Impact Analysis: Area under cultivation for cotton is all set in reaching a record level of 12.3 million hectares by end of September, 2017. Higher production in America and Australia will however mark a fall in cotton price in the near future.

Impact: Positive

Sown area for cotton has posted a record growth of 20% in FY18 (as on 3rdweek of July). The area under sown for the crop has recorded 10.43 million hectares as on 3rd week of July in FY18 – compared to the previous year, the area was 8.68 lakh million hectares.

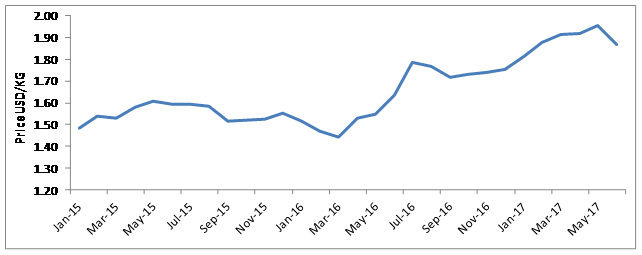

Area under sown for cotton was less than 11 million hectares in FY17 on account of lower cotton price in the domestic as well in the international market. The average cotton price has remained below $1.6/kg during June, 2014 to December, 2016, which was around $2.0/kg during first half of 2014. The lower price for long period has discouraged farmers to cultivate the crop. However, as the cotton price accelerated to three year high of $1.95/kg in May, 2017, the crop became the most chosen. It is understood that farmer’s crop preference is based on the price levels in the preceding year.

Based on the price trend, SMERA expects that the area under cultivation for cotton would reach a record level of 12.3 million hectares by end of September, 2017. Higher sawn area for cotton in India and higher production in America and Australia however marks a fall in cotton price in the near future. India shares nearly 25% of global yarn production. Therefore, lower cotton price will benefit the Indian yarn industry in the coming production spell.

The expected fall in cotton price and lower power and interest rate cost will be an advantage for the industry in the supply side. On the demand side, however, the industry is reeling under the impact of weaker external demand. India’s textile export growth has contracted by an average of (-) 4% over the past three years owing to a fall in export to China by -16.6%. China shares 40% in the global textile industry and destination for 11% of India’s textile exports. The country is moving towards higher value adding segment (such as aerospace, artificial intelligence, biotechnology, and robotic). Therefore, it is cutting production capacity of the lower value adding segments like textile. Under such circumstances, India needs to increase the production capacity to fill the space created by China and global market share.

Cotton production and area under cultivation:

|

Financial Year |

Production |

Area under cultivation |

|

FY11 |

33.00 |

11.24 |

|

FY12 |

35.20 |

12.18 |

|

FY13 |

34.22 |

11.98 |

|

FY14 |

35.90 |

11.69 |

|

FY15 |

34.81 |

13.08 |

|

FY16 |

30.15 |

11.87 |

|

FY17 |

32.57 |

10.55 |

|

FY18* |

37.97 |

12.35 |

Source: Ministry of

Agriculture, RBI, SMERA Research

Note:

(*) indicates SMERA estimates, production in million tons and area in million

hectares

Movement of cotton price in global market: