Macro Perspective

As per the Budget estimate (BE) for FY20, the overall central public expenditure is estimated to be Rs.27.8 lakh crores (BE). This allocation is an increase of 13% as compared to that of the previous year. Among the major sectors, agro allied sector is the biggest gainer - having received approx. Rs. 1.5 lakh crores; this translates into a growth of 73.2%. Other major gainers have been Social and Education and Health sectors, which have seen sharp rises of 11% and 12.8%, respectively.

There has been a tremendous shift to welfare expenditure from the erstwhile capex focus. One example has been the proposed direct income support program, "PM-KISHAN” for marginal farmers (land holding below 2 hectares). As per our assessment, Rs.77,000 crores will be required in FY20 which will end up adding 10 bps to the fiscal deficit of the financial year.

Apparent from this shift, allocation for investment in heavy sectors such as Infrastructure have suffered. The overall allocation for the sector has increased by 7.4%, which is half of the previous year. Despite this, the quantum is substantial at Rs.3.7 lakh crore including Rs.1.56 lakh crore in transport sector (BE).

Revenue front is however seen faltering. Tax revenue is estimated to increase by 14.3% in FY20 as against 19.5%, the previous year. The slower growth is connected with direct tax exemptions and rationalization of GST slabs.

The direct income support will drive up private consumption. Acuité believes that private consumption will lead to GDP growth in FY20 from the aggregate demand perspective. Moreover, as a result of higher disposable income, core inflation rate may revert to the mean. This in turn may impact interest rates and yield pressures for the exchequer.

Budget Summary

| FY18 (Actual) | FY19 RE | FY20 BE | % in FY19 | % in FY20 | |

| Revenue | 14,35,233 | 17,29,682 | 19,77,693 | 20.5% | 14.3% |

| Tax revenue | 12,42,488 | 14,84,406 | 17,05,046 | 19.5% | 14.9% |

| Non-tax | 1,92,745 | 2,45,276 | 2,72,647 | 27.3% | 11.2% |

| Total Receipts | 21,41,975 | 24,57,235 | 27,84,200 | 14.7% | 13.3% |

| Total Expenditure | 21,41,975 | 24,57,235 | 27,84,200 | 14.7% | 13.3% |

| Fiscal Deficit (FD) | 5,91,064 | 6,34,398 | 7,03,999 | 7.3% | 11.0% |

| FD/GDP | 3.5 | 3.4 | 3.4 |

Budget Allocation Major Sectors

| Sectors | FY18 (Actual) | FY19 (RE) | FY20 (BE) | Change in FY19 | Change in FY20 |

