Brief: Profitability of food processing industry has been improving as Indian FPI declines compared to Global average; However, India’s agriculture & processed food exports still in negative trend; A double digit growth in agricultural exports is required to double farmers’ income in the next five year.

Impact: Positive

India’s overall export turned positive in second half of FY17 after nearly 21 months of negative growth. The overall export has accelerated 27.6% in Feb 2017 and as a result, the cumulative growth of the year reached 4.7% (Apr-Feb). Somewhat sustained by the bullish trend, even though the export of agriculture and processed food items has marginally improved, it is still on a negative track. Export of floriculture and seeds are growing at a positive trend for past three years, while export of livestock and cereals, which accounts for 65% in agricultural export, has been contracting by (-) 6.4% and (-) 7.1% respectively in FY16 and FY17 (YTD). SMERA believes that livestock export has been impacted due to ban on cow slaughter in some states.

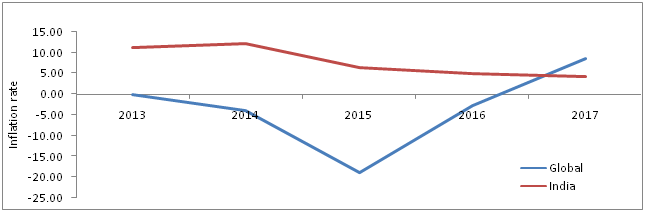

SMERAattributes recentnegative growth in overall agricultural exports to the higher price level in domestic compared to the global market. India’s agricultural production has been impacted significantly in FY15 and FY16 owing tosever drought for two consecutive years and as a result, price level in the domestic market remained high when global food price index was at nearly nine year low. However, witha healthy monsoon, food grain production in FY17 recorded a solid growth of 8%. At the same time, input costs such as those of fertilizer have also dropped due massive capacity augmentations. As a result of healthy growth in production, the food inflation in domestic market has taken a rebound and is currently lower than the global market. Therefore, due to better competitiveness, SMERA believes that India’s agricultural exports would post robust growth rate in FY18. Considered as a barometer, food processing industry on a standalone basis has recorded a marginal growth of 1.8% (FY17 YTD) in top-lines; this is an improvement as compared to a contraction recorded last year. Profitability too has significantly improved in FY17 as compared to dismal performance in the past two financial years.Despite record global food supplies, India has been able to sustain its food inflation below the global average; this in itself is a major pointer of achieved efficiencies.

It must be understood that if India wishes to achieve the target of doubling farm incomes within the next five years, a double digit growth in agricultural exports is paramount.This will also be pivotal for meaningfully sustaining a strong growth in production as farmer profitability will hold the key for a diversified agro economy.

Categor- wise export growth

|

Particulars |

Share (%) |

FY15 |

FY16 |

FY17* |

|

Livestock |

27.58 |

2.27 |

-15.19 |

-6.43 |

|

Cereals |

37.61 |

-6.92 |

-32.19 |

-7.10 |

|

Processed food |

17.91 |

-2.70 |

-29.17 |

2.07 |

|

Fruits & Veg |

9.56 |

-8.75 |

-2.12 |

9.45 |

|

Processed fruits &vegetable# |

6.38 |

-6.73 |

11.07 |

-4.5 |

|

Floriculture& Seeds |

0.96 |

1.55 |

2.25 |

1.4 |

|

Total ( Agri& Processed) |

100.00 |

-5.37 |

-24.63 |

-3.7 |

|

Overall exports |

-- |

-1.30 |

-15.58 |

4.7 |

Source: APEDA, SMERA Research;

Note:* indicates Apr-Feb of year

# including pulses

FPI Comparison: India & Global