Why India's sovereign ratings deserve an upgrade

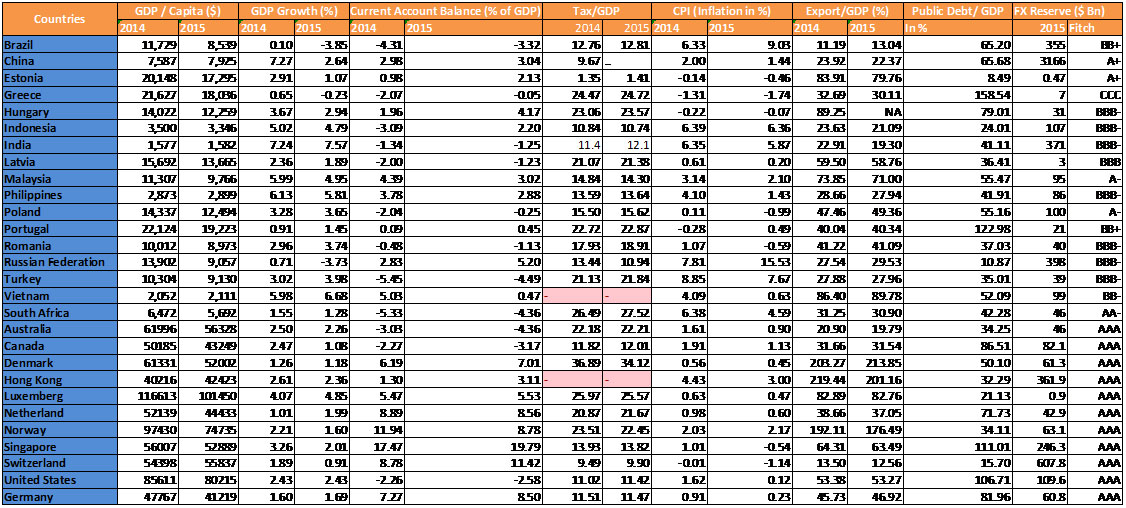

Acuité Ratings & Research Limited strongly believes that India's sovereign ratings are due for an upgrade. Among the world’s top ten economies, the justification to classify India under the minimum investment grade category lacks merit. We maintain that traditional rating models for sovereigns have become too conventional and are no longer driven by independent judgements or opinions. We call for a rating methodology relevant for rating dynamic sovereigns such as India. Analysts looking at sovereigns who are more comfortable looking westwards need to spend time to understand soft, non-financial aspects of our economy. Further, we believe that the assessment of India's debt paying capability should not be confined to particular factors such as low per capita income and sovereign debt but also various other parameters such as external debt to GDP, reducing fiscal deficit, forex (import coverage) as well as strong institutional frameworks. Acuité’s has built a case in favour of an upgrade of India's sovereign ratings is based on the following factors;

Debt to GDP: No reason to be alarmed

We believe that India's debt levels are well under control and as things stand today, India's sovereign debt levels are better than several higher rated sovereigns, including G8 countries. Even though a majority of India’s recent growth has been fuelled by government expenditure and mobilization of government debt has been increasing by 15%; public debt however remains manageable at 60% to GDP. At 22%, India also maintains one of the lowest external debt to GDP ratios among peers. Given the global recession, we believe that deficit spending has been fuelling economic activity and India is not an exception. Global debt (private + public) has exceeded 300% of global GDP; India records significantly lower numbers as compared to higher rated peers such as China, US along with other higher rated sovereigns. We maintain that with an annualized incremental GDP of nearly $200 billion, India has been experiencing unprecedented growth and has outclassed its peers.

