Impact: Positive (Manufacturing

Activity)

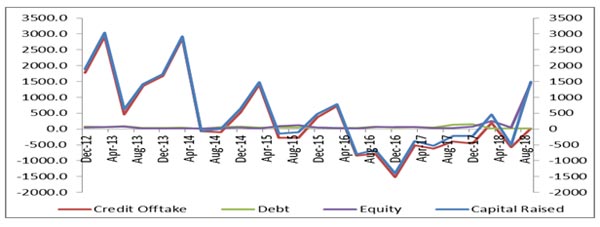

Brief: Data reveals that over the past four quarters, manufacturing entities have raised nearly Rs. 0.2 lakh crore from debt issuances. This pales, when compared to Rs. 0.4 lakh crore that was collectively raised from the primary equity markets. We suspect large corporates are listing group entities to raise money from the market. These developments in the capital market therefore point to the insecurities of the manufacturing sector, which has now re-shifted its focus on the equity markets. Primarily this is happening because of two reasons, first, debt market issuances at this time suffer from a massive duration risk as well as global volatility. Second, financing from traditional sources such as banks has become extremely difficult due to PCA and NPA scenarios bogging the system along with the prevailing liquidity situation.

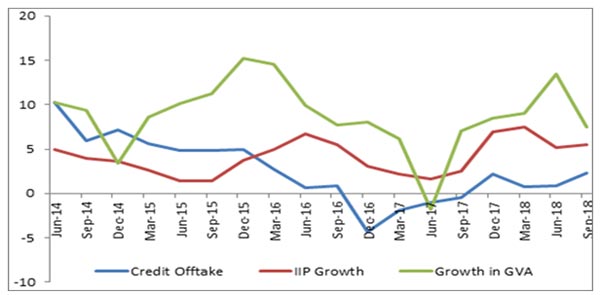

GVA data reveals that the value addition in the manufacturing sector has been growing at a healthy rate of over 7.5% since Q3, FY18. Growth in the IIP index, which is consistently recording an above 5% expansion during the time frame corroborates well with this belief. This implies that industrial (manufacturing) sector has a strong growth in both value addition as well as unit produced terms.

However, credit offtake to the industrial sector is expanding at a lacklustre pace of 1.5% over the past four quarters even with a favourable base. While we understand that in recent times, factors such as liquidity deficit and higher interest rates have been making credit access to manufacturing entities difficult – the source of the fuel powering the industrial expansion remains a conundrum.

It is worth mentioning that overall credit offtake is expanding vigorously. The expansion is pegged at 13% (as on November 2018) backed by service sector offtake, which is recording almost 25% so far this year. While considering the capital markets, higher corporate yields have made debt issuances more expensive for the industrial sector. 10-year duration AAA corporate bond yields for instance have increased by 173 bps in a year and reached 9.12% in September, 2018.

Since both capital and money market debt instruments are unfavourable, equity market seems to be the most preferable options for the entities in the manufacturing sectors. Data reveals that over the past four quarters, manufacturing entities have raised nearly Rs. 0.2 lakh crore from debt issuances. This pales, when compared to Rs. 0.4 lakh crore that was collectively raised from the primary equity markets. When comparing these numbers to same time last year, it is revealed that the quantum raised from the primary equity market stood at just Rs. 0.21 lakh crore and that from debt market being pegged at Rs. 0.29 lakh crores. Therefore, IPOs worth Rs.0.43 lakh crore being launched in Q2, FY19 alone, comes as a no surprise.

We suspect large corporates are listing their group entities in the capital markets to raise money from the market. These developments in the capital market points to the insecurities of the manufacturing sector, which has now re-shifted its focus on the equity markets. Primarily this is happening because of two reasons, first, debt market issuances at this time suffer from a massive duration risk as well as global volatility. Second, financing from traditional sources such as banks has become extremely difficult due to PCA and NPA scenarios bogging the system along with the prevailing liquidity situation. Also, the covenants in the equity market are less cumbersome as compared to other sources primarily because of the former’s status as junior debt in the overall capital structure. This is something that is making the issuers feel more secure about equity. We expect that this trend will continue in the medium term until some kind of systemic halcyon is reached.

Performance of Manufacturing Sector:

Source: Acuité Research, CMIE

Source: Acuité Research, CMIE

Instrument wise Capital Raised (in Rs. Billion):

Source: Acuité Research

Source: Acuité Research