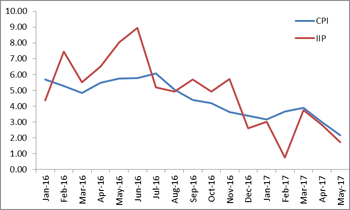

Due to mild consumer demand, the industrial production is also growing at a slower rate. Moreover, we found a higher correlation between CPI and IIP with a coefficient of 0.76 (during January 2016-May 2017). What this signifies is the fact that industrial production has an inherent connection to inflationary/ deflationary conditions in the market. As demand falls, the supply side adjusts itself through production cuts and a lack of expansion. This leads to an equilibrium between market forces being set much lower than the optimal. Such conditions generally signal towards deflation, however we believe that a base reversal post July will get things back on track - foreseeable atleast until Q3 FY18.

Category wise contribution in CPI

Source: SMERA Research

IIP & CPI Trend Analysis

Source: SMERA Research