Brief: Growth in export for net exporter industries has been under pressure in recent months, whereas, net importer industries have benefited from a stronger Rupee; MSMEs are likely to be affected more from a stronger Rupee as their share in overall export is around 50%.

Impact: Negative

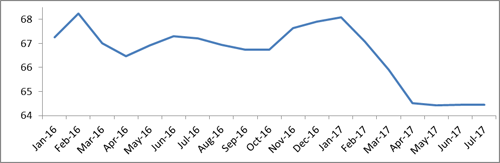

Indian rupee has appreciated significantly against the US dollar since January and reached 64 in August, 2017. The USD-INR currency pair had earlier hit an all-time high of 68.08 in Jan, 2017 in reaction to the Fed rate hike. Strengthening of Indian rupee is likely to have an adverse impact on the export intensive sectors such as textile, leather, transport equipment (such as automobile) and agriculture.

Assessing the performance via numbers, the net export of the textile industry (including readymade garment) has stood at nearly $30 billion in FY17. Similarly, net export of the leather industry has been $4.3 billion. In the transport equipment sector, net export of the automobile industry is pegged at $7.2 billion. We believe that earning from export of these industries is expected to be lower in Q1, FY17 due to the strengthening of the Rupee. Moreover, the ancillary industries, which are in the supply chain will be under pressure as well. SMERA expects that MSMEs will be more impacted than others from this appreciation as they account for around 50% in overall exports. Agriculture sector, however, will be the less impacted sector due to higher commodity prices in the global market.

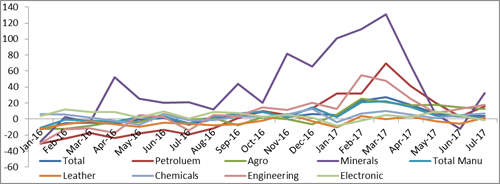

In recent months, growth in overall export has decelerated to 3.9% in July, 2017. Import, on the other hand, is growing at double digits. As per our analysis, growth in export for the industries, which are net exporter (except commodities), has been lower than expected in recent months. Growth in commodity exports is healthy owing to rise in commodity prices in the global market. Not to mention, export of agriculture and mineral has posted 16 and 22% growth respectively during April to July, 2017. On the other hand, growth in export of the net importer industries is strong. This is because the stronger INR lowers input costs and increases purchasing power in the international market. Therefore, financial profile of these industries is expected to be healthy.

Looking ahead, Indian rupee is expected to remain strong in the near future as well backed by strong macro-economic outlook. Business amiable reforms initiated by the Indian government are also encouraging capital inflows that are having a positive impact on the Rupee. Export oriented industries should however prepare to absorb the impact of a stronger currency.

Export and import by major sectors in FY17 (in $ Bn)

|

Major Sector |

Import |

Export |

Net export |

Impact of INR appreciation |

|

Agriculture |

25.58 |

33.41 |

7.83 |

Negative |

|

Leather |

0.99 |

5.33 |

4.33 |

Negative |

|

Chemical |

34.17 |

33.58 |

-0.59 |

Positive |

|

Engineering |

74.22 |

63.64 |

-10.58 |

Positive |

|

Electronic |

45.56 |

6.97 |

-38.59 |

Positive |

|

Textile |

4.01 |

33.89 |

29.88 |

Negative |

|

Mineral |

21.56 |

3.20 |

-18.36 |

Positive |

|

Transport equipment |

17.58 |

21.6 |

4.02 |

Negative |

Source: Ministry of Commerce, Government of India, CMIE, SMERA Knowledge Centre

Movement of USD-INR

Source: RBI, SMERA Knowledge Centre

Movement in export of the major industries:

Source: CMIE, SMERA Knowledge Centre