Brief: The Insolvency and Bankruptcy Board of India (IBBI) is the country’s attempt to safeguard creditor interests and builds a framework that will introduce specialist actors as soon as an event is triggered. Now widespread in most prominent economies, the ‘in –place’ system will aid speedy resolutions of bad debt as India evolves into a full-fledged market economy.

Impact: Positive

The rise of Insolvency and Bad Debt

Bad loans are estimated to be nearly 8.4% of Indian GDP and are estimated to rise moderately in the short term. It may be argued that such bad loans are a side effect of rapid expansion, which the Indian economy underwent during its growth phase of 2004-09. As profitability and revenues were on the rise in almost every sector, corporates anticipated future demand and rapid capacity augmentations became a norm. The story however didn’t end well since post the 2009 financial crises, the return on investments were nowhere to be seen. With slowing exports and subdued domestic demand, corporates sat on excessive capacities and utilization levels languished at near 65% levels. The most hit were large borrowers (corporates), with larger exposures. Since most slippages were in exposures of the Rs. 200 million category and over, lenders comprising mainly of commercial banks and bond holders found themselves at risk. Public sector banks were the most vulnerable and were holders of nearly 75% of these loans and therefore potentially $60-$100 billion in systemic lock out.

Rehabilitation of these so called Non Performing Assets (NPAs) has been tedious as debtors continued to hold the controlling power and are unnecessarily delaying resolutions. The Government of India and the RBI introduced several initiatives to expedite the resolution and restructuring of bad debt, however this too was not successful with recoveries averaging less than 20%. Initiatives such as Joint Lender Forums (JLF) on the other hand were formed to get all lenders on one platform but it was plagued by regulatory complications. Also, multiple lenders to one account made matters complex as resolution of every NPA account with multiple lender parties, required an approval constituted by at least 60% by number and 75% by quantum. Lending banks therefore continued to sit on non-performing assets without any resolutions, over heating their balance sheets. The provisioning made for such accounts mounted additional pressure on bank Net Interest Margins and caused lending resources to diminish. In the scenario, without NPA resolutions, banks have become increasingly conservative in their lending operations adversely impacting offtake.

The initiation of Insolvency Resolution Process (IRP)

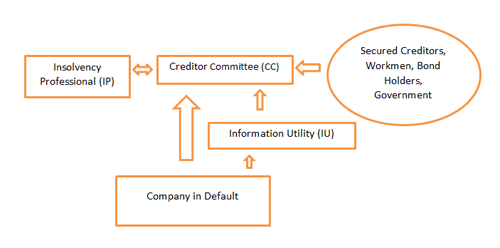

The introduction of the Insolvency and Bankruptcy laws is expected to restore the control to the creditors and hence is anattempt to safeguard their interests. The Government’s vision is to build a framework that will introduce specialist actors as soon as an event is triggered. Now widespread in most prominent economies, the in –place system will aid speedy resolutions of bad debt as India evolves into a full-fledged market economy. Under these laws, an Insolvency Resolution Process (IRP) is triggered by a creditor as soon as a default event occurs. The process starts with an intimation sent by any creditor to the defaulted entity, the National Company Law Tribunal (NCLT) then authorizes the process and gives a go ahead to the IRP. This is followed by the creation of a Creditor Committee (CC) that decides upon the fate of the failing company. Notably, the Creditor Committee composes not only of the large secured creditors (namely commercial banks) but also workmen (employees), whose dues are outstanding along with Bond holders. Also, worth mentioning is the fact that Government’s share in the debt outstanding is considered junior to all other obligations. Within the new waterfall mechanism, the former’s share is classified as subordinated and follows private parties and workmen. This is done to encourage unsecured parties and deepen India’s bond markets.

Once the IRP is initiated, the CC is given 180 days for the debt resolution, if no decision is reached within the timeframe, the committee will receive an extension of 90 days beyond which liquidation will be initiated. The entire process will be under the supervision of a registered Insolvency Professional (IP), who will be appointed by the IBBI. The IP will also oversee the liquidation of the company in an event when the CC has been unable to reach a decision within the stipulated 270 days of the proceedings. Furthermore, dedicated Information Utilities (IU) will be appointed to assist the IRP. These IUs will be specialist information archivers, which will facilitate the proceedings through supply of credible financial information pertaining to the company in question. It must be noted that the period for which the IRP is in place, there will be a moratorium, within which no claims will be settled. Proceedings will culminate into a dispute resolution encompassing all parties involved.

We

believe that the IBBI will eventually subsume most bankruptcy and insolvency

instruments such as SARFAESI Act, RDDBFI Act, S4A and SDR and allow more

transparency and accountability. The impact of the IBBI will be far reaching

and will help reform defaulter apathy towards creditors. With a dedicated

standardized process in place that involves specialized actors committed to

resolve a default scenario in a time bound fashion – we expect significant

impact on the very perception of default. Systematic insolvency and bankruptcy

proceedings for individuals on the other hand will also reduce the time

involved and offer an alternate path. Even more so, for individuals with annual

income of less than Rs. 60,000, the IBBI provisions a ‘Fresh Start’ that

basically allow entrepreneurial spirits to continue. As things stand today, even

though it is still too early to assess the real changes that will be brought

about by the IBBI, it is clear that debt restructuring or eventual liquidation

will be a speedier exercise and hopefully less frustrating for the

stakeholders.

The IRP Process Diagram:

Benefits & Highlights:

·Transfer of control to Creditors

·No disparity between secured and unsecured creditors

·Introduction of a specialized framework and actors

·Speedy resolution (provision of 180 days and maximum of 270 days)

·Government dues treated as junior debt within the water fall mechanism