Impact: Positive (Macroeconomy)

Brief: Strong show of the global PMI index sooths sentiments in an extremely volatile time. The global business sentiment has been driven by the strong economic outlook of the US and increasing consumption power of commodity exporters (benefiting by higher prices). We are inquisitive to know whether this momentum is sustainable and how the India market is impacted by this overall global outlook.

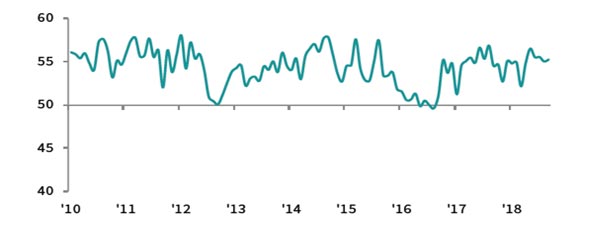

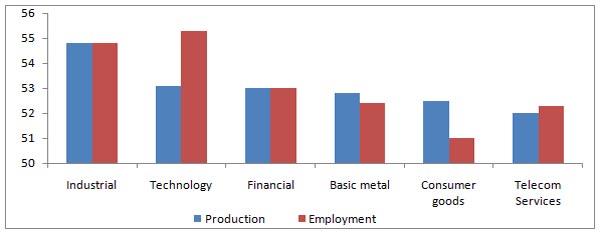

The global sector PMI index for September, released by IHS Markit, remains close to 54. The index was 53.4 in the previous month. The driver of September PMI index includes industrial service, software & services, financial services, pharmaceutical and industrial goods. The industrial services are growing at a faster pace as compared to other sectors. Meanwhile, software services on the other hand, is the highest employment generating sector.

The global business sentiment has been driven by the strong economic outlook of the United States; an economy that is growing at 2.3% in 2018 and is recording unemployment rate at a multi-year low. Evincing this expansion, trade deficit of the economy stands at $391 billion during first seven months of 2018 as against $360 billion during the same period last year. Subsequently, rising commodity prices have increased the consumption power of the oil exporting countries. Therefore, since these two set of groupings (US and Oil Exporters) are expanding - the index has been showing improvement despite hindering volatility.

Given the current scenario, even though escalating commodity prices (and accompanying financial costs) are sapping the global business sentiment, strong global demand has been weighed. Economic momentum is therefore sustainable unless a new variable is introduced in the coming quarters. Employment generation also remains strong in most sectors apart from Automotive sector, which in turn is impacted by increasing automation and recent scandal at a leading auto player. In terms if output however, the sector remains a strong performer. Media remains the only sluggish sector in the reckoning. Sectors relevant to India including pharmaceutical, information technology, banking and chemicals are all recording robust numbers, both in terms of output and employment. We are inquisitive to know whether this momentum is sustainable and how the India market is impacted by this overall global outlook.

Global Industries and Services PMI:

Source: Nikkei Markit

PMI Output and Employment Index:

Source: Nikkei Markit