| Agro & Allied sectors | 52,628 | 86,602 | 1,49,981 | 64.6% | 73.2% |

| Rural Development | 1,34,973 | 1,35,109 | 1,38,962 | 0.1% | 2.9% |

| Infrastructure | 3,05,051 | 3,45,164 | 3,70,076 | 13.1% | 7.2% |

| of which Transport | 1,10,399 | 1,45,399 | 1,56,187 | 31.7% | 7.4% |

| Social sectors | 1,70,649 | 1,86,067 | 2,06,723 | 9.0% | 11.1% |

| Education and Health | 1,33,209 | 1,39,575 | 1,57,386 | 4.8% | 12.8% |

| Scientific Ministries | 22,115 | 25,099 | 26,237 | 13.5% | 4.5% |

| Ministry of Defence | 2,76,574 | 2,85,423 | 3,05,296 | 3.2% | 7.0% |

Subsidies

| FY18 (Actual) | FY19 RE | FY20 BE | Change in FY19 | Change in FY20 | |

| Food | 1,00,282 | 1,71,298 | 1,84,220 | 70.8% | 7.5% |

| Fertilizer | 66,441 | 70,075 | 74,986 | 5.5% | 7.0% |

| Petroleum | 24,460 | 24,833 | 37,478 | 1.5% | 50.9% |

| Interest Subsidies | 22,146 | 22,682 | 25,161 | 2.4% | 10.9% |

| Other subsidies | 11,099 | 9,800 | 11,921 | -11.7% | 21.6% |

| Total | 2,24,429 | 2,98,688 | 3,33,766 | 33.1% | 11.7% |

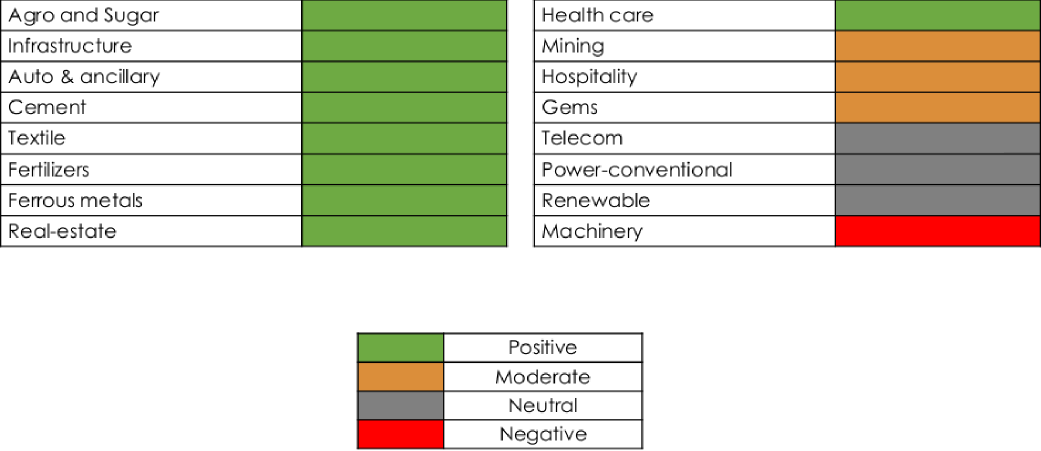

Sectoral impact analysis : Summary

Agro and allied industries: Positive

Government will provide an assured income support to the small and marginal farmers, under "Pradhan Mantri Kisan Samman Nidhi (PM-KISAN)” programme, aiding ~12 crore farmer families. It is expected to entail an annual expenditure of Rs.75,000 crores FY19-20,

further an additional provision of Rs. 20,000 crores RE for FY18-19. The scheme is expected to supplement farmer income and also aid meeting their needs before the harvest season.

The amount of interest subvention from government has doubled the crop loan to farmers which has increased to Rs.11.68 lakh crores in 2018-19. We expect to see farmers purchase better quality seeds which will lead to higher yield due to the availability of loans and

other schemes by the government such as soil health cards, irrigation schemes and neem-coated urea to remove shortage of fertilizers.

The government has allocated Rs. 550 crores under scheme for creation and maintenance of Buffer stock of Sugar as against Rs. 450 crores in the previous budget. Further it has allocated Rs. 1000 crores under scheme for assistance to sugar mills for 2018-19 season. We

expect increased stability in profits in the segment.

Allocation under Rashtriya Gokul Mission increased to Rs.750 crores in FY19. Also, the "Rashtriya Kamdhenu Aayog" to upscale sustainable genetic up-gradation of cow resources and to enhance production and productivity of cows. This is expected to increase the dairy output of the country, thus boosting the sector.

Government has decided to create a separate Department of Fisheries so as to provide sustained and focused attention towards development of this sector. This augurs well for the fisheries sector in the long run. Under the Kisan Credit Card scheme, the government has increased support to animal husbandry and fishery farmers, with a 2% interest subvention and further on timely repayment an additional 3% interest subvention.

Increasing farmer reforms in the agri sector such as interest subsidies, will mitigate the debt stress in the sector, further subsidy on timely repayments will promote timely debt repayments in the sector.

Auto and Auto ancillaries: Positive

Budget has been highly positive for auto and auto ancillary sector, providing much needed push as the sector has been facing regulatory headwinds since 2017.

Increase of income tax slab to Rs.5 lakhs will boost disposable incomes from the middle class segment which has been cautious over the last two years. The rural demand especially for motorcycles, mopeds would see impetus due to the direct benefit transfers to marginal farmers and increased allocation for rural roads by over 25% to Rs.9000 crores under PMGSY. We expect this to have an incremental growth of 50-100 bps in FY 20.

Tractors segment to see marginal benefits as the direct benefit transfer scheme is for farmers with less than 2 hectares, a segment that has low tractor penetration.

Real estate: Positive

The period of exemption for levy of tax on notional rent, on unsold inventories, has been extended from 1 year to 2 years, from the end of year in which the project is completed. This will reduce tax burden on real estate players whose large pile of inventory

has remained unsold in the recent years & demand is not picking up. Majority of housing inventory is lying unsold in metro & tier I cities like Mumbai, Pune, Bengaluru, Gurugram etc. This move is expected to benefit large developers in the real estate market.

Demand for affordable housing segment will improve. The benefits under Section 80-IBA of the Income Tax Act have been extended for one more year, i.e. to the housing projects approved till 31st March, 2020. Under Section 80-IBA, 100% profits are

exempt for housing builders & developers (affordable housing) subject to some conditions. This move will make more homes available under affordable housing scheme and give a push to the crumbling real estate sector. Major cities for affordable housing segment include Hyderabad, Kolkata, Navi Mumbai, Ghaziabad(NCR) etc

Machinery: Negative

Budget has abolished import duties on 36 capital goods which will increase imports of capital goods. This would further reduce competiveness of domestic industry as India already imports majority of capital goods. However, this would be helpful for consumer goods manufactures as their cost of investment reduces. Current account deficit of capital goods is expected to increase further.

