Impact: Neutral

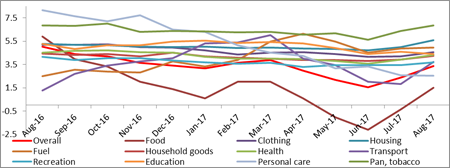

India’s Consumer Price Index (CPI) has recorded 3.4% growth in August, 2017, as against 2.4% the previous month. The rise in the consumer price is primarily driven by the non-core (food and fuel) category. Price index for this category has accelerated to 2% in August, 2017 from a deflation of (-) 1.2% in June, 2017. Price of food items are likely to accelerate further. The core category (excluding food & fuel) is also following the similar trend, which is accelerated from 3.9% to 4.5% during the same period. The consumer demand is expected to remain strong in the coming months owing to healthy monsoon, farm loan weaver, and implementation of pay commission award. We, therefore, expect the overall inflation to remain near the 4% level in the second half of FY18. SMERA’s expectation was in line with the RBI and we believed that inflation (especially core) will breech the 3.5% levels, H2 onwards.

Among the sub-category, inflation rate for pan & tobacco that includes beer & alcohols and tobacco items has reached 6.8% in August, 2017. This is in line to the IIP numbers pertaining to the consumer non-durables category, which is showing some recovery. The liquor industry has highly impacted by the government regulation in recent months (demonetization, ban on selling near highways) and production of this industry has contracted by (-) 25.7% between November, 2016 and June, 2017. The supply constraint in the industry has put upward pressure on price. However, it has been observed that inflation rate pertaining to this category always remains above the overall inflation rate due to raise in tax rate in every budget.

Price of housing and other household goods such as furniture and utensils has also witnessed robust growth in August, 2017. Inflation rate for housing was hovering at 5% during January to July, 2017 but has now increased to 5.6% in August. Similarly, household goods including furniture and utensils have recorded a six month high inflation of 4.2%.

Consumer Price Index:

Source: MOSPI, SMERA Knowledge Centre