Brief: Engineering sector may have a trade surplus by end of FY18 and likely increase its share in world export to 1.6% in FY18 from nearly 1.4% in FY16. This is a positive development and gains its momentum from the Make in India initiative under the current Government’s manufacturing focus; the rising commodity prices will increase the input cost of this sector and thereby have a negative impact on the profit margin of the industry.

Impact: Positive

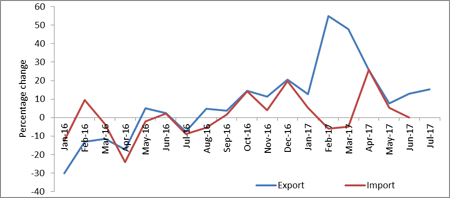

Engineering goods export, accounting for nearly 25% in overall export, is driving the growth rate of overall exports in India. Export growth of the category has been in a positive trend for the past 12 months (since August, 2016) and has recorded an average of 19% expansion. The leading industries in this sector are transport equipment, machine tools and iron & steel. Imports pertaining to this category, on the other hand, has contracted by (-) 9% during the said period. This category has recorded trade deficit of nearly $11 in FY17. SMERA, however, expects that the sector may be moving towards a trade surplus by the end of FY18 and likely increase its share in world export to 1.6% in FY18 from nearly 1.4% in FY16. This is a positive development and gains its momentum from the Make in India initiative under the current Government’s manufacturing focus.

On the other hand, price of basic metal and mineral in the international market is growing on an average of 25% in the past nine months. SMERA therefore expects that the rising commodity prices will increase the input cost of this sector and thereby have a negative impact on the profit margin of the industry. With stress advance ratio of the engineering goods sector at 17.8%, we believe that the cost of financing will increase and have a further debilitating effect on the sector. Combining the overall poor capex cycle and capacity utilization levels across the economy, the credit offtake too has dried up with a contraction of (-) 2.2% as on June 2017. Larger and better rated entities have however secured their financing through non-banking instruments such as NCDs, CPs and Bonds.

Movement in export and import of engineering goods industry:

Source: Ministry of Commerce, SMERA Knowledge Centre