Impact: Neutral

Federal Open Market Committee (FOMC) has hiked fed rate by 25 bps to 1.25 during the 4th FOMC meet of 2017. The Central Bank expects the US economy to grow at 2.2% and inflation rate being under control at 1.6% in 2017. Similarly, labor market of the US economy is expected to remain robust. Moreover, trade restriction approach of the Trump administration would positively contribute the same.

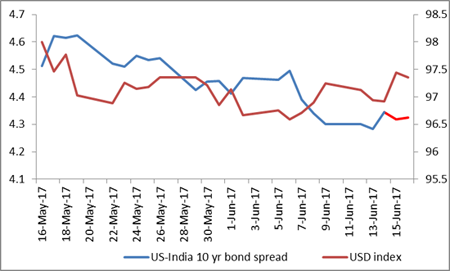

The crude oil price in the global market is unlikely to be volatile and therefore, with a second rate hike in four months, the Fed wants to give a positive signal to the market - since the economic outlook of the economy is robust. Generally, Fed rate hike lowers the bond spreads globally and thereby cause higher capital outflows from emerging markets. The World Bank estimates the global economy to expand at 2.7% in 2017, which is 20 bps higher than previous year. World trade volume would also record 4% growth in 2017 as against 2.5% last year. SMERA believes that the strong growth outlook of the global economy would subside the markets’ vulnerability to the fed rate hike. We do not expect much impact on Indian money or capital markets as the RBI has built a formidable defense in the name of massive forex reserves. The market is also more stable and seem to have become accustomed to this change.