Impact: Negative (Bond Prices); Duration Risk to Asset Pricing

Brief: The flattening of the US long term yield curve and the new issuance of Japanese long term debt will have additional impact on Indian long term debt instruments. Asset prices are in for a repricing with the factoring in of incremental duration risk

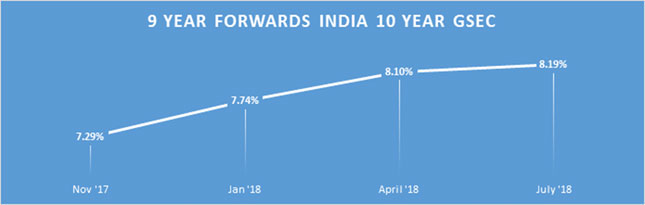

Our calculations reveal that the market is pricing atleast 2 rate hikes in the short term for Indian capital market instruments. 9 year Forwards are currently yielding 8.19%, which is nearly 40 bps higher than the current valuations. Public expenditure (largely deficit financing) may be a reason for the triggering demand-supply mismatch. The flattening of American yield curve adds a significant caution to our outlook given continued demand for US long term debt. The current rate cycle of the Federal Reserve is hinting an accelerated normalization with significant reduction in central bank asset holdings. Despite this, the long term yields continue to be depressed signaling inversion risk.

However, Japanese issuance of more debt (and subsequent absorption by the Japanese central bank) under its yield management program has pushed up long term yields of 'safe haven' sovereign debt (including that of the US) to an extent. This better priced crowding out effect has been putting pressures on emerging market debt as foreign capital makes its way back to the US, Germany and Japan. India is one of the most vulnerable markets at this time. We currently see Indian AAA rated corporate debt to price a 90-100 bps premium over 10-year sovereign. A higher ask rate for Government debt will see an impact (and percolation) on corporate issuances and therefore repricing risk is foreseen.