Tax to GDP: India to achieve OECD levels within a decade

Ideally, Tax and other Revenue Yields for a reasonably performing macro-economy are generally 20% of the GDP and expenditure on public welfare is financed through this vertical. At 13% currently, even though India's Tax to GDP ratio has been cited as a rating risk, Acuité believes that this is a short term phenomenon. With a tax base growing at nearly 16% per annum (14% five year average), Acuité expects India’s tax to GDP ratio to breach the 20% mark within five years and reach OECD level of 34% by the year 2029. These numbers will put India ahead of AAA rated sovereigns such as the US, Switzerland and Australia in less than a decade. We draw significant comfort from these sustained growth numbers and are confident of Indian Government's abilities to finance its operations over a medium to long term horizon. A 17-18% average increase in Indirect taxes has given the government an incremental $ 8 billion of additional annual revenue in FY13 to FY16; this is expected to continue in FY17 as well. The figures are 50% more than budget estimates of the previous years and this straight away adds this incrementalamount to the exchequer’s revenue sources.

GST: A transformative tax structure

This introduction brings about one of the most important reforms in India’s indirect tax system. By introducing a uniform tax rate across India, there will be transparency in the tax collection processes and improvements in efficiency. The tax structure is likely to add 100-150 bps to India’s GDP growth, post complete adoption.With a faster growing economy, per capita incomes are expected to correlate positively, increasing per capita consumption. Efficiencies in the system will aid in exports (especially perishable items) and positively influence Current Account Balance (CAB); inflation too is likely to be in check.

Acuité expects GST to help increase Government revenue by way of incremental taxes as provisions for 'Input Tax Credit (ITC)' will persuade most companies to become GST compliant.

Unorganized economic activity will reduce and supply chains will be better synced. Acuité believes that despite tax benefits on offer, most MSEs would choose to be GST compliant and will be within the tax framework in order to claim ITCs (Input Tax Credits) for their contribution in the supply chain. These compliances may include initial training and technical investments but will be beneficial in the medium to long term for profitability and growth. Inflationary tendencies of such investments will be nullified by the reimbursements and differential thresholds. Considering 55% of the consumption emanating from the unorganized sector, this will be a major development in India’s rating outlook.

AQR: Timely identification of bad loans is a rating positive

We draw significant comfort from the introduction of Asset Quality Review (AQR), which has created an ecosystem where high and timely disclosures have become a norm. With banks now being extra cautious in lending, even though credit offtake has fallen below 5%, a narrative has been successfully incorporated in India’s banking system that will help heal the Indian corporate debt market. This exercise will effectively bifurcate capital to healthy accounts in order to withstand stress brought about by India’s second impending growth phase.

Indian banking system’s total stressed assets are estimated at 16.6% (including NPA and Restructured Loans) which amounts to 8.4% of GDP. The solution to the problem has been suggested in the form of a new Government backed 'Public Sector Rehabilitation Agency' (PARA) that will take over bad loans from Commercial Banks. The move will allow banks to focus on healthy loans and help heal their balance sheets. Since 70-75% of the bad loans are held by Public Sector Commercial Banks, potentially $60-$100 billion may have to be managed by a public debt rehabilitation agency or bad bank. This arrangement may be built around the concept of other successful examples of other top rated sovereigns such as the $431 billion United States’ Troubled Asset Relief Program (TARP), United Kingdom’s $60 billion UK Asset Resolution Company (UKAR) and Indonesia’s $60 billion Bank Restructuring Agency (IBRA). Such agencies function in a time bound fashion and are henceforth dissolved once the intentions are met. The arrangement can be more successful than the private Asset Reconstruction Companies (ARCs) since issued Security Receipts (SRs) could be fully backed by the Government, reassuring investors.

Acuité believes that India’s exercise to identify stress in its banking system will go a long way in strengthening the country’s financial markets and long term sustainability. This places India, ahead of higher rated sovereign of China, which significantly delayed this exercise and is currently facing a potential risk amounting to over $2 trillion, 18% of its GDP.

India: A systemically important economy

Acuité draws comfort from the fact that India is the world’s fastest growing major economy maintaining an average growth of over 7%. The country has achieved the sixth largest economy status in nominal terms and third largest in terms of purchasing power.India maintains a large diversified economy which exerts significant influence over the global economy. Among the top ten economies, the justification to classify India under the minimum investment category group lacks merit.

