Acuite Pre-Budget Commentary

State of Macro Economy and Budget Expectations - 2018-19

Acknowledging the importance of "Implementation" in India’s development agenda, the Economic Survey 2017-18 has largely focused on completion, facilitation and compliance. These are perhaps the most commonly used keywords in the survey document - emphasizing the Government’s intention as it prepares for India’s next growth phase. Buoyed by India’s impressive 30 rank jump in the World Bank Ease of Doing Business rankings as well as the one notch upgrade in the Sovereign Rating, the survey outlines the inherent strengths and weaknesses of the macro economy. Obviously, in these times of rapid change and global flux, we believe that policy formulation cannot be parochial and the Economic Survey has rightly presented an increasingly global outlook and concerns; on the lines similar to RBI’s Monetary Policy Committee (MPC).

The Survey outlines four factors, which it deems challenging to India’s macro stability and critical for growth sustainability. These factors pertain to upgrading India’s human capital in order to meet evolving global requirements, hostilities against globalization, climate change & related agriculture stress and resource transfer to productive sectors. Despite high liquidity levels in the global economy and somewhat strong capital inflows to emerging markets, there have been significant inhibitions to global trade and commerce. What’s surprising is the fact that the most powerful naysayer voices have emanated from the former bastions of free trade such as US, EU and Japan (due to its agricultural restrictions). Large emerging markets such as Brazil, South Africa, Russia and India too have been vocal as their markets are flooded by capacity broad-banding in China, Taiwan and South Korea.

With the failure of the Paris Round on Climate Change, under the United Nations Framework Convention on Climate Change (UNFCC), we argue that environmental damage mitigation has again emerged as a major hurdle for the global commerce. As a prominent emitter of greenhouse gases, India’s forthcoming budgets as well as future economic policies will be massively influenced by this variable. This will become even more important in this year’s Economic Survey 2017-18 and Budget 2018-19, given President Donald Trump reneging American commitment towards the Green Climate Fund. This has resulted in a leadership reshuffle and China and India taking on larger roles. The Budget 2018-19 is expected to augment Indian commitment towards this end. Initiatives pertaining to electric mobility and renewable energy are foreseen.

It can be argued that for a domestic demand driven economy such as India, the aforementioned factors can be dealt with through negotiations and rising economic influence. However, we believe that for India the most critical among these factors will be the upgrade of "Human Capital" as well as "Effective Resource Mobilization". India’s previous Budgets (FY2015-16 and FY2016-17) have added significant weight to skill development initiatives and value creation in the total Gross Value Added. We are of the opinion that India’s Total Factor Productivity (TFP) has largely suffered because of poor quality of Human Capital and resultant low innovation levels.

The Economic Survey 2017-18 has argued on these lines and thus the factor cannot be ignored or superseded in the current scheme of things. Connected, the argument of effective resource mobilization is another imperative atonement for a capital scarce economy such as India. There are certain sectors in the Indian economy which simply do not justify the magnitude of resource allocation at this time, given their smaller significance. While there are other sectors, which despite the insignificant weights have been adding much more value and hence qualify for higher allocations. We believe that the budget will present a plan to further tweak IIP as well as CPI weights for the sake of effective future policy.

Macro Situation: Global volatility, capacity utilization levels and inventories at center stage

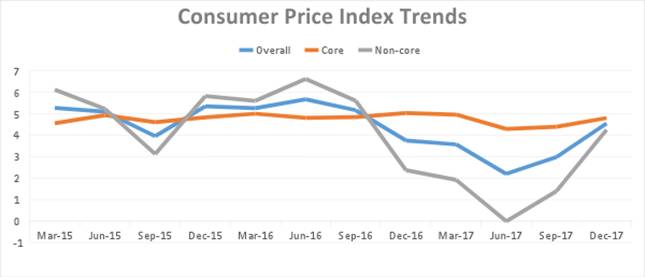

One macroeconomic variable that we are watching very closely is the CPI number and expect the Budget 2018-19 to remain cognizant. The growing volatility in commodities as well as policy uncertainty is perhaps leading to a lot of insecurity since there is a possibility of H1 and H2 numbers being vastly different. Even though this again depends on the price movement of crude, industrial and agro commodities, we remain skeptical of status quo. Rising substantially, Brent Futures are currently traded at over $64/ barrel; the current rally in Wheat and Rice futures cannot be ignored either given monetary tightening and trade disagreements. March Wheat Futures are currently trading nearly 1.5% higher and Rice is not different.

We continue to monitor these developments closely and argue that H2 numbers may be higher than expected. The argument, especially pertaining to agro commodities also holds because of the "Excess Yields Scare" of the previous Kharif season, when farmers lost value of their produce. Favorable MSPs and interest subvention schemes resulted in the market being flooded by excess production in several categories - causing demand supply mismatches. This time, farmers are expected to remain cautious casting a shadow of doubt on the H2 expectations. While the Economic Survey 2017-18 estimates the CPI to average 3.3%, we see a rising trend in both Core as well as Headline perspectives. As apparent from the graph above, all CPI categories have begun their upward movement and we don’t expect the WPI to be any different, given raw material inventories will be exhausted. Though the Economic Survey pegs the Agriculture GVA growth at over 2%, we remain less optimistic.

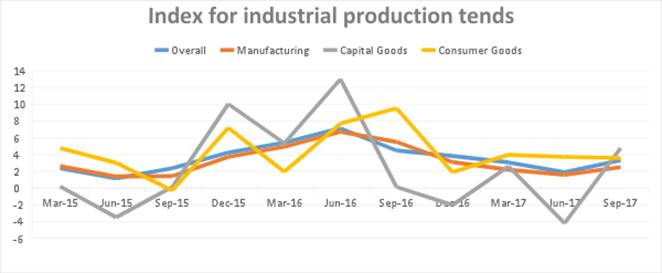

As far as the Industrial Index is concerned, while overall the Index has improved as per expectations, the status of inventories still remains unclear. In the previous years, both the Budget and Economic Surveys were concerned about inventory buildups across the value chain, not much has been mentioned this year. While this may lead to a situation where the Budget 2018-19 may ignore this issue completely, we argue that Consumer Durables - Capital Goods conundrum remains unresolved. In the years preceding, Capital Goods category was in a constant state of underperformance, contracting in double digits. Consumer Durables on the other hand expanded on the back of systemic inventory buildups. Since then, a realignment of the Capital Goods category towards "Work in Progress" nomenclature has arrested the fall but seemingly at the cost of Consumer Durables, which is now an underperforming category. It can be argued that inventories are exhausted but given high capacity underutilization levels and consumer demand remaining strong (considering personal loans growth), something is amiss. We have seen that Capex and Consumer Durable inventories have virtually no lag since the former is generally well coordinated.

Larger Impetus on Make in India: Manufacturing still not out of the woods

We expect "Make in India" to remain in its position of prominence in the Budget 2018-19. Even though reinvigoration of manufacturing was one of Narendra Modi Government’s primary mandates for this term, the sector has not picked up as strongly as envisioned. As mentioned earlier, poor capacity utilization levels - a remnant of the high growth phase in the past decade has acted detrimental and the so called "Twin Balance Sheet" scenario has prevailed. According to the Survey, Industry’s share in the GVA shrank to nearly 5% in 2017 as compared to the previous year’s near 10% level. Interestingly, services on the other hand, increased its share to over 72%. What this actually means is that industrial activity, especially manufacturing is adding lesser value to the economy both in terms of volume (at factor cost) and value. Substitution of cheaper imports combined with GST and Demonetization effects are to be blamed for the debacle. While we do expect a plethora of packages (TUFS and others) for the industry in the budget, a renewed focus on R&D and innovation will be an effort to nudge the industry up the value chain. Again, according to the Economic Survey, India’s R&D expenditure as a percent to GDP is only 0.6% as compared to China’s 2.1%. A decline in Corporate Tax is also envisioned in the budget and may be connected to R&D expenses of a company.

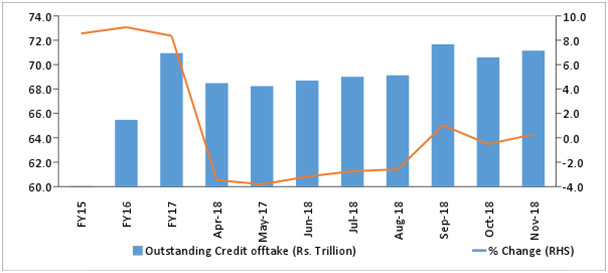

Indian manufacturing must therefore move beyond import substitution to global competence and the country must incorporate a USP driven strategy. As apparent from the charts below, despite modest increases, India’s share in global merchandise trade remains miniscule as compared to even smaller East Asian players. Debatably, there have been minor improvements in offtake (Non-Food) on a YoY basis along with strong activity in money markets - the on the ground results are yet to emerge.

Outstanding Credit Offtake:

Source: RBI, Acuite Research

List of countries by share in global manufacturing export:

Manufacturing export (% Share) |

1980 | 1990 | 2000 | 2014 |

| EU | - | - | 43 | 38.5 |

| US | 13 | 12.1 | 13.8 | 9.5 |

| Japan | 11.2 | 11.5 | 9.6 | 4.9 |

| China | 0.8 | 1.9 | 4.7 | 18 |

| India | 0.5 | 0.5 | 0.7 | 1.6 |

| Mexico | 0.4 | 1.1 | 3 | 2.5 |

| Canada | 2.7 | 3.1 | 3.7 | 1.7 |

| Malaysia | 0.2 | 0.7 | 1.7 | 1.2 |

| Thailand | 0.1 | 0.6 | 1.1 | 1.4 |

Source: WTO, Acuite Research

List of countries by share in global merchandise export:

| Merchandise Export | |||||

| Year | 1948 | 1983 | 1993 | 2003 | 2015 |

| World (USD billion) | 59 | 1838 | 3688 | 7380 | 15985 |

| World (% share) | 100 | 100 | 100 | 100 | 100 |

| US | 21.6 | 11.2 | 12.6 | 9.8 | 9.4 |

| Canada | 5.5 | 4.2 | 3.9 | 3.7 | 2.6 |

| Mexico | 0.9 | 1.4 | 1.4 | 2.2 | 2.4 |

| Brazil | 2 | 1.2 | 1 | 1 | 1.2 |

| EU | 35.1 | 43.5 | 45.3 | 45.9 | 37.3 |

| Germany | 1.4 | 9.2 | 10.3 | 10.2 | 8.3 |

| France | 3.4 | 5.2 | 6 | 5.3 | 3.2 |

| UK | 11.3 | 5 | 4.9 | 4.1 | 2.9 |

| South Africa | 2 | 1 | 0.7 | 0.5 | 0.5 |

| China | 0.9 | 1.2 | 2.5 | 5.9 | 14.2 |

| Japan | 0.4 | 8 | 9.8 | 6.4 | 3.9 |

| India | 2.2 | 0.5 | 0.6 | 0.8 | 1.7 |

Source: WTO, Acuite Research

Public Debt & Government Expenditure: Still the Only Game in Town

Given the state of the private sector, with PFCF still languishing, Government Expenditure (G) will remain a powerful player when it comes to Aggregate Demand (AD). Some of these plans are derailed by the implementation of the GST, we expect the Budget to present further plans to optimize this - particularly because of deviations in expectations seen in Direct Tax collections. The Economic Survey though estimates Direct Tax Growth at 18.3% and Indirect Tax Growth at 13.7% (April-November period), which is in line with our expectations as well. Despite the Central GST, which has suffered due to receivable lags and the "Compensation Fund" holdup, we expect that the Budget will adhere to its allocation goals.

Having said that, there is a high chance the Fiscal Deficit target will remain near the 3.2% level (±20 bps, "Escape Clause") due to the ongoing and future commitments. For FY18, are expectations for Fiscal Deficit remain on the higher side, with the Government exhausting its 20 bps grace. Having stated the requirement for infrastructure investment in the range of $4 trillion (nearly double to Indian current GDP in nominal terms), the Economic Survey paves the way for higher Government Expenditure in the field.

We expect that Capital Expenditure will maintain its current momentum of near 14% of all spending. Subsidies on the other hand will also remain constant given the Government’s interest subvention and loan waver commitments; pegging its share near the 12% mark. Since this is the last budget before the General Elections 2019, we expect that such unproductive expenditure will remain high. A few segments that will attract higher allocations this year will be Renewables, Health, Education, Agricultural Marketing and infrastructure, especially logistics related. In order to augment the private sector, the Budget may also propose new PPP schemes with more favorable gap funding opportunities. All these will however depend on the PSB recapitalizations and their ability to improve their adequacy in terms of BASAL 3 regulations. The rising Gross NPA levels and fragile balance sheets of Indian public owned banks is seen as a major impediment in reinvigorating growth and restart the offtake cycle. The Budget is expected to significantly focus on banks and their health; special provisions are therefore expected for safeguarding public interests.

Source: CMIE, Acuite Research

Note: *CY: Calendar Year

| Average Credit to GDP Gap | |

| World (10 Year Trend) | 2.22 |

| World (Year 17 Trend) | -6.46 |

| India (10 Year Trend) | 2.47 |

| India (Year 17 Trend) | -8.8 |

Source: Acuite Research

Central Government Tax Revenue (Rs. Billion)

| Direct tax | Indirect tax | Total tax revenue | Direct tax (% change) | Indirect tax (% change) | Total tax revenue (% change) | |

| 2009-10 | 4,249 | 5,597 | 9,846 | |||

| 2010-11 | 5,087 | 7,413 | 12,501 | 19.7 | 32.4 | 27.0 |

| 2011-12 | 5,712 | 8,715 | 14,428 | 12.3 | 17.6 | 15.4 |

| 2012-13 | 6,512 | 10,367 | 16,880 | 14.0 | 19.0 | 17.0 |

| 2013-14 | 7,268 | 11,198 | 18,465 | 11.6 | 8.0 | 9.4 |

| 2014-15 | 8,034 | 12,173 | 20,207 | 10.5 | 8.7 | 9.4 |

| 2015-16 | 8,762 | 14,791 | 23,553 | 9.1 | 21.5 | 16.6 |

| 2016-17 | 9,908 | 16,587 | 26,495 | 13.1 | 12.1 | 12.5 |

Source: CMIE, Acuite Research

Debt Outstanding in Trillion Rupees

| Treasury Bills 364 days | Commercial paper | Corporate bond | |

| FY12 | 0.90 | 0.91 | 10.52 |

| FY 13 | 1.30 | 1.09 | 12.90 |

| FY14 | 1.37 | 1.07 | 14.67 |

| FY15 | 1.48 | 1.93 | 17.50 |

| FY16 | 1.48 | 2.60 | 20.19 |

| FY17 | 1.42 | 3.98 | 24.05 |

| FY18 (Dec) | 1.33 | 4.09 |

Source: RBI, Acuite Research