Infrastructure: Positive

Infrastructure sector will see increased growth in the Northeast states, with the Government proposing to increase the allocation by 21% to Rs. 58000 crores in FY19-20, we expect increased number of projects to be awarded in the sector.

The government expenditure towards NHAI has remained fairly stable and in line with expectations. However allocation under PMGSY has been ramped up by over 25% to Rs.19000 crores boosting infra spending in rural areas.

For railways, proposed capex in the industry is Rs. 66700 crores, of which the Government to support with Rs.55100 crores. This is expected to increase the debt of EPC players in the sector. The government is increasing its acceleration in major cleaning projects on the country’s water bodies in order to efficiently use water in irrigation.

Gems and jewellery: Marginally Positive

Increased disposable incomes to the tune of Rs.5-10 thousand per household per annum for about 20-30 lakh households due to raised income tax bracket should serve as tailwinds for jewellery designers. The middle class drive most of the demand for gold. Middle class people usually park part of their savings in gold. With gold prices falling & average disposable income set to increase, demand for gold is expected to rise.

Mining: Marginally Positive

The Ministry of Mines has allocated Rs.16.9 billion for mineral exploration for the fiscal year 2019-20. This is 3.4 per cent lower compared to the revised allocation of Rs.17.5 billion for 2018-19. Rs.8.22 billion for the exploration of coal and lignite was allocated. This is 5.1 per cent higher compared to the revised estimate of Rs.7.81 billion of FY 19. This is expected to boost India’s domestic coal production. Further the trickle effect from expected improvement in Infrastructure, real estate and Auto segments expected to bolster iron ore and bauxite production.

Ferrous metals: Positive

Improved demand from automotive industry (especially two wheelers) and added impetus from infrastructure spending in the north eastern regions to the tune of 21% to 58,000 Cr, expected revival in real estate should bear well for the sector over the long run.

Fertilizers: Positive

An amount of ₹ 749.96 billion has been allocated towards the payment of fertiliser subsidy for 2019-20 in the Union Budget. This is seven per cent higher compared to previous year’s revised estimate of 700.85 billion.

Under the PM Kisan programme, vulnerable landholding farmer families, having cultivable land upto 2 hectares, will be provided direct income support at the rate of ₹ 6,000 per year. This would incentivise them to buy phosphatic fertilizers.

Textile: Positive

Textile industry will see benefit from the relaxation for MSME’s on funding and interest rates. The budget allocation towards technological upgradation (TUFS) scheme has seen a decline to RS. 700 crores from previous allocation of Rs. 2300 crores. Last year only 30% of the budgeted amount could be used due to low disbursements in the sector. Procurement of cotton by cotton corporation under price support scheme is allocated Rs. 2018 crore for FY19-20 as against Rs. 924 in previous budget, an increase of 118%. We expect cotton input prices to stabilize and witness an increase in investments in MSME textile space.

Power (Renewable): Neutral

There were no schemes for pushing renewable energy. With muted capacity addition to the tune of 5GW in FY19 (till December), the target of 175 GW till 2022 seems like an overstretch. There was a decline in allocation for Wind projects by 25%, down from Rs. 950 crores in FY 19 while allocation for Solar remained stable.

Healthcare : Positive

GOI It has announced an allocation of Rs. 1750 crores for capital expenditure and Rs. 61547 crores revenue budget under Ministry of health and family welfare.

Under the Ayushman Bharat scheme, it aims to provide medical treatment to 50 crore people. Under Pradhan Mantri Jan Arogya Yojana PMJAY the government has allocated Rs. 6400 crores, the scheme will provide cover of Rs. 5 lakh per family.

Rs 250 crores has been allocated for setting up Ayushman Bharat Health and Wellness Centers under the National Urban Health Mission to provide comprehensive and quality primary care. Rs 1350 crore has been earmarked for setting up Health and Wellness Centers under the National Rural Health Mission. The government allocated Rs.2,500 crore to its National AIDS and STD Control Programme 20% increase from the previous year. The Rashtriya Swasthya Bima Yojna (RSBY) which features under the NHM saw an allocation of Rs. 6556 crore for FY19-20.

All of this should increase healthcare awareness and penetration in the rural areas, which will trickle into the private healthcare sector.