MPC cuts Repo further and changes stance to accommodative. However, a slow monetary transmission will undermine the committee’s efforts and blunt the purpose of an accommodative stance

During the second MPC meeting of FY20, the Monetary Policy Committee (MPC) has trimmed repo rate by 25 bps; the rate under Liquidity Adjustment Facility (LAF) now stands at 5.75% with the Reverse Repo being 5.5%. This is for third consecutive time, the RBI’s monetary committee has cut rates to stabilize a slowing economy. In addition to the rate cut, the central bank has changed its stance from neutral to accommodative. This gives a signal that more rate cuts are on the cards and will see a situation that is characterized by a Weighted Average Call Money Rate (WACR) averaging lower than the Repo rate in the medium to long term. The decision considers the global and domestic economic outlook along with the liquidity situation in the domestic banking sector.

The global front has been a very important determinate of the monetary stance and especially pertains to the US-China trade tension and Brexit, which collectively undermine the global economic outlook. Due to the slowdown caused, further disruption in the global supply chain is expected and may linger. Moreover, geo-political situation in the Middle East (Yemen crises and the US sanction on Iran) has caused volatility in the crude oil price. The volatilities caused have resulted in a flight to safety situation in the global capital market and negatively impacting emerging markets including India. The muted inflows in both equity and debt markets over Q4 FY19 and Q1 FY20 is a case in point. Arguably, these global headwinds are expected to disrupt India’s domestic economic outlook through trade and capital flows - a red flag for the committee members.

On the domestic front, with a secular decline in food prices, the rural consumption power has weakened substantially. As a result, private consumption, mainstay in GDP growth, has been expanding at a lukewarm pace. This in turn is also impacting capital formation growth (sub 4% in Q4) along with the external sector – factors that are undermining the country’s economic outlook. Therefore, the central bank believes that an accommodative monetary policy will probably prevent further declines. CPI inflation has been consistently below the committee’s expectations and continues to languish especially from the headline perspective.

Even though Q4 print of 2.5% is in line with forecast, the MPC has its consensus set at 3-3.1% in H1 FY20, with a downward bias. The falling core inflation is also making the committee uncomfortable as a subdued demand non-food and non-fuel items often signals deflationary conditions. Despite the households expecting further declines over a three months horizon, the improving Capacity Utilization levels along with a stable Government provides some comfort, nonetheless. The overall growth rate for FY20 has been slashed by 20 bps though and now stands at 7%.

On the liquidity perspective, the weighted average call money rate (WACR) was six bps higher than repo rate in April, 2019. However, with massive infusions by way of OMOs, LAF and Swaps, the WACR has been declining gradually and reached 23 bps (negative to Repo) as on June 04, 2019. In addition, with the onset of government expenditure, the liquidity situation is likely to improve further. This will be in addition to the rise in M3 (Currency in Circulation + Short term and Long Term Deposits) and decline in M1 (Currency in Circulation).

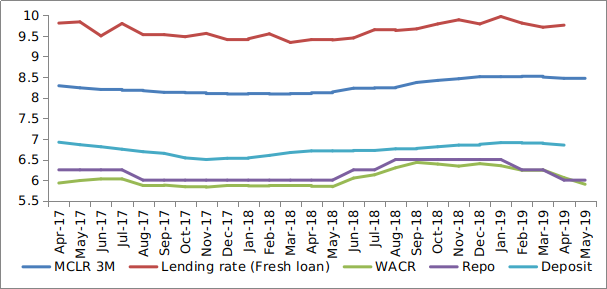

The committee is however concerned with the low transmission of rate benefit to the end consumer. For instance, during January to May, 2019 period, RBI had reduced the Repo rate by 50 bps. Yet, the three months average MCLR has reduced by only 4 bps and Interest rate on fresh loan has reduced by 21 bps. This indicates commercial banks are not passing enough benefits to the end consumer. We reckon that a slow monetary transmutation will undermine the committee’s efforts and blunt the purpose of an accommodative stance.

Interest Rate Movements

Source: Acuité

Research, CMIE