India has outperformed similar rated peers in parameters such as, consumer price index, external sector performance and is well on its way in meeting its FRBM mandates. Acuité estimates that CPI will remain lower than 4.9%, which is significantly better performance as compared to peers such as Indonesia, Brazil and Russia. Also, India maintains its number 14 position as a global trader; the external sector is performing strongly as compared to major heavy weights such as the US, China and Japan. Amidst a global slowdown, growth rate of merchandise exports of these countries have dropped by above (-) 6% in 2016/17. India’s export growth, however, has contracted marginally by near (-) 3.5% in 2016/17. This indicates, competitiveness of Indian industries in the global market is improving. The current account balance to GDP ratio has improved significantly as well from -1.3% in FY15 to -1.1% in FY 16 and further -0.98% in, FY17.

Also, the recent outcome of state elections augurs well for political stability to strengthen the reforms measure. This will help attract more overseas inflows - both through foreign portfolio investors (FPI) and foreign direct investments. As a sign of growing investor’s confidence, the economy has been drawing special attentionfrom foreign portfolio investors, which are now turning net buyers despite of policy uncertainty emanating from the US Fed. FDI equity on its part has been increasing by nearly 40%, comfortably reaching the $50 billion mark in FY17. This in turn has strengthened the INR and has become the best performing currency among emerging market peers.

Reform oriented government and its willingness to implement change

We derive comfort from over two decades of stable, reform oriented governments in India. This correlates well with the very low political risk involved and smooth democratic transitions leading to unparalleled government accountability among peers. The economy is well on its way in meeting its current fiscal deficit target of 3.2% by end of FY18. The gradual reduction of deficit by way of reduced spend on subsidy as well as better fiscal management through raising fresh tax avenues has helped this cause. Acuité estimates that India’s better position in terms of fiscal responsibility places it higher as compared to similar rated peers such as Brazil and Malaysia.

Modi government’s pro development agenda has been fuelling confidence in India’s future economic outlook and current affairs. The focus remains in building India’s basic internal frameworks which will in turn accelerate economic activity and efficiency. Also, through exercises such as Demonetization, there has been a tremendous push to formalize the economy. Therefore in terms of its future vision, the Government remains committed to its three pronged strategy basing itself around, Transportation, Digitization, Energy and Sustainability (Green). With an investment commitment (budgetary allocation) of over $30-40 billion on an annual basis solely for infrastructure development, the Government’s resolve is a rating positive.

Additionally, initiatives such as GST, Asset Quality Review (AQR) as well as Bankruptcy Code point towards the Government’s reformist intent. Furthermore, an increasingly transitional rural economy requires a lot of support at this time and poverty alleviation efforts have therefore maintained focused in the hinterlands. As expected, rural economy and agriculture sector has been lately given more emphasis in governmental reforms and by way of public expenditure. Several measures in agriculture sector has been initiated to double the farmers’ income in next five years. These initiatives has been complemented by healthy rainfall and concerted effort has been made to make India monsoon proof in the near term. Several other initiatives are likely to improve the quality of life of the people significantly and thereby per-capita income of the country as well. Moreover, this will further accelerate the pace of economic growth in future.

Rating Recommendation: India should be rated at BBB+

While considering the case of China, we find that the economy maintained a BBB+ rating in the year 1999 despite mirroring current Indian parameters. The country recorded a fiscal deficit of over 7.5%, had a per capita income below $1000 (in current prices) and a GDP growth of nearly 7.6%. India in comparison is positioned in better circumstances at this point in time. Despite being an export oriented economy recording a favorable current account balance, China’s forex reserves were half of what India maintains today while being a domestic demand driven economy. Even while considering the weight of the economy in terms of global GDP, China’s contribution was less significant than that of India currently. Considering these factors, Acuité recommends India’s sovereign ratings to stand at BBB+.

|

Variable |

India (Year 2016) |

China (Year 1999) |

|

GDP Per Capita |

$1805* ($1581 in Current Prices) |

$1637 ($869 in Current Prices) |

|

GDP Growth |

7.6% |

7.6% |

|

Forex Reserves |

$360 Bn |

$160 Bn |

|

Relative Weight in Global GDP |

3% |

3.5% |

|

Sovereign Rating |

BBB- |

BBB+ |

Source: Acuité Research; World Bank *Base Year